- Welcome to the DEN Contact Us-------PUBLIC INTEREST defense FOR INFRINGMENT OF COPYRIGHT 'ALBERTA & BC ONTARIO SHADOW CIA VK DURHAM CROWN Whale'

- DEBTORS IN A SECRET FOREIGN PROCEEDING

- Booming BC natural-gas sector

- The indictment (1) that the defendants had engaged in a common plan or conspiracy (2) to commit crimes against peace, (3) war crimes, and (4) crimes against humanity. The third count, that of committing war crimes, had ten subdivisions, in the fifth of wh

- bc rail inquiry=Convertible Gold Debentures

-

s1778 -THE ROOT OF HMS CROWNS PONZIE

- DEED 189934 in "TRUST (99 YEARS)."

- SHADOW CIA Maximus- Isreal

- Crown of England. STATUTORY INSTRUMENT 1997 No. 1778--MAXIMUS GOLD ESTATE CORRUPTIONThis Order may be cited as the Social Security (United States of America)

- THE PRESIDENT'S CENTURIONS such as those men President Harry S.

- 83.27. Punishment for terrorist activity 83.27 (1) Notwithstanding anything in this Act, a person convicted of an indictable offence, other than an offence for which a sentence of imprisonment for life is imposed as a minimum punishment, where the act or

-

The key word is control of the individual.

- USELESS EATERS are broke and dumbed down -two $120 Billion Dollar“Unauthorized Gold

- some time in 1987-88.

- BREAKING OF THE CODE OF SILENCE is an absolute.-PUBLIC SAFETY MINISTER FAILING TO PROTECT CITIZENS ..........PICKTON THESIS ACCORDING TO THE DEADMAN IN JERVIS INLETS JOURNAL

- U.S.DEBT INSTRUMENTS.... GAIAForgery 1957 PREUVIAN GOLD BOND TIMELINE & CHAIN OF TITLE

- DEED OF ASSIGNMENT FOR CONSIDERATION EQUITY GOLD COLLATERAL INTEREST SEAL 1 & 2

- $17 Trillion DOLLARS GOLD

- U.S.DEBT INSTRUMENTS....Forgery...and "Orders from the TOP:"DO NOT INVESTIGATE."

- Social Security Purchased by Crown

- We underwrote another $6.5 Trillion Dollars for the Global Humanitarian

- 1988 DURHAM TRUST INTERNATIONAL -ASSIGNMENT OF INTEREST

- 1991 -BRADY BONDS OWED TO DURHAM TRUST INTERNATIONAL

- 1994-LEO WANTA FORGERY -VK DURHAM AUTHOR US WELFARE QUEEN ---Russell Herman's Boatmens Bank Account.

- 1994 RICK MARTIN -LAST WILL AND TESTAMENT OF RUSSELL HERMAN &COSMOS SEAFOOD ENERGY MARKETING

- 2003 KINGSCROFT INVESTMENT FRAUD -DURHAM TRUST

- 2011- FBI SOVEREIGN CITIZENS MOVEMENT CRIMINAL CROWN PROSECUTORS FRAUD MILL - PACIFIC WEST COST UNDER ATTACK BY CROWN PIRATES BC marine based WARCRIMES FINANCED A GLOBAL WALL STREET/CROWN/SOVEREIGN DIRECTING MINDS /FREEMASON SOCIETY BY SUSPECTED ILLEGAL C

- BC FEDERAL WATERS ARE A DANGEROUS PLAYGROUND FOR VICTIMS -IMPERIAL OIL WORLD CORRUPTION -DID CAMPBELL RIVER CITY HALL SELL THE FORGED DEEDS TO WILLY PICTON'S ESTATE

- breaking news CR CITY HALL & MAXIMUS US Counterfeiting of US Debt =HEADQUARTERS OF THE NWO- GROUND ZERO 9-11 May 2012

- AG MINISTRIES------------------ILLEGAL ROYAL QUEEN'S CROWN REVENUE -DISCLAIMER :

- MINISTER OF JUSTICE OF CANADA NEEDS TO BE HELD ACCOUNTABLE FOR CROWN PROSECUTORS IDENITY CREDIT THEFT CRIMES

- 83.28 (1) Judge Definition of “judge”

- public safety - LAWYER- FEDERAL MINISTER OF PUBLIC SAFETY IS FAILING CANADIANS AND AMERICANS -FBI WANTED INTERNATIONAL PONZIE PIRATES attack in communities throughout PACFIC WEST COAST

- 1997-2011 -INDIAN ACT BRITISH TYRANNY - USING ABORIGINAL CULTURE TO LAUNDER ILLEGAL GAINS FOR BRITISH AGENTS -Campbell River Harbours & Homeland DFO security CROWN DEATH POOL INSURANCE INDUSTRY -REGULATORS NEEDED ASAP

- CRA----------FEDERAL PRIVACY BREACHES -2700 missing CRA FILES

- CRA ,,,,READ FIRST -COPYCAT PONZIE -everybody got hit. The safety net was ripped out.” FORGER BOB WHITE

- 2011 PONZIE WARNING - HMS PONZIE IS BACK -IRS/CRA US/CANADA MILITARY MEMBERS Alaska gold fever PONZIE = ROYAL Canadian Mint forges a new path to cash in on gold fever

- intro -CAPITAL HMS Junk CANADIAN bonds

- THE QUEENS ROYAL SOVEREIGN CROWN FRAMED SITTING MLA BOB WILSON

- THE FRAUD ISSUE: UK CROWN estate freehold property rights

- 1997-2011 DFO & NORWEGIAN AQUACULTURE INDUSTRY CULTURE OF PONZIE GOLD CORRUPTION sovereign citizens FELLOWSHIP movement may be manipulating US homeland security

- KENTUCKY ED & WEST MEMPHIS CHIEF BOB ARE LOOKING FOR THE MASTERMINDS

- corporate fraud NORWAY/CHILE AQUACULTURE INDUSTRY

- HMS MOTHERLOAD DEED/MORTGAGE FRAUD PONZIE ESTATE ASSESTS AND DEBTS -ISSUE:MIA BC SUPREME COURT FINAL ORDER FOR A 1988 BMO MORTGAGE

- 1969-2011 CROWN PROSECUTORS PONZIE ROBOSIGNERS LIST - CROWN ESTATE- DFO MARINE - ALBERTA QUEENS BENCH -HMS PONZIE

- 1974- CROWN MINISTERS FORGED INFEASABLE TITLE /OWNERSHIP THE CROWN PROSECUTORS FORGED ESTATE AND LAND TRANSFER

- SPIN DOCTORING Is a LETHAL MEDIA DISEASE

- POWELL RIVER CIBC= WALLS STREET MERS PAPER TERRORISM

- intro Breaking news--------smoking gun...........July 23 2011

- #1 UPDATE OCT 2011 -4 MONTHS LATER UPDATE- OCT 2011 WALL STREET UNDER ATTACK

- #2 EMERGENCY INJUCTIVE ORDER =cease and desist -Life insurance -over insured/SERIOUS PERSONAL SAFETY THREAT -over company insured-2003 TD ILLEGALLY INSURED PENSION BENIFICARY /NO WET INK DOCUMENT

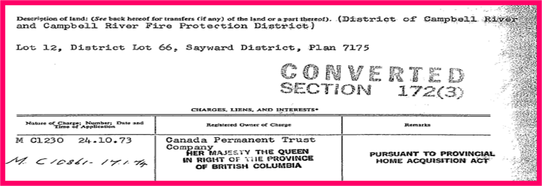

- #3 intro -ILLEGAL CROWN ASSIGNMENT- ILLEGAL CREDITORS AND FORGE GOVERMENT LEINS.-BC HOME AQUISTION ACT FALSE CHARGE ON CLEAR TITLE

- #4 11MAY11-affadavit of PONZIE -JOYCE KENDALL LOST RECORDS -MARY WILLIAMS/JOYCE KENDAL FORGED AUTHORSHIP

- #5- IN THE LINE OF PUBLIC FAMILY SAFETY DUTY

- #6- 1973- BC DOUBLE DEED FRAUD CANADA TRUST/TD MORTGAGE FRAUD BIRTH OF ASCALADE INC.. & CROWN PONZIE

- #7 2011 MAY -SOVEREIGN BSIG AGENT -TREVOR JOYAL - NORTH ISLAND HMS PONZIE INVESTORS GROUP

- #8 -COURT AUTHORSHIP-WITNESSES ACCUSED-HANDWRITING FINGERPRINTS FROM PERU LED TO CAMPBELL RIVER ,CALGARY,FLORIDA ,CALIF CRIMINALS EGO LED TO SLOPPY FORGING

- #9 -intro -PROF COX FROM DUKES UNVERSITY EXPLAINS OUR FORGED imperial QUEEN ESTATES NIGHTMARE

- Innovative Aquaculture MARINE/FEDERAL WATER BASED Projects SOVEREIGN /CHRISTIAN FELLOWSHIP /PONZIE clean up fund

- ISSUE :SOVEREIGN INVESTORS FORGED ESTATE TAKEOVERS /FELLOWSHIP FRAUD

- FACEBOOK UNIVERSITY/JUDCIAL ETHICS COURT

- #10- LEHMAN BROTHERS -THE REAL FLORIDA- MR BRUCE GRANT BONAVENTURE/

- #11 - IDENTITY THEFT DUE TO FORGED BC MARRIAGE CERTIFICATE CREATING 2 FORGED JOINT MATRIMONIAL LIFE STATES -ALBERTA WILEYS

- #13-- INTERNATIONAL MERS SOVEREIGN SOVEREIGN PONZIE BRANCH SHUT DOWN /RESTORE COURT RECORD /LEGAL LAND TITLES AND DEBT OWNERSHIP.......1QT-NOT WELCOME IN NASHVILLE....TRIBUTE TO BRANDON & BILL AND THE CHEIF & 60 MINUTES

- #14- INTRO & ISSUES -- BACKGROUND OF THE INVESTMENT/TAX SHELTER /FLORIDA ESTATE FRAUD PENSION PONZIE SCHEME Parliament needs to act to close the loophole that allowed the situation to occur FORGED INCORPORATED OFFSHORE ,US, BC ALBERTA ONTARIO,LTD companie

- #15-PONZIE CRIME IN PROGRESS -INTERNATIONAL CROWN PONZIE INCORPORATED TRAIL /DIRTY DEEDS OF TRUST DONE DIRT CHEAP/ /NEW HEALTH AND SAFETY ISSUE ON OR OFF THE JOB -BC WEST COAST SOVEREIGN CITIZEN MOVEMENT DESTROYING COASTAL COMMUNITIES AND INDUSTRY-TARGETE

- #16- CALGARY -ALGER TRUSTEE BANKRUPTCY FRAUD -SOVEREIGN EX SIGNS AS JUDGE HORNER

- #17- -SERIOUS THREAT TO LIFE/TARGETED VICTIM 0F MASSIVE LEVELS OF IDENTITY THEFT ALBERTA -SELLER OF AN RESIDENTIAL COMPLEX FOR $600,000

- #18- -2011- LIFE INSURANCE FRAUD OVER INSURED COMPANY INTEREST - ALBERTA PERSONAL PROPERTY REGISTRY CORRUPTION- REMOVE FRAUD FROM ALBERTA P

- #20- BC MINISTRY OF SOCIAL SERVICES DROPPED THE BALL -public safety =JERVIS DEADMANS CONNECTION TO DAVIS /LAWYER/ CHILDREN VICTIMS - LETHAL SPIN OFF EFFECTS OF A SOVEREIGN RUN PONZIE

- #21- public safety =CRA / MAXIMUS WELFARE sovereign QUEENS PAPER WRIT PONZIE TERRORISM US MAXIMUS ponzie -across state linesCANADIAN FEDS/US

- #22- PLAINTIFFS -GLENMOUNT

- #23- KINGSCROFT UNIT PURCHASE AGREEMENT

- #24- 1999 ONTARIO LTD 658051

- #25- -JOYCE KENDAL AFFADAVIT -KENDAX

- #40- 17-JUN02- PRINCIPLE TERRY L. DODWELL SENTENCED FOR 15 YEARS The Vavasseur programme was operated and controlled by an American citizen named Terry Dowdell who purported to be able to generate substantial profits by trading in bonds.

- #26- GRANTEE.........1998 (“Vavasseur”), a Bahamian corporation owned beginning in April 1998 and continuing through 2001,

- #27- GRANTEE...........ATCO DEED KATHLEEN MARIE ALVES

- #27b- =cease and desist - CROWN ATTORNEY GENERALS MINISTRY//US MAXIMUS/CRA -NAME GAME/ESTATE FRAUD/COLD CALCULATED ACCOUNTING FRAUD

- #28- -cease and desist -1969 -2011 PONZIE WAR - FORGED & VIOLATED CONSENT BC ESTATE DEED OF TRUST -- CIBC /DAVIS CONNECTION TO BC SUPREME COURT-DIVORCE /FORECLOSURE LIFE BENCHER BC SUPREME COURT JUSTICE GRANT BURNYEAT

- #30- =cease and desist -BISG sovereign investors payout on insurance fraud

- #31- cease and desist -2009-ATB FINANCIAL-CROWN SECURITIES FRAUD/IDENTITY CREDIT THEFT ,ESTATE FRAUD

- #32- A ISSUE OUTSOURCING GOVERMENT CONTRACTS - US MAXIMUS INC IN HOUSE SOVERIGN CROWN FORGED CONTRACT Structurists-BC ATTORNEY GENERALS OFFICE BRENT HIRD/SUSAN CARR AGENT FOR THEMIS /MAXIMUS/FMEP

- #33- MERS ASSIGNED/FORGED 1988 BMO -1ST MORTGAGE/DEED OF TRUST - APPENDIX #A WAS ADDED SEP23 1993

- #34-----EVIDENCE-1995 BC SUPREME STATEMENT OF CLAIM FOR FINAL ORDER

- #35- FLORIDA TRUST BOND BRANCHES- Who bought bonds issued by different trusts that were set up by a particular bank or mortgage company, ?

- #36- -SMOKING GUN........ 1989 INDUSTRY CANADA FRAUD

- #37- -SOVEREIGN INTERNATIONAL COMMUNITY APPEAL COURT --------- RE :BC DIVORCE FRAUD BC SUPREME COURT FINAL ORDER

- #38- -1969-2011 IN THE PATH OF A HMS BRIXON GROUP BC WESTCOAT/ALBERTA PONZIE with business advantages/perks and lifestyle appeal.[4]

- #39- -KINGSCROFT BONAVENTURE ILLEGAL FINANCIAL SERVICES COMPANY

- #40 -Maximus /BC HEALTH CORRUPTION/IDENITY THEFT FRAUD RING/ SOVEREIGN CITIZEN MOVEMENT ACCOUNTING

- #41- -LEGAL OATHBREAKERS IN COLLUSION W/INDUSTRY CANADA/ PERJURY INFESTATION AND - SOVERIEGN WALL STREET CONTRACT STRUCTULISTS TAKE OVER-

- #42 -1997- THE IMPERIAL SOVEREIGNS QUEEN IN THE RIGHT OF CANADA-ILLEGAL ATTACHMENT

- #43- -CEASE AND DESIST SOVERIEGN BSIG INVESTOR POOL AGENT PERU LINDA DIXON

- #44- -2011- CIBC CEASE AND DESIST BONAVENTURE COURT CROWN- /WALL STREET SOVERIEGN CREDITORS INTENDED TO DEFRAUD DEBTOR

- #45-MCKEE BC FIRST NATIONS insurance MASTERMINDS CROWN CIBC/ATB FINANCIAL ALBERTA CROWN BANKinvestigation-

- #46 --public safety/FEDERAL WATERS/HARBOUR BASED -illegal MONEY MOVERS /estates via forged federal liens/attachments FINANCING OFFSHORE VENTURE CAPITAL/PRIVATE WEALTH/INDUSTRY INVESTORS IE:GOLD IN PERU

- #47- -SW CALGARY LEGAL SOVEREIGN CITIZEN AID HIGH INTEREST RETURN PONZIE HOUSE- BONAVENTURE COURT FINANCED BY FRAUD

- #48- -INTERNATIONAL PROSECUTIONS NEEDED TO STOP MERS COMMON LAW COURT CLEAN UP ASAP----- COMMON LAW INTERNATIONAL SOVEREIGN LEGISLATION/ SLAYER LAWS

- #49- US NATIVE SOVEREIGN MASTERMIND IN JAIL IN CALIFORNIA -JANICE WEEKS KATONA SEEKING TO REOPEN A 1992 CHAPTER 11 FLORIDA BANKRUPTCY CASE-TO ALLOW TRUSTEE/ADMINISTER TO RELEASE TRUST ASSETS-NO GO SHOT DOWN BY FLORIDA ORLANDO BANKRUPTCY COURT- JUDGE K

- #50- -SOVEREIGN BC QUEEN/PENSION MINISTRY OF SOCIAL SERVICES /FMP FRAUD GRAB

- #51- -CANADIAN LEGAL AID IMPERIAL CROWN MASTERMINDS OF US/CANADA SOVERIEGN STRUCTULISTS MASTERMINDS ENGINEERED CONTRACTS ARE KILLING WEST MEMPHIS POLICE AND POLITCALLY TARGETED WHISTLEBLOWER EASY TARGETS

- #52- -1995- PERJURING PLAINTIFF BC SUPREME/FAMILY COURT - PONZIE/PERJURY /BONAVENTURE SECRET SOVERIEGN COURT/TRANSFER OF A FORGED ESTATE 1993

- #53- -PERJURY FINANCED CRIMES AGAINST HUMANITY = SOVEREIGN WRONGDOERS FAILED TO INFORM JUSTICE MEIKLEM OF THE BC SUPREME COURT ON JUNE 19 1995 -THAT THE BMO 1ST MATRIMONIAL MORTGAGE IN QUESTION HAD ACTUALLY BEEN FORECLOSED - EXPLAINS MIA/ BMO 1ST MATR

- #54- -PUBLIC SAFETY - CRA/MAXIMUS CROWN /CITIZEN SOVERIEGNS PENSION PONZIE/

- #55- --MONEY MOVER HIJACKED STEELWORKERS PENSION ACCOUNT TAKEOVER/SEIZED BY ILLEGAL ATTACHMENTS

- #56- -CONTEMPT/TREASON SERVICE ALBERTA CROWN DEBT COLLECTIONS

- #57- -QUEENS BENCH AUTHOR NOT IS NOT A JUDGE BUT SOVEREIGN EX WIFE OR EX GITLFRIEN-AKA FLORIDAS LINDA GREENS

- #58- -BROKEN COURT RECORD -1995 LORDSHIP ISSUE IGNORED BY BIG CORP/BIG BANK CROWN SOVEREIGN LEGAL COMMUNITY =DEBTOR STATEMENT OF CLAIM BEFORE THE SUPREME COURT OF BC

- #59- -FORGED COURT RECORD -INSERT BLANK AMOUNT MERS MORTGAGE BANK/WIRE FRAUD FOR FINAL BC SUPREME COURT ORDER owed to the Queen FOR THE 1ST MORTGAGE

- #60- -MERS IMPERIAL CROWN SOVEREIGN DEBT SLAVE MASTERMINDS

- #61- TRUSTEE BURNETT-TRUST ACCOUNT BANK ACT-

- #62- -1995-DEFENDANT BC SUPREME/FAMILY COURT - TARGETED DEBTOR AFFADAVIT

- #63- -1995 FINAL BC SUPREME COURT TAMPERED TRANSCRIPTS -ORDER

- #64- -BC LAND TITLES CORRUPTION/FORGED DEED MILL

- #65- -INTRO BROKEN CHAIN OF TITLE 1989-2011 CIBC/BC &AB LAND TITLES -FORGED CHAIN OF OWNERSHIP

- #66- -1993 VICTRO REGISTRY BIG CORP COMPANY REGISTRY VICTORIA BC

- #67- -TREASON ALBERTA CROWN -JUDGE HORNER-HARPER-DAVIS-BURNYEAT

- #68- --1992 BC SUPREME COURT FINAL ORDER/SEPERATION AGREEMENT SIGNED UNDER FALSE PRETENCES/

- #69- MAXIMUS IGNORED BC SUPREME COURT FOR BIG BANKS AND BIG CORP

- #70- --MASTERMIND JUSTICE KAREN HORNER BANKRUPTCY FORECLOSURE FRAUD HARPER HORNER bloodline calgary queens bench court orders

- #71- -illegal FLORIDA LEGAL AID IMPERIAL CROWN ESCROWED DEPOSITS /ponzie bank/wire fraud

- #72- -NATIVE SOVEREIGN BC MASTERMIND MCKEE CDS INSURANCED FRAUD -MASTERMIND MCKEE CONNECTION TO TARGETED VICTIM/WHISTLEBLOWER - FIRST NATION IMMUNITY /TAX FREE/ROYAL LAW

- #73- -WHO IS THE REAL LINDA GREEN- AGENTS TRANSFER OF ESTATE INCLUDING /MORTGAGED PROPERTY OR FOR SALE OR CONYENANCE

- #74- --ESTATE ATTACHMENTS MERS DEED OWNERS INCLUDE PENSIONS

- #75- -2011-SOVERIEGN QUEEN IN THE RIGHT OF CANADA VERSUS US ROYAL LAW COURT

- #76- -CROWN SOVERIEGNS COURT ADMINISTRATOR ENFORCING ROYAL LAW -public safety risk assesment

- #77- -2003 -JUSTICE DEPARTMENT ATTACHMENT WITHDRAWL

- #78- -1995- BUISNESS TRUST ACCOUNTING FRAUD/TRUSTEE FRAUD ALABAMA THE BIRTH OF HMS PONZIE SECURITIES FRAUD AMERICAN HERITGAGE CHURCH LOANS/BONDS PONZIE HEADQUARTERS

- #79- -1973-2011 BC WEST COAST BIG CORP/WALL STREET CITY HALL CORRUPTION

- #80- 2005-QUEBEC LINDA DIXON

- #81- -MAXIMUS US NATIVE INDIAN SOVEREIGN CITIZEN TRUSTS ESTATES US AND CANADA WELFARE QUEENS/BC BMO MORGICIDE

- #82- -2011 CIBC/ JANICE WEEKS KATONA

- #83- =ILLEGAL Canadian BONDS SEIZED BY IRS

- #84- -1992 IRS SEIZED CANADIAN BONDS SOVERIEGN GROUP RECOVERY CORRUPTION -PREMEIR CAPTITALTRUST -JANCICE WEEKS KATONA

- 61-US NATIVE INDIAN SOVEREIGN TRUSTS 8-Premier Benefit Capital Trust CONNECTED TO CIBC DAVIS scheme, which defrauded investors of more than $7.5 million; two of the principles

- 62-NATIVE SOVEREIGN -BC/ALBERTA/SAN FRAN JAIL SIGNATURES-FLORIDA'S MERS LINDA GREEN/BC CLERK/ALBERTA JUDGE AGENT/OWNER OF ILLEGAL CANADIAN COMPANIES KINGSCROFT/KENDAX/658 AKA LINDA GREEN/JOYCE KENDALL

- #85- -AB =REGISTARS CORRUPTION OF SOUTH ALBERTA LAND TITLES

- #86- --BC/ALBERTA WELFARE MERS QUEENS SOVEREIGN DOUBLE deed forgers

- #87- --CANADA TRUST LIEN 1973-1ST MORTGAGE /DEED OF TRUST SUN LIFE OF CANADA GROUP MORTGAGE CANADIAN APPENDIX #AHISTORY

- #88- --BC FORGED WRITS/CREDITORS FEDERAL ATTACHMENTS

- #89- --2010 ACCOUNTING FRAUD COLLIERS INTERNATIONAL BONAVENTURE COURT SOLD NOV

- #90- -RBC MUTUAL FUNDS SIEZED

- #91- -SUNLIFE PENSION SEIZED-SUNLIFE 1ST MORTGAGE FRAUD

- #92- -2009 SUNLIFE OF CANADA/RBC/BMO/CIBC /ATB CROWN/BANK OF CANADA/ organized mortgage fraud

- #93- TORONTO DOMINION MORTGAGE FRAUD DISCHARGE CLAIM GARTH BAILEY

- #94- -1992 3 PARTY LIABILITY LEGAL AID/ CIBC -FALSE LIEN /FAKE INJURY SETTLEMENT(3RD PARTY)

- #95 a- illegal atttach TELEVECTOR

- #95b- --illegal atttach EVERGREEN CREDIT UNION/

- #95c- -illegal atttach CIBC

- #95d- --illegal atttach -BMO

- #95-e -illegal atttach MAXIMUS

- #95f- -illegal atttach STOLT SEAFARMS

- #95g- -2003--illegal atttach WITHDRAWN STOLT SEAFARMS ATTACH

- #96 - =ILLEGAL writs

- #96a- -LEGAL AID ALBERTA/BC AUTO ATTACHED WRITS OF FRAUD

- #96b- AJ- ILLEGAL WRIT 1989 34-38 SUNLIFE OF CANADA

- #96c- -FX ILLEGAL WRIT 1989 44-48

- #96d- -BM ILLEGAL WRIT 1989 39-43

- #96e- -CQ ILLEGAL WRIT 1989 49-53

- #96f- -DH ILLEGAL WRIT 1989 54-63

- #96g- -DX ILLEGAL WRIT 1989 64-68

- #96h- -ER ILLEGAL WRIT 1989 69 -73

- #96i- -EW ILLEGAL WRIT 1989 74-78

- #96 j- FX ILLEGAL WRIT 1989 84- 88

- #96k- -GD ILLEGAL WRIT 1989 89- 93

- #97- -EARL H PACE TRUSTS investigation

- #97b- 93-WHO IS THE REAL FLORIDA MR BRUCE GRANT BONAVENTURE

- #98- -WHO IS THE REAL FLORIDA E ERNEST HARPSTER ??? IS HE ALIVE OR DEAD

- #99- -2007 LEHMAN BROTHERS HOLDING

- #100- -BC MAXIMUS /MEP ALBERTA IN CONTEMPT OF JUTICE MEIKLEMS FINAL ORDER

- #101- -CANADA /US MERS ROBO SIGNERS MERS/MAXIMUS LINDA GREENS SIGNATURES OF EXTORATION

- #101b- - MERS CRA/WELFARE LINDA DIXON AFFADAVIT

- #101c- -FLORIDA TRUST SUN LIFE PENSION WRIT 1989- AJ LINDA GREEN-DIXON

- #101d- -PASCO COUNTY FLORIDA EARL H PACE TRUST

- #102- S CALIFORNIA DISTRICT COURT JUDGE MILLER

- #103- ORLANDO FLORIDA BANKRUPTCY COURT

- #104- CANADA JUDICIAL SECURITIES SOVEREIGN - JUDGE KAREN HORNER PRIME MINISTER HARPERS COUSIN

- #105- IMPERIAL CRA WELFARE MERS QUEEN SOVEREIGN LEHMAM LINDA GREEN CREDIT DEFAULT SWAPS GOAT POO

- #106- WHO IS THE REAL MR BRUCE GRANT BONAVENTURE? THE TRUTH BEHIND SW CALGARY REAL ESTATE TAX SHELTER BONAVENTURE COURT AKA COMPLEX AND GARTH BAILEY HMS/BRIXON GROUP PONZIE

- #107- KENDAX WHO IS THE REAL JOYCE KENDAL ?????New Page

- #108- JOYCE KENDAL KENDAX LTD ROBO SIGNED florida judge jennerman

- #109- 1969 BC LAND TITLES CHAIN OF TITLE BROKEN BY FORGERY DATING BACK TO 1969JUDICIAL FEDERAL LIENS AND ATTACHMENTS OF INCOME AND PENSIONS ON INTERNATIONAL WATERS INCLUDING FUTURE CONSIDERATIONS AND INTEREST CHARGES

- CROWN SOVERIEGNS IN COLLUSION WITH US MAXIMUS HMS/BRIXON GROUP ponzie MERS PAPER CRA/maximus/BIG CORP PAPER TERRORISM -across state lines

- #110- ALBERTA SOVEREIGN TRUSTEE FRAUD

- #111- 2003-WILEY prefab home -albertaDIAMOND VALLEY MANUFACTURING

- #112- 95-INTRO 1973/ 1974 - CAMPBELL RIVER TD/CANADA TRUST MORTGAGE FRAUD TITLE C1229- BC GOVERMENT FORGED LIEN PURSUANT TO BC PROVINCIAL HOME AQUISTION ACT

- #113- BRIAN WILEY AND MELANIE WILEY ALBERTA CONDO SELLERS

- #114- -LEGAL SOVEREIGN AID SOCIETY 2011 MAXIMUS LTD LEGAL SOVEREIGN AID SOCIETY ponzie PAPER CRA TERRORISM -across state linesCANADIAN FEDS/USPENSION PONZIE SOVEREIGN REAL ESTATE INVESTMENT CLEAN UP FUND

- #115- -Trust law From Wikipedia, the free encyclopedia

- SOVEREIGN BUNGA

- #116- -LEGAL SOVEREIGN AID SOCIETY SOVEREIGN CITY HALL MASTERMINDED GOAT POO SECURITIES CONTRACT SOVEREIGN ROYAL LAW 1988 BMO 1ST MORTGAGE UNDER OATH THE CANADIAN SOVEREIGN MERS WELFARE QUEENS CROWN CLERK PONZIE

- #117- -LEGAL SOVEREIGN AID SOCIETY SOVEREIGN CITY HALL SWINDLEGATE INTERNATIONAL LEGAL SOVEREIGN AID SOCIETY

- #118- -LEGAL SOVEREIGN AID SOCIETY ILLEGAL CROWN BANKRUPTCY AND CROWN FORECLOSURE FRAUD 100% GOAT POO CREDIT DEFAULT SWAPS USING US FLORIDA DISTRICT COURTS AS THEIR SOVEREIGN GET AWAY CARS FLORIDA 25MAY1995 CAPITAL JANICE WEEKS KATONA church ponzie BC

- #119- 1995 BC SUPREME COURT JUDGE MEIKLEM'S FINAL DEAL-JUNE 19

- #120- -JUDICIAL CROWN SOVERIEGNS -THE CLERK

- #121- MAXIMUS INSURANCE INDUSTRY NEEDS IMMEDIATE SOVEREIGN REFORM AND STRICTER LAWS

- US JUDGES WHO ACTUALLY GETS IT

- FLORIDA EARL PACE TRUST

- FORGED TRANSFER OF JOINT COMPANY ESTATE

- 2009-ALBERTA GRANTEE-GAS COMPANY OWNS WILE-Y ESTATE

- 2010- CEASE AND DESIST -BSIG BONAVENTURE / CHURCH PONZIE INVESTORS GROUP

- I WANT THIS JUDGES OPINION

- WEST COAST INTERNATIONAL community corruption

- DRUGS/WASHINGTON STATE/BC CONNECTION

- VAAS

- 2002 PROPERTY CALGARY

- 2002 ALBERTA IO ACRES

- SOVEREIGN CITIZENS INTERNATIONAL REGULATORS /PROSECUTORS NEEDED ASAP

- SCARED AND HIDING

- 56.1. Identity documents 56.1 (1) Every person commits an offence who, without lawful excuse, procures to be made, possesses, transfers, sells or offers for sale an identity document that relates or purports to relate, in whole or in part, to another pers

- 58. Fraudulent use of certificate of citizenship 58. (1) Every one who, while in or out of Canada,

- 46. (1) High treason Every one commits high treason who, in Canada,

- 46. (3) Canadian citizen (3) Notwithstanding subsection (1) or (2), a Canadian citizen or a person who owes allegiance to Her Majesty in right of Canada,

- •83.02 - Financing of Terrorism •83.02. Providing or collecting property for certain activities

- 83.03. Providing, making available, etc., property or services for terrorist purposes

- 83.04. Using or possessing property for terrorist purposes

- 83.18. Participation in activity of terrorist group 83.18 (1) Every one who knowingly participates in or contributes to, directly or indirectly, any activity of a terrorist group for the purpose of enhancing the ability of any terrorist group to facilitat

- 83.19. Facilitating terrorist activity 83.19 (1) Every one who knowingly facilitates a terrorist activity is guilty of an indictable offence and liable to imprisonment for a term not exceeding fourteen years.

- 83.2. Commission of offence for terrorist group 83.2 Every one who commits an indictable offence under this or any other Act of Parliament for the benefit of, at the direction of or in association with a terrorist group is guilty of an indictable offence

- 83.21. Instructing to carry out activity for terrorist group 83.21 (1) Every person who knowingly instructs, directly or indirectly, any person to carry out any activity for the benefit of, at the direction of or in association with a terrorist group, for

- 83.22. Instructing to carry out terrorist activity 83.22 (1) Every person who knowingly instructs, directly or indirectly, any person to carry out a terrorist activity is guilty of an indictable offence and liable to imprisonment for life.

- 83.23. Harbouring or concealing 83.23 Every one who knowingly harbours or conceals any person whom he or she knows to be a person who has carried out or is likely to carry out a terrorist activity, for the purpose of enabling the person to facilitate or c

- 182. Dead body 182. Every one who(b) improperly or indecently interferes with or offers any indignity to a dead human body or human remains, whether buried or not,

- New Page

- 181. Spreading false news 181. Every one who wilfully publishes a statement, tale or news that he knows is false and that causes or is likely to cause injury or mischief to a public interest is guilty of an indictable offence and liable to imprisonment fo

- 131. Perjury 131. (1) Subject to subsection (3), every one commits perjury who, with intent to mislead, makes before a person who is authorized by law to permit it to be made before him a false statement under oath or solemn affirmation, by affidavit, sol

- 133. Corroboration 133. No person shall be convicted of an offence under section 132 on the evidence of only one witness unless the evidence of that witness is corroborated in a material particular by evidence that implicates the accused.

- 136. Witness giving contradictory evidence 136. (1) Every one who, being a witness in a judicial proceeding, gives evidence with respect to any matter of fact or knowledge and who subsequently, in a judicial proceeding, gives evidence that is contrary to

- 137. Fabricating evidence 137. Every one who, with intent to mislead, fabricates anything with intent that it shall be used as evidence in a judicial proceeding, existing or proposed, by any means other than perjury or incitement to perjury is guilty of a

- 138. Offences relating to affidavits

- 139. Obstructing justice 139. (1) Every one who wilfully attempts in any manner to obstruct, pervert or defeat the course of justice in a judicial proceeding,(2) Every one who wilfully attempts in any manner other than a manner described in subsection (1)

- New Page

- 140. Public mischief 140. (1) Every one commits public mischief who, with intent to mislead, causes a peace officer to enter on or continue an investigation by (a) making a false statement that accuses some other person of having committed an offence;

- New Page

- 142. Corruptly taking reward for recovery of goods 142. Every one who corruptly accepts any valuable consideration, directly or indirectly, under pretence or on account of helping any person to recover anything obtained by the commission of an indictable

- 119. Bribery of judicial officers, etc. 119. (1) Every one is guilty of an indictable offence and liable to imprisonment for a term not exceeding fourteen years who

- New Page

- the fish rots from the head

- New Page

- PBCT CONTRACTS DURHAM TRUST JANICE KATONA WEEKS

- New Page

- 2011 -NOV -VKD RESPONDS RE: DURHAM TRUST="Deliberate Bankrupting" "National Security Agency" and "NASA" associated with Ariel Life Systems (of the astronaut-space program) further connecting into the BASEBALL and FOOTBALL groups with a John D' Aquisto and

- New Page

- New Page

- New Page

- New Page

- New Page

- New Page

- New Page

- international body dedicated to information-sharing and an international court

- New Page

- New Page

- New Page

- De Schutter also warned Canada would face tough questions when it gets a peer review of its human rights record next year at the United

- the account was a sweeping facilaty

- New Page

- New Page

- Preet Bharara, the U.S. Attorney in Manhattan,

- New Page

- New Page

- New Page

- New Page

- United States Patriot; wife of murdered Colonel AKA WESTCOAST MAXIMUS WELFARE QUEEN /CITY HALL ESCORT

- New Page

- coast guard

- Secret “Occult Economy” Coming Out of the Shadows?

- New Page

- creation of special committees to address the "legal risks."

- John Aloyisius Dolan, 1850s-1890s, Iowa

- And $288 million is a lot to lose on one investment. Especially when it’s money that Canadians are expecting to retire on.

- VK DURHAM INTERNATIONAL CORRUPTIONa policy not approved by Congress remainS UNacceptable. when your own members flirt with mutiny, you have to know you’ve touched a raw nerve.

- JUDGE BONNER

- The Crown is not bound by laws passed in Parliament.

- INDIAN AFFAIRS- NWT NEW AGE ECONOMY

Feds divorced from reality of crime in Canada

1ST MORTGAGE DEBT OWNERSHIP

NO CROWN Regulatory ACTION OR Initiatives - QUEEN PONZIE PARTICIPANT

ILLEGAL ESTATE DEBT LIABILITY/OBLIGATION HELD UNDER IN A FLORIDA TRUST

OWED TO THE QUEEN IN THE RIGHT OF CANADA HER HEIRS SUCCESSORS AND ASSIGNS

ILLEGAL ALBERTA GOVERMENT PERSONAL PROPERTY FEDERAL ATTACHMENTS FOR CHILD SUPPORT /ALIMONY ARREARS BASED ON

Sarbanes-Oxley Act

WHO OWNS THE ESTATE CONTAINING ILLEGAL 1ST MORTGAGE DEBT ?

a JUNE 19 1995 BC SUPREME COURT FINAL ORDER FOR A BC BMO MORTGAGE DEBT ASSIGNED TO THE QUEEN AND A US CONTRACTOR MAXIMUS WAS IGNORED.

ALL US/CANADIAN COURT ORDERS INCLUDING A Habeas corpus writ , legal action, through TRUSTEE/prisoner FOR SOVEREIGN CITIZENSBOND RECOVERY INVESTORS HMS/BRIXON PONZIE GROUP ATTACHED TO THIS CASE ARE ILLEGAL

THE 1988 BMO MORTGAGE IN QUESTION HAD BEEN DISCHARGED IN SEPT 1994 DUE TO WIFE'S DECLARING PERSONAL BANKRUPTCY WHILE LEGAL RIGHTS WERE UNDER ASSIGNMENT TO THE MINISTRY OF FAMILY AND CHILDERN /DUE TO IRS SEIZURE OF COMPANIES UNDER JANICE WEEKS KATONA

IE

NO CROWN Regulatory ACTION OR Initiatives - QUEEN PONZIE PARTICIPANT

ILLEGAL ESTATE DEBT LIABILITY/OBLIGATION HELD UNDER IN A FLORIDA TRUST

OWED TO THE QUEEN IN THE RIGHT OF CANADA HER HEIRS SUCCESSORS AND ASSIGNS

ILLEGAL ALBERTA GOVERMENT PERSONAL PROPERTY FEDERAL ATTACHMENTS FOR CHILD SUPPORT /ALIMONY ARREARS BASED ON

Sarbanes-Oxley Act

WHO OWNS THE ESTATE CONTAINING ILLEGAL 1ST MORTGAGE DEBT ?

a JUNE 19 1995 BC SUPREME COURT FINAL ORDER FOR A BC BMO MORTGAGE DEBT ASSIGNED TO THE QUEEN AND A US CONTRACTOR MAXIMUS WAS IGNORED.

ALL US/CANADIAN COURT ORDERS INCLUDING A Habeas corpus writ , legal action, through TRUSTEE/prisoner FOR SOVEREIGN CITIZENSBOND RECOVERY INVESTORS HMS/BRIXON PONZIE GROUP ATTACHED TO THIS CASE ARE ILLEGAL

THE 1988 BMO MORTGAGE IN QUESTION HAD BEEN DISCHARGED IN SEPT 1994 DUE TO WIFE'S DECLARING PERSONAL BANKRUPTCY WHILE LEGAL RIGHTS WERE UNDER ASSIGNMENT TO THE MINISTRY OF FAMILY AND CHILDERN /DUE TO IRS SEIZURE OF COMPANIES UNDER JANICE WEEKS KATONA

IE

INDUSTRY CANADA IN HOUSE ESTATE PONZIE

The federal minister is revoking the citizenship of some 1,800 people because they became Canadians by fraudulent means: false records, outright lies and manufactured legends.

Precision 2009

Quick background: Precision Drilling on Monday slashed its payout to unitholders to zero, for a savings of $77-million a year. To beef up its balance sheet and to help make a US$400-million bridge loan melt away, it plans to raise US$150-million through an equity offering and US$250-million through privately-placed senior notes.

Its ill-timed Grey Wolf Inc. acquisition and the slow drilling season are to blame.

Chad Friess, for UBS: “These capital injections materially strengthen Precision’s balance sheet and substantially address concerns over the company’s ability to service its debt.

Read more: http://network.nationalpost.com/np/blogs/tradingdesk/archive/2009/02/11/two-sides-of-precision-drilling.aspx#ixzz1SqT4GsRW

concerns over the ILLEGAL ESTATE company’s ability to service its debt.

Goldman was the CDO’s placement agent, initial purchaser, collateral put provider, and liquidation agent.

It also hired a hedge fund with former Goldman employees, Greywolf Capital Management, to act as the collateral manager. Greywolf selected the CDO’s assets, with Goldman’s approval.

KEY EXECUTIVES FOR Greywolf Capital Management LP.* Name Board Relationships Title Age Jonathan Stephen Savitz No Relationships Chief Executive Officer, Chief Investment Officer, and Managing Partner -- Jeffrey Daniel Silva No Relationships Chief Financial Officer -- Brett Matthew Bush No Relationships Chief Operating Officer -- James Roland Gillespie CFA No Relationships Partner -- Robert Alan Miller No Relationships Partner

CROWN MINISTER OF GAINS/WELFARE MINISTRY

THE MATRIMONIAL PROPERTY IN ILLEGAL JOINT OWNERSHIP WAS IN ALBERTA PAPER WIFE'S MELANIE AND PAPER HUSBAND BRIAN THOMAS OF CALGARY AB

FORECLOSURE/BANKRUPTCY

AT THE TIME BC SUPREME COURT JUSTICE MEIKLEM ORDERED HIS FINAL JUNE 19 1995 SPECIFIC COMBINED PROPERTY/FAMILY LAW ORDER UNDER INTENT AND CONSENT TO BE ENFORCED AS CHILD SUPPORT

JUSTICE MEIKLEM AND THE VICTIM WERE UNAWARE OF THE MUTIPLE TITLES REGISTERED AGAINST THE MATRIMONIAL PROPERTY IN A ALBERTA TRUST/ESTATE IN THE MIDST OF COMPANY FORECLOSURE ,BANKRUPTCY ,RESTRUCTING PROCEEDINGS IN ALBERTA'S QUEENS BENCH .

ALBERTA SOVEREIGN FICTIOUS PAPER WIFE AND HUSBAND

OWNED SHELL COMPANIES,

FICTIOUS ALBERTA WIFE MELANIE JANET AND ALBERTA HUSBAND BRIAN THOMAS SOLD FORGED JOINT COMPANY OWNERSHIP ESTATE DEBTS, AND ILLEGAL ESTATE ASSETS (CONDOS) TO KATHERINE MARIE ALVES OF OKOTOKS

SW CALGARY

BONAVENTURE COURT INDIVIDUAL UNITS INCLUDING FORGED INCOME/LIFE INSURANCE POLICIES ON EACH UNIT /PENSION AND FEDERAL ATTACHMENTS AGAINST MUTUAL FUNDS

GRANTEE - WESTERN CANADIAN NATURAL GAS COMPANY

DEBTOR- BC EX HUSBAND COURT ORDERED MORTGAGE/DEBT OBLIGATIONS ILLEGALLY CREATED BY COURT CLERKS/DEPUTY REGISTRARS

MERS AUTOMATICALLY ATTACHED ILLEGAL BC WRITS FILED IN ALBERTA QUEENS BENCH COURTHOUSES

BC EX HUSBAND PRINCIPLE DEBTOR'S VICTIM

/OVER INSURED AS COMPANY INTEREST

MORTGAGE OBLIGATION OWED DUE TO FORGED JOINT COMPANIES HELD IN A FLORIDA ESTATE

BC ESTATE FUTURE CASH FLOW -ENDLESS

BC EX HUSBAND OWES A US$400-million bridge loan /INCCURRED THROUGH A HMS PONZIE ORGANIZED MORTGAGE FRAUD RACKETEERING PONZIE

SOVEREIGN corporate/CROWN governance /INVESTIGATION : ABUSE OF POWER/EXTORATION /RACKETEERING

Congress of the United States passed legislation known as the Sarbanes-Oxley Act which mandates how companies govern themselves and disclose information

Precision Drilling Corporation ("Precision") is subject to the new U.S. rules due to the fact that it is listed on the New York Stock Exchange.

ESTATE COMPANY PONZIE

INVESTORS GROUP MORTGAGE FRAUD

ESTATE BIG CORP TRUST CRIMINAL ENTERPRISE

ILLEGAL TRUST INCOME/CASHFLOW capital injections materially strengthen Precision’s what appears to be a questionable balance sheet

As a result of past bankruptcies and other failures of large United States companies stemming from apparent inadequacies in corporate governance and appropriate disclosure to the public, the Congress of the United States passed legislation known as the Sarbanes-Oxley Act which mandates how companies govern themselves and disclose information. http://www.winnipegfreepress.com/business/breakingnews/precision-drilling-rises-to-second-quarter-profit-of-164-million-revenues-up.html

CAMPBELL RIVER ,SW CALGARY,FLORIDA

PRECISSIONS STOCK BASED ON SECURITIES FRAUDS /ILLEGAL ASSETS AND FLORIDA TRUST CASHFLOW INCOME

New York Stock Exchange.

Precision 2010

Precision's shares rose 39 cents to $15.78 in early trading on the Toronto Stock Exchange.

Precision 2010

Precision's shares rose 39 cents to $15.78 in early trading on the Toronto Stock Exchange.

PART A - 1989

IMPERSONATION ALBERTA IDENITY THEFT

ALBERTA SOVEREIGN PAPER WIFE-MELANIE JANET WILEY

JOINT MATRIMONIAL DEBTS OWED TO THE QUEEN OF CANADA

DOUBLE DEED FRAUD

ALBERTA SOVEREIGHN PAPER WILEY'S OWE

1ST LIEN CREDITOR

CANADA TRUST COMPANY

PART B-1988

CAMPBELL RIVER DEED MILL

DOUBLE DEEDED MORTGAGE FRAUD

24SEP94

MORTGAGE FORECLOSED BY THE DISTRICT OF CAMPBELL RIVER

TAX ARREARS /TAX SALE

2ND LIEN CREDITOR BANK OF BMO

FORMER BC EX WIFE =EX BC SPOUSE OWES AN ONTARIO RBC loan $ 145,000 ON DEMAND

INSURED/BROKER 1ST CANADIAN TITLE COMPANY IN JOINT NAMES WITH THE TARGETED VICTIM

NOW LIVING IN ALBERTA AND REMARRIED

During the Senate's April hearing, Senator Jon Tester [D-Mont.]

Emac's Bottom Line Goldman Sachs Accused of Misleading Congress, Clients

By Elizabeth MacDonald

Goldman Sachs (GS) misled clients and Congress about the firm's investments in securities tied to real estate deals, according to a two-year investigation of the financial crisis, says Sen. Carl Levin [D-Mich.], chairman of the Senate panel that led the investigation.

The Senator says he wants the Justice Department and the Securities and Exchange Commission to examine whether Goldman Sachs violated the law by misleading clients who bought collateralized debt obligations without knowing the firm was betting they would fall in value.

And Sen. Levin wants federal prosecutors to review whether to bring perjury charges against Goldman Sachs chief executive Lloyd Blankfein as well as other current and former employees who testified in Congress last year.

Last April, Goldman's CEO Blankfein denied under oath before the Senate panel that the firm had what the firm itself called a "big short" against the housing market in documents the Senate had collected from the firm.

In April 2010, CEO Blankfein testified: "Much has been said about the supposedly massive short Goldman Sachs had on the U.S. housing market. The fact is we were not consistently or significantly net 'short the market' in residential mortgage-related products in 2007 and 2008..We didn't have a massive short against the housing market and we certainly did not bet against our clients."

Potential perjury charges may also zero in on testimony given by a Goldman Sachs executive before the Senate Permanent Subcommittee on Investigations about an asset-backed securities deal dubbed “Timberwolf,” people close to the matter say.

A probe could also lead to testimony from former top Goldman Sachs executive Thomas Montag, now president of global banking and markets at Bank of America Merrill Lynch (BAC), and other Goldman executives, regarding email correspondence, sources indicate.

The Department of Justice did not return calls for comment, and the SEC declined comment. A source close to the matter at Bank of America says Montag was never interviewed by the Senate panel.

“Our testimony was truthful and accurate, and that applies to all of our testimony,” says Goldman Sachs spokesman Michael DuVally.

DuVally also emailed this statement: “While we disagree with many of the conclusions of the report, we take seriously the issues explored by the Subcommittee. We recently issued the results of a comprehensive examination of our business standards and practices and committed to making significant changes that will strengthen relationships with clients, improve transparency and disclosure and enhance standards for the review, approval and suitability of complex instruments.”

And Goldman’s DuVally emailed this statement about the allegedly misleading testimony:

“The testimony we gave was truthful and accurate and this is confirmed by the Subcommittee's own report. The report references testimony from Goldman Sachs witnesses who repeatedly and consistently acknowledged that we were intermittently net short during 2007. We did not have a massive net short position because our short positions were largely offset by our long positions, and our financial results clearly demonstrate this point.”

Zeroing in on the Timberwolf Deal

Last April, Sen. Levin questioned Daniel Sparks, the Goldman executive who ran Goldman Sachs’s mortgage business at the time, on whether Goldman Sachs was misleading clients into buying investments its executives knew were steadily dropping into junk territory.

Sen. Levin pointed out an e-mail exchange Montag sent to Sparks on the Timberwolf deal, a $1 billion collateralized debt obligation.

“'Boy that Timberwolf was one sh---- deal,' Levin quoted from Montag’s 2007 email. "How much of that sh---- deal did you sell?"

A source close to the matter at Bank of America says: "Tom was just referring to the deal being bad for Goldman, because it was losing money from the time it launched the deal. The market imploded, clients and Goldman were losing money on it. It actually could have been very good for a client to buy at a deal value much lower than launched." (Note: A source contacted FBN after this story ran to indicate Montag was referring only to the firm losing money in his email, not Goldman's clients.)

During the Senate's April hearing, Senator Jon Tester [D-Mont.] noted other testimony that, in 2007, Goldman could “see some things happening,” and that Goldman itself was betting against the mortgage market.

Senator Tester asked Goldman’s Sparks, in light of those developments, “how [he] got comfortable with sales,” and how he “in good faith” sold the CDO securities to Goldman’s customers – how he could “sell them out and collect the fees and make the dough?”

Senator Tester and Sparks then had the following exchange:

Senator Tester: Every one of these [CDOs] were – it looks like a wreck waiting to happen because they were all downgraded to junk in very short order.

Sparks: Well, Senator, at the time we did those deals, we expected those deals to perform.

Senator Tester: Perform in what way?

Sparks: To not be downgraded–

Senator Tester: Perform to go to junk, so that the shorts made out?

Sparks: To not be downgraded to junk in that short a time frame. In fact, to not be downgraded to junk. ...

Senator Tester: Do you feel confident that the information about each one of these [CDOs]... was given to the investors, all of the information that was out there, and the credit rating agencies too?

Sparks: Well, I generally feel that the disclosure for the new issues that Goldman Sachs brought was good."

However, while Sparks testified that, in 2007, the Mortgage Department expected its CDOs “to perform,” a "contemporaneous draft presentation that he allegedly helped prepare in May 2007 stated that the 'desk expects [the CDOs] to underperform,'” the Senate report says.

Other emails allegedly provide Sparks’ negative views of the CDO market at the time, including emails in which Sparks allegedly described the subprime market as “bad and getting worse,” and allegedly directed Goldman’s mortgage traders to “get out of everything,” and “stay on the short side,” the Senate report charges.

Sparks allegedly wrote in emails, among other things: “Game over,” “bad news everywhere,” and “the business is totally dead,” the Senate report says.

And many of Sparks’s dire predictions were made before three of the four CDOs discussed at the hearing were even offered to customers, the Senate report says.

Sparks also testified that the Mortgage Department did not expect the Goldman-issued CDOs to be downgraded, even though all were within a year of issuance.

Ultimately, all of the CDOs discussed at the Subcommittee’s hearing were downgraded to junk status.

Timberwolf Deal Plunges in Value

Within five months of Timberwolf’s debut, the Triple-A rated CDO had lost almost 80% of its value, and it was liquidated in 2008, according to the panel’s report.

The CDO had Goldman’s clients making optimistic bets on its performance of CDOs, with Goldman buying derivatives that took the pessimistic side, as the subcommittee’s report indicates Goldman routinely did.

According to the Senate report, Goldman’s Timberwolf deal allegedly relied on “CDO assets that began to fall in value almost as soon as the Timberwolf securities were issued,” yet Goldman “solicited clients to buy the securities.”

The report alleges Timberwolf “contained or referenced CDO assets with more than 4,500 unique mortgage related securities, but Goldman offered potential investors little help in understanding those securities, and targeted clients with limited or no experience in CDO investments.”

The report charges: “When marketing Timberwolf, Goldman withheld its internal marks showing the securities losing value and did not mention its short position.”

Inflated Assets

Top Goldman executives allegedly knew the firm “was selling poor quality assets at inflated prices,” but because of its short position, “Goldman profited at the expense of the clients to whom it sold the Timberwolf securities,” the Senate report alleges.

Overall, Goldman lost money on the deal because Goldman was forced to keep many of the unsold Timberwolf securities on its books, the report says.

Specifically, Goldman had taken a short position on about 36% of the $1 billion in assets underlying the Timberwolf CDO and made money from that investment, but ultimately lost money when it could not sell all of the Timberwolf securities, the report says.

Goldman was the CDO’s placement agent, initial purchaser, collateral put provider, and liquidation agent.

It also hired a hedge fund with former Goldman employees, Greywolf Capital Management, to act as the collateral manager. Greywolf selected the CDO’s assets, with Goldman’s approval.

Montag Weighs In

As Timberwolf’s securities rapidly began losing value, almost as soon as they were purchased, in February 2007, Goldman’s Sparks told Thomas Montag, then a top executive with Goldman, that Timberwolf was one of two deals “to worry about,” according to Senate disclosures.

Specifically, on February 26, 2007, Montag asked Sparks about two CDO-squared transactions being assembled by the CDO Origination Desk, Timberwolf and Point Pleasant, the report says. Sparks allegedly expressed his concern about both. According to Senate disclosures:

Montag: “cdo squared–how big and how dangerous.”

Sparks: “Roughly 2bb, and they are the deals to worry about.”

But Goldman rushed Timberwolf to market, and it closed on March 27, 2007, approximately six weeks ahead of schedule, according to the Senate report.

However, “despite doubts about its performance and asset quality, Goldman engaged in an aggressive campaign to sell the Timberwolf securities," the report alleges.

As part of its tactics, a Goldman executive instructed Goldman personnel not to provide written information to investors about how Goldman was valuing or pricing the Timberwolf securities, and its sales force offered no additional assistance to potential investors trying to evaluate the 4,500 underlying assets, the Senate report charges.

Even so, Sparks and another Goldman executive put the full court press on, sending out numerous sales directives to the Goldman sales force, stressing that Timberwolf was a priority for the firm, the Senate report alleges.

But behind the scenes, Goldman was internally lowering the value of Timberwolf, the Senate report charges. And Goldman continued to sell the securities at a much higher price than the company knew it was worth.

Targets "Non-Traditional" Buyers

Goldman also began targeting Timberwolf sales to “non-traditional” buyers and those with little CDO familiarity, such as increasing its marketing efforts in Europe and Asia, the Senate report charges.

On June 18, 2007, Goldman sold $100 million worth of Timberwolf securities to an Australian hedge fund, Basis Capital, the report says.

But just 16 days later, on July 4, Goldman informed Basis Capital that the securities had lost value, and it had to post additional cash collateral to secure its CDS contract, the Senate report says.

On July 12, 2007, Goldman told Basis Capital that the value had dropped again, and still more collateral needed to be posted, the Senate report alleges.

In less than a month, the value of Timberwolf had fallen by $37.5 million. Basis Capital posted the additional capital, but soon after declared bankruptcy. Basis Capital is now suing Goldman Sachs.

Before the Basis sales, on June 1, 2007, Goldman Sachs had sold $36 million in Timberwolf securities to a Korean life insurance company, Hungkuk Life, that had little familiarity with the product, the Senate report says.

The head of the Korean sales office said his office was willing to sell the company additional securities, if assured the office would receive a 7% sales credit.

Goldman agreed, and said “get ‘er done,” the Senate report says.

The sales office sold another $56 million in Timberwolf securities to the life insurance company which paid $76 per share when Goldman’s internal value for the security was $65, the Senate report alleges.

Within ten days of that sale, Montag, the senior Goldman executive, sent an email to the Mortgage Department head, Sparks, stating: “boy that timeberwof [Timberwolf] was one sh---- deal,” the Senate report says.

Despite that comment, Goldman continued to market Timberwolf securities to its clients, the Senate report alleges.

In the fall of 2007, a Goldman analyst provided executives with a price history for Timberwolf securities, the Senate report notes.

It showed that, in five months, Timberwolf securities had lost 80% of their value, falling from $94 in March to $15 in September, the Senate report says.

Upon receiving the pricing history, Goldman’s Timberwolf deal captain, Matthew Bieber, wrote that March 27 – the day Timberwolf issued its securities – was “a day that will live in infamy,” the Senate report says.

Bear Stearns Hedge Funds Collapse

Hastening the collapse of these CDOs’ values was the failure of two Bear Stearns hedge funds had also triggered a rapid decline in the value of subprime mortgage related assets held in CDOs like Timberwolf.

The creditors of the Bear Stearns hedge funds met with Bear Stearns management in an attempt to organize a “workout” solution to stabilize the funds, the Senate report says.

Goldman and Bear Stearns agreed to an unwind in which Goldman bought back $300 million of two Triple-A CDO tranches of Goldman’s Timberwolf CDO, which the hedge funds had purchased two months earlier in April 2007.

Goldman paid Bear Stearns 96 and 90 cents on the dollar, respectively, for the two Timberwolf tranches, the Senate report says.

Unsuccessful Workout

But the attempt to organize a workout solution for the funds was ultimately unsuccessful, the Senate report notes.

“Large blocks of subprime assets from the Bear Stearns hedge funds’ inventory began flooding the market, further depressing subprime asset values,” the Senate report says.

The Bear Stearns hedge funds failed in mid-June, subprime assets plummeted in value, and Goldman established what firm executives internally called its "big short" by the end of the month, the Senate report notes.

Goldman's Net Short

After its net short was in place, Goldman’s Mortgage Department began rapidly marking down the value of its residential mortgage-backed securities and its CDO assets, the Senate report says.

That had the dual effect of raising the value of Goldman’s net short position, while cutting the value of many of its customers’ holdings, the Senate report alleges.

Goldman Takes a Battle Axe

Goldman took a battle axe to these assets, cutting a broad and deep swath through its clients’ positions by month’s end in June, July and August 2007, due to plummeting ratings downgrades.

When one of the markdowns took effect on July 25, 2007, which Sparks called “the CDO monster remark,” Senate disclosures show.

In an email to a Goldman executive, Sparks wrote: “We made massive mark adjustments this week, pushed them through because of basis and counterparty exposure.”

In a separate email to Montag, Sparks made clear that by “basis,” he meant Basis Capital, the Australian hedge fund that had financed the purchase of Timberwolf.

AIG, Morgan Stanley and Deutsche Bank Get Angry

However, the CDO markdown drew an immediate negative reaction from Goldman’s customers, Senate disclosure show.

A July 31, 2007, internal report was sent to a dozen Goldman senior executives and Mortgage Department personnel regarding pending “mortgage derivative collateral disputes,” meaning customers who were disputing the lower valuations and resulting cash margin and collateral calls, the Senate disclosures indicate.

The email identified the “10 largest disputes,” listing AIG Financial Products, Morgan Stanley, and Deutsche Bank, among others, Senate disclosures show.

The email stated: “The overall derivative collateral dispute amount is now $7.0 billion.”

The email also noted that the total in dispute from the prior week had been $3 billion, which suggests that the July 25 markdowns had caused the amount in dispute to more than double in a week, the Senate report indicates.

Montag immediately forwarded the report to Goldman’s CEO Blankfein: “7 billion of collateral disputes!!!” (sic).

Blankfein responded: “Make sure they prioritize weaker credits where our risk is threatening,” Senate disclosures indicate.

In other words, Blankfein directed Goldman personnel to focus on disputes with clients that had the weakest credit, and might have fewer resources to pay the amounts owed to Goldman as a result of the downward marks, the Senate report indicates.

The same markdowns causing losses for those clients were simultaneously increasing the profitability of Goldman’s net short, the Senate report says.

Goldman's Losses

Goldman’s 36% short position in Timberwolf produced about $330 million in revenues “at the direct expense of the clients to whom Goldman had sold the Timberwolf securities,” the Senate report says.

Goldman also made $3 million in interest while the Timberwolf assets were in Goldman’s warehouse account, the report says.

But because Goldman was unable to sell about a third of the Timberwolf securities, it had to keep the unsold securities on its books, the report says. So it ended up losing $562 million from them, the report says.

Goldman also lost $226 million from the decline in the value of the collateral securities securing the CDO, the report says.

When offset by the profits from its Timberwolf short, Goldman ended up with a total loss of about $455 million, the report says.

Timberwolf’s investors lost virtually their entire investments, the report says.

Read more: http://www.foxbusiness.com/markets/2011/04/14/goldman-sachs-accused-lying-congress/#ixzz1SrQQRuPM

By Elizabeth MacDonald

Goldman Sachs (GS) misled clients and Congress about the firm's investments in securities tied to real estate deals, according to a two-year investigation of the financial crisis, says Sen. Carl Levin [D-Mich.], chairman of the Senate panel that led the investigation.

The Senator says he wants the Justice Department and the Securities and Exchange Commission to examine whether Goldman Sachs violated the law by misleading clients who bought collateralized debt obligations without knowing the firm was betting they would fall in value.

And Sen. Levin wants federal prosecutors to review whether to bring perjury charges against Goldman Sachs chief executive Lloyd Blankfein as well as other current and former employees who testified in Congress last year.

Last April, Goldman's CEO Blankfein denied under oath before the Senate panel that the firm had what the firm itself called a "big short" against the housing market in documents the Senate had collected from the firm.

In April 2010, CEO Blankfein testified: "Much has been said about the supposedly massive short Goldman Sachs had on the U.S. housing market. The fact is we were not consistently or significantly net 'short the market' in residential mortgage-related products in 2007 and 2008..We didn't have a massive short against the housing market and we certainly did not bet against our clients."

Potential perjury charges may also zero in on testimony given by a Goldman Sachs executive before the Senate Permanent Subcommittee on Investigations about an asset-backed securities deal dubbed “Timberwolf,” people close to the matter say.

A probe could also lead to testimony from former top Goldman Sachs executive Thomas Montag, now president of global banking and markets at Bank of America Merrill Lynch (BAC), and other Goldman executives, regarding email correspondence, sources indicate.

The Department of Justice did not return calls for comment, and the SEC declined comment. A source close to the matter at Bank of America says Montag was never interviewed by the Senate panel.

“Our testimony was truthful and accurate, and that applies to all of our testimony,” says Goldman Sachs spokesman Michael DuVally.

DuVally also emailed this statement: “While we disagree with many of the conclusions of the report, we take seriously the issues explored by the Subcommittee. We recently issued the results of a comprehensive examination of our business standards and practices and committed to making significant changes that will strengthen relationships with clients, improve transparency and disclosure and enhance standards for the review, approval and suitability of complex instruments.”

And Goldman’s DuVally emailed this statement about the allegedly misleading testimony:

“The testimony we gave was truthful and accurate and this is confirmed by the Subcommittee's own report. The report references testimony from Goldman Sachs witnesses who repeatedly and consistently acknowledged that we were intermittently net short during 2007. We did not have a massive net short position because our short positions were largely offset by our long positions, and our financial results clearly demonstrate this point.”

Zeroing in on the Timberwolf Deal

Last April, Sen. Levin questioned Daniel Sparks, the Goldman executive who ran Goldman Sachs’s mortgage business at the time, on whether Goldman Sachs was misleading clients into buying investments its executives knew were steadily dropping into junk territory.

Sen. Levin pointed out an e-mail exchange Montag sent to Sparks on the Timberwolf deal, a $1 billion collateralized debt obligation.

“'Boy that Timberwolf was one sh---- deal,' Levin quoted from Montag’s 2007 email. "How much of that sh---- deal did you sell?"

A source close to the matter at Bank of America says: "Tom was just referring to the deal being bad for Goldman, because it was losing money from the time it launched the deal. The market imploded, clients and Goldman were losing money on it. It actually could have been very good for a client to buy at a deal value much lower than launched." (Note: A source contacted FBN after this story ran to indicate Montag was referring only to the firm losing money in his email, not Goldman's clients.)

During the Senate's April hearing, Senator Jon Tester [D-Mont.] noted other testimony that, in 2007, Goldman could “see some things happening,” and that Goldman itself was betting against the mortgage market.

Senator Tester asked Goldman’s Sparks, in light of those developments, “how [he] got comfortable with sales,” and how he “in good faith” sold the CDO securities to Goldman’s customers – how he could “sell them out and collect the fees and make the dough?”

Senator Tester and Sparks then had the following exchange:

Senator Tester: Every one of these [CDOs] were – it looks like a wreck waiting to happen because they were all downgraded to junk in very short order.

Sparks: Well, Senator, at the time we did those deals, we expected those deals to perform.

Senator Tester: Perform in what way?

Sparks: To not be downgraded–

Senator Tester: Perform to go to junk, so that the shorts made out?

Sparks: To not be downgraded to junk in that short a time frame. In fact, to not be downgraded to junk. ...

Senator Tester: Do you feel confident that the information about each one of these [CDOs]... was given to the investors, all of the information that was out there, and the credit rating agencies too?

Sparks: Well, I generally feel that the disclosure for the new issues that Goldman Sachs brought was good."

However, while Sparks testified that, in 2007, the Mortgage Department expected its CDOs “to perform,” a "contemporaneous draft presentation that he allegedly helped prepare in May 2007 stated that the 'desk expects [the CDOs] to underperform,'” the Senate report says.

Other emails allegedly provide Sparks’ negative views of the CDO market at the time, including emails in which Sparks allegedly described the subprime market as “bad and getting worse,” and allegedly directed Goldman’s mortgage traders to “get out of everything,” and “stay on the short side,” the Senate report charges.

Sparks allegedly wrote in emails, among other things: “Game over,” “bad news everywhere,” and “the business is totally dead,” the Senate report says.

And many of Sparks’s dire predictions were made before three of the four CDOs discussed at the hearing were even offered to customers, the Senate report says.

Sparks also testified that the Mortgage Department did not expect the Goldman-issued CDOs to be downgraded, even though all were within a year of issuance.

Ultimately, all of the CDOs discussed at the Subcommittee’s hearing were downgraded to junk status.

Timberwolf Deal Plunges in Value

Within five months of Timberwolf’s debut, the Triple-A rated CDO had lost almost 80% of its value, and it was liquidated in 2008, according to the panel’s report.

The CDO had Goldman’s clients making optimistic bets on its performance of CDOs, with Goldman buying derivatives that took the pessimistic side, as the subcommittee’s report indicates Goldman routinely did.

According to the Senate report, Goldman’s Timberwolf deal allegedly relied on “CDO assets that began to fall in value almost as soon as the Timberwolf securities were issued,” yet Goldman “solicited clients to buy the securities.”

The report alleges Timberwolf “contained or referenced CDO assets with more than 4,500 unique mortgage related securities, but Goldman offered potential investors little help in understanding those securities, and targeted clients with limited or no experience in CDO investments.”

The report charges: “When marketing Timberwolf, Goldman withheld its internal marks showing the securities losing value and did not mention its short position.”

Inflated Assets

Top Goldman executives allegedly knew the firm “was selling poor quality assets at inflated prices,” but because of its short position, “Goldman profited at the expense of the clients to whom it sold the Timberwolf securities,” the Senate report alleges.

Overall, Goldman lost money on the deal because Goldman was forced to keep many of the unsold Timberwolf securities on its books, the report says.

Specifically, Goldman had taken a short position on about 36% of the $1 billion in assets underlying the Timberwolf CDO and made money from that investment, but ultimately lost money when it could not sell all of the Timberwolf securities, the report says.

Goldman was the CDO’s placement agent, initial purchaser, collateral put provider, and liquidation agent.

It also hired a hedge fund with former Goldman employees, Greywolf Capital Management, to act as the collateral manager. Greywolf selected the CDO’s assets, with Goldman’s approval.

Montag Weighs In

As Timberwolf’s securities rapidly began losing value, almost as soon as they were purchased, in February 2007, Goldman’s Sparks told Thomas Montag, then a top executive with Goldman, that Timberwolf was one of two deals “to worry about,” according to Senate disclosures.

Specifically, on February 26, 2007, Montag asked Sparks about two CDO-squared transactions being assembled by the CDO Origination Desk, Timberwolf and Point Pleasant, the report says. Sparks allegedly expressed his concern about both. According to Senate disclosures:

Montag: “cdo squared–how big and how dangerous.”

Sparks: “Roughly 2bb, and they are the deals to worry about.”

But Goldman rushed Timberwolf to market, and it closed on March 27, 2007, approximately six weeks ahead of schedule, according to the Senate report.

However, “despite doubts about its performance and asset quality, Goldman engaged in an aggressive campaign to sell the Timberwolf securities," the report alleges.

As part of its tactics, a Goldman executive instructed Goldman personnel not to provide written information to investors about how Goldman was valuing or pricing the Timberwolf securities, and its sales force offered no additional assistance to potential investors trying to evaluate the 4,500 underlying assets, the Senate report charges.

Even so, Sparks and another Goldman executive put the full court press on, sending out numerous sales directives to the Goldman sales force, stressing that Timberwolf was a priority for the firm, the Senate report alleges.

But behind the scenes, Goldman was internally lowering the value of Timberwolf, the Senate report charges. And Goldman continued to sell the securities at a much higher price than the company knew it was worth.

Targets "Non-Traditional" Buyers

Goldman also began targeting Timberwolf sales to “non-traditional” buyers and those with little CDO familiarity, such as increasing its marketing efforts in Europe and Asia, the Senate report charges.

On June 18, 2007, Goldman sold $100 million worth of Timberwolf securities to an Australian hedge fund, Basis Capital, the report says.

But just 16 days later, on July 4, Goldman informed Basis Capital that the securities had lost value, and it had to post additional cash collateral to secure its CDS contract, the Senate report says.

On July 12, 2007, Goldman told Basis Capital that the value had dropped again, and still more collateral needed to be posted, the Senate report alleges.

In less than a month, the value of Timberwolf had fallen by $37.5 million. Basis Capital posted the additional capital, but soon after declared bankruptcy. Basis Capital is now suing Goldman Sachs.

Before the Basis sales, on June 1, 2007, Goldman Sachs had sold $36 million in Timberwolf securities to a Korean life insurance company, Hungkuk Life, that had little familiarity with the product, the Senate report says.

The head of the Korean sales office said his office was willing to sell the company additional securities, if assured the office would receive a 7% sales credit.

Goldman agreed, and said “get ‘er done,” the Senate report says.

The sales office sold another $56 million in Timberwolf securities to the life insurance company which paid $76 per share when Goldman’s internal value for the security was $65, the Senate report alleges.

Within ten days of that sale, Montag, the senior Goldman executive, sent an email to the Mortgage Department head, Sparks, stating: “boy that timeberwof [Timberwolf] was one sh---- deal,” the Senate report says.

Despite that comment, Goldman continued to market Timberwolf securities to its clients, the Senate report alleges.

In the fall of 2007, a Goldman analyst provided executives with a price history for Timberwolf securities, the Senate report notes.

It showed that, in five months, Timberwolf securities had lost 80% of their value, falling from $94 in March to $15 in September, the Senate report says.

Upon receiving the pricing history, Goldman’s Timberwolf deal captain, Matthew Bieber, wrote that March 27 – the day Timberwolf issued its securities – was “a day that will live in infamy,” the Senate report says.

Bear Stearns Hedge Funds Collapse

Hastening the collapse of these CDOs’ values was the failure of two Bear Stearns hedge funds had also triggered a rapid decline in the value of subprime mortgage related assets held in CDOs like Timberwolf.

The creditors of the Bear Stearns hedge funds met with Bear Stearns management in an attempt to organize a “workout” solution to stabilize the funds, the Senate report says.

Goldman and Bear Stearns agreed to an unwind in which Goldman bought back $300 million of two Triple-A CDO tranches of Goldman’s Timberwolf CDO, which the hedge funds had purchased two months earlier in April 2007.

Goldman paid Bear Stearns 96 and 90 cents on the dollar, respectively, for the two Timberwolf tranches, the Senate report says.

Unsuccessful Workout

But the attempt to organize a workout solution for the funds was ultimately unsuccessful, the Senate report notes.

“Large blocks of subprime assets from the Bear Stearns hedge funds’ inventory began flooding the market, further depressing subprime asset values,” the Senate report says.

The Bear Stearns hedge funds failed in mid-June, subprime assets plummeted in value, and Goldman established what firm executives internally called its "big short" by the end of the month, the Senate report notes.

Goldman's Net Short

After its net short was in place, Goldman’s Mortgage Department began rapidly marking down the value of its residential mortgage-backed securities and its CDO assets, the Senate report says.

That had the dual effect of raising the value of Goldman’s net short position, while cutting the value of many of its customers’ holdings, the Senate report alleges.

Goldman Takes a Battle Axe

Goldman took a battle axe to these assets, cutting a broad and deep swath through its clients’ positions by month’s end in June, July and August 2007, due to plummeting ratings downgrades.

When one of the markdowns took effect on July 25, 2007, which Sparks called “the CDO monster remark,” Senate disclosures show.

In an email to a Goldman executive, Sparks wrote: “We made massive mark adjustments this week, pushed them through because of basis and counterparty exposure.”

In a separate email to Montag, Sparks made clear that by “basis,” he meant Basis Capital, the Australian hedge fund that had financed the purchase of Timberwolf.

AIG, Morgan Stanley and Deutsche Bank Get Angry

However, the CDO markdown drew an immediate negative reaction from Goldman’s customers, Senate disclosure show.

A July 31, 2007, internal report was sent to a dozen Goldman senior executives and Mortgage Department personnel regarding pending “mortgage derivative collateral disputes,” meaning customers who were disputing the lower valuations and resulting cash margin and collateral calls, the Senate disclosures indicate.

The email identified the “10 largest disputes,” listing AIG Financial Products, Morgan Stanley, and Deutsche Bank, among others, Senate disclosures show.

The email stated: “The overall derivative collateral dispute amount is now $7.0 billion.”

The email also noted that the total in dispute from the prior week had been $3 billion, which suggests that the July 25 markdowns had caused the amount in dispute to more than double in a week, the Senate report indicates.

Montag immediately forwarded the report to Goldman’s CEO Blankfein: “7 billion of collateral disputes!!!” (sic).

Blankfein responded: “Make sure they prioritize weaker credits where our risk is threatening,” Senate disclosures indicate.

In other words, Blankfein directed Goldman personnel to focus on disputes with clients that had the weakest credit, and might have fewer resources to pay the amounts owed to Goldman as a result of the downward marks, the Senate report indicates.

The same markdowns causing losses for those clients were simultaneously increasing the profitability of Goldman’s net short, the Senate report says.

Goldman's Losses

Goldman’s 36% short position in Timberwolf produced about $330 million in revenues “at the direct expense of the clients to whom Goldman had sold the Timberwolf securities,” the Senate report says.

Goldman also made $3 million in interest while the Timberwolf assets were in Goldman’s warehouse account, the report says.

But because Goldman was unable to sell about a third of the Timberwolf securities, it had to keep the unsold securities on its books, the report says. So it ended up losing $562 million from them, the report says.

Goldman also lost $226 million from the decline in the value of the collateral securities securing the CDO, the report says.

When offset by the profits from its Timberwolf short, Goldman ended up with a total loss of about $455 million, the report says.

Timberwolf’s investors lost virtually their entire investments, the report says.

Read more: http://www.foxbusiness.com/markets/2011/04/14/goldman-sachs-accused-lying-congress/#ixzz1SrQQRuPM