- Welcome to the DEN Contact Us-------PUBLIC INTEREST defense FOR INFRINGMENT OF COPYRIGHT 'ALBERTA & BC ONTARIO SHADOW CIA VK DURHAM CROWN Whale'

- DEBTORS IN A SECRET FOREIGN PROCEEDING

- Booming BC natural-gas sector

- The indictment (1) that the defendants had engaged in a common plan or conspiracy (2) to commit crimes against peace, (3) war crimes, and (4) crimes against humanity. The third count, that of committing war crimes, had ten subdivisions, in the fifth of wh

- bc rail inquiry=Convertible Gold Debentures

-

s1778 -THE ROOT OF HMS CROWNS PONZIE

- DEED 189934 in "TRUST (99 YEARS)."

- SHADOW CIA Maximus- Isreal

- Crown of England. STATUTORY INSTRUMENT 1997 No. 1778--MAXIMUS GOLD ESTATE CORRUPTIONThis Order may be cited as the Social Security (United States of America)

- THE PRESIDENT'S CENTURIONS such as those men President Harry S.

- 83.27. Punishment for terrorist activity 83.27 (1) Notwithstanding anything in this Act, a person convicted of an indictable offence, other than an offence for which a sentence of imprisonment for life is imposed as a minimum punishment, where the act or

-

The key word is control of the individual.

- USELESS EATERS are broke and dumbed down -two $120 Billion Dollar“Unauthorized Gold

- some time in 1987-88.

- BREAKING OF THE CODE OF SILENCE is an absolute.-PUBLIC SAFETY MINISTER FAILING TO PROTECT CITIZENS ..........PICKTON THESIS ACCORDING TO THE DEADMAN IN JERVIS INLETS JOURNAL

- U.S.DEBT INSTRUMENTS.... GAIAForgery 1957 PREUVIAN GOLD BOND TIMELINE & CHAIN OF TITLE

- DEED OF ASSIGNMENT FOR CONSIDERATION EQUITY GOLD COLLATERAL INTEREST SEAL 1 & 2

- $17 Trillion DOLLARS GOLD

- U.S.DEBT INSTRUMENTS....Forgery...and "Orders from the TOP:"DO NOT INVESTIGATE."

- Social Security Purchased by Crown

- We underwrote another $6.5 Trillion Dollars for the Global Humanitarian

- 1988 DURHAM TRUST INTERNATIONAL -ASSIGNMENT OF INTEREST

- 1991 -BRADY BONDS OWED TO DURHAM TRUST INTERNATIONAL

- 1994-LEO WANTA FORGERY -VK DURHAM AUTHOR US WELFARE QUEEN ---Russell Herman's Boatmens Bank Account.

- 1994 RICK MARTIN -LAST WILL AND TESTAMENT OF RUSSELL HERMAN &COSMOS SEAFOOD ENERGY MARKETING

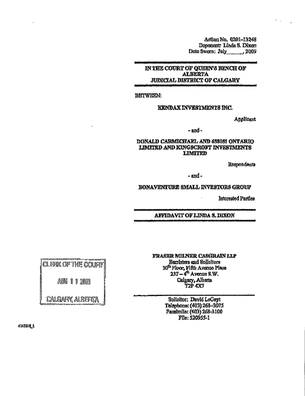

- 2003 KINGSCROFT INVESTMENT FRAUD -DURHAM TRUST

- 2011- FBI SOVEREIGN CITIZENS MOVEMENT CRIMINAL CROWN PROSECUTORS FRAUD MILL - PACIFIC WEST COST UNDER ATTACK BY CROWN PIRATES BC marine based WARCRIMES FINANCED A GLOBAL WALL STREET/CROWN/SOVEREIGN DIRECTING MINDS /FREEMASON SOCIETY BY SUSPECTED ILLEGAL C

- BC FEDERAL WATERS ARE A DANGEROUS PLAYGROUND FOR VICTIMS -IMPERIAL OIL WORLD CORRUPTION -DID CAMPBELL RIVER CITY HALL SELL THE FORGED DEEDS TO WILLY PICTON'S ESTATE

- breaking news CR CITY HALL & MAXIMUS US Counterfeiting of US Debt =HEADQUARTERS OF THE NWO- GROUND ZERO 9-11 May 2012

- AG MINISTRIES------------------ILLEGAL ROYAL QUEEN'S CROWN REVENUE -DISCLAIMER :

- MINISTER OF JUSTICE OF CANADA NEEDS TO BE HELD ACCOUNTABLE FOR CROWN PROSECUTORS IDENITY CREDIT THEFT CRIMES

- 83.28 (1) Judge Definition of “judge”

- public safety - LAWYER- FEDERAL MINISTER OF PUBLIC SAFETY IS FAILING CANADIANS AND AMERICANS -FBI WANTED INTERNATIONAL PONZIE PIRATES attack in communities throughout PACFIC WEST COAST

- 1997-2011 -INDIAN ACT BRITISH TYRANNY - USING ABORIGINAL CULTURE TO LAUNDER ILLEGAL GAINS FOR BRITISH AGENTS -Campbell River Harbours & Homeland DFO security CROWN DEATH POOL INSURANCE INDUSTRY -REGULATORS NEEDED ASAP

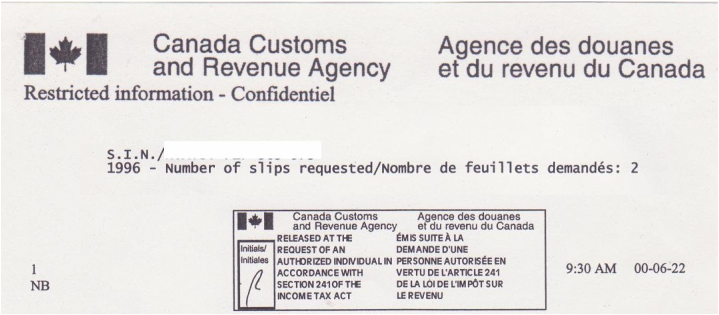

- CRA----------FEDERAL PRIVACY BREACHES -2700 missing CRA FILES

- CRA ,,,,READ FIRST -COPYCAT PONZIE -everybody got hit. The safety net was ripped out.” FORGER BOB WHITE

- 2011 PONZIE WARNING - HMS PONZIE IS BACK -IRS/CRA US/CANADA MILITARY MEMBERS Alaska gold fever PONZIE = ROYAL Canadian Mint forges a new path to cash in on gold fever

- intro -CAPITAL HMS Junk CANADIAN bonds

- THE QUEENS ROYAL SOVEREIGN CROWN FRAMED SITTING MLA BOB WILSON

- THE FRAUD ISSUE: UK CROWN estate freehold property rights

- 1997-2011 DFO & NORWEGIAN AQUACULTURE INDUSTRY CULTURE OF PONZIE GOLD CORRUPTION sovereign citizens FELLOWSHIP movement may be manipulating US homeland security

- KENTUCKY ED & WEST MEMPHIS CHIEF BOB ARE LOOKING FOR THE MASTERMINDS

- corporate fraud NORWAY/CHILE AQUACULTURE INDUSTRY

- HMS MOTHERLOAD DEED/MORTGAGE FRAUD PONZIE ESTATE ASSESTS AND DEBTS -ISSUE:MIA BC SUPREME COURT FINAL ORDER FOR A 1988 BMO MORTGAGE

- 1969-2011 CROWN PROSECUTORS PONZIE ROBOSIGNERS LIST - CROWN ESTATE- DFO MARINE - ALBERTA QUEENS BENCH -HMS PONZIE

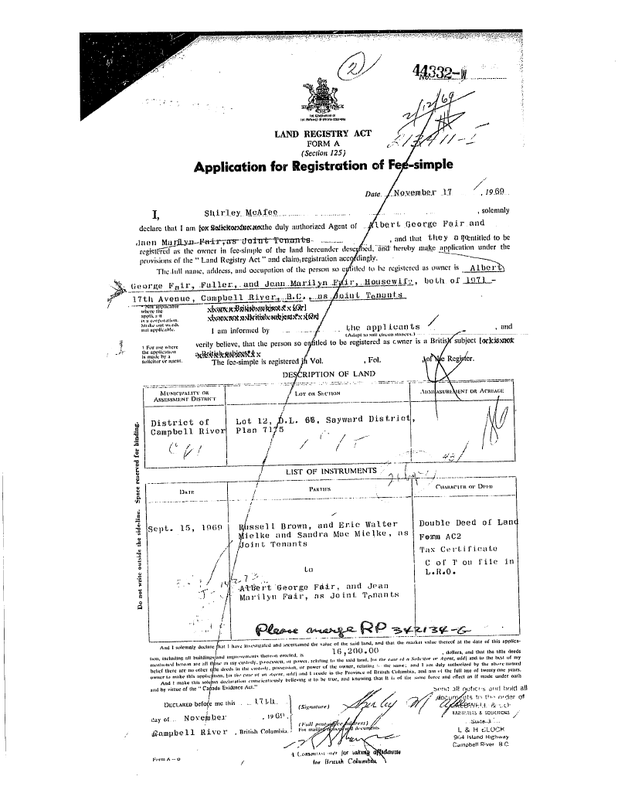

- 1974- CROWN MINISTERS FORGED INFEASABLE TITLE /OWNERSHIP THE CROWN PROSECUTORS FORGED ESTATE AND LAND TRANSFER

- SPIN DOCTORING Is a LETHAL MEDIA DISEASE

- POWELL RIVER CIBC= WALLS STREET MERS PAPER TERRORISM

- intro Breaking news--------smoking gun...........July 23 2011

- #1 UPDATE OCT 2011 -4 MONTHS LATER UPDATE- OCT 2011 WALL STREET UNDER ATTACK

- #2 EMERGENCY INJUCTIVE ORDER =cease and desist -Life insurance -over insured/SERIOUS PERSONAL SAFETY THREAT -over company insured-2003 TD ILLEGALLY INSURED PENSION BENIFICARY /NO WET INK DOCUMENT

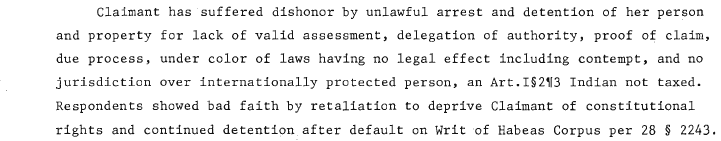

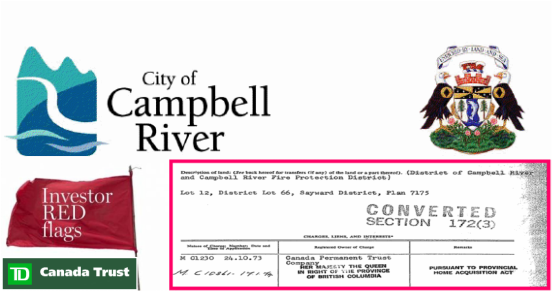

- #3 intro -ILLEGAL CROWN ASSIGNMENT- ILLEGAL CREDITORS AND FORGE GOVERMENT LEINS.-BC HOME AQUISTION ACT FALSE CHARGE ON CLEAR TITLE

- #4 11MAY11-affadavit of PONZIE -JOYCE KENDALL LOST RECORDS -MARY WILLIAMS/JOYCE KENDAL FORGED AUTHORSHIP

- #5- IN THE LINE OF PUBLIC FAMILY SAFETY DUTY

- #6- 1973- BC DOUBLE DEED FRAUD CANADA TRUST/TD MORTGAGE FRAUD BIRTH OF ASCALADE INC.. & CROWN PONZIE

- #7 2011 MAY -SOVEREIGN BSIG AGENT -TREVOR JOYAL - NORTH ISLAND HMS PONZIE INVESTORS GROUP

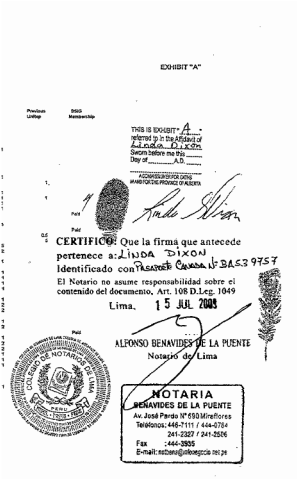

- #8 -COURT AUTHORSHIP-WITNESSES ACCUSED-HANDWRITING FINGERPRINTS FROM PERU LED TO CAMPBELL RIVER ,CALGARY,FLORIDA ,CALIF CRIMINALS EGO LED TO SLOPPY FORGING

- #9 -intro -PROF COX FROM DUKES UNVERSITY EXPLAINS OUR FORGED imperial QUEEN ESTATES NIGHTMARE

- Innovative Aquaculture MARINE/FEDERAL WATER BASED Projects SOVEREIGN /CHRISTIAN FELLOWSHIP /PONZIE clean up fund

- ISSUE :SOVEREIGN INVESTORS FORGED ESTATE TAKEOVERS /FELLOWSHIP FRAUD

- FACEBOOK UNIVERSITY/JUDCIAL ETHICS COURT

- #10- LEHMAN BROTHERS -THE REAL FLORIDA- MR BRUCE GRANT BONAVENTURE/

- #11 - IDENTITY THEFT DUE TO FORGED BC MARRIAGE CERTIFICATE CREATING 2 FORGED JOINT MATRIMONIAL LIFE STATES -ALBERTA WILEYS

- #13-- INTERNATIONAL MERS SOVEREIGN SOVEREIGN PONZIE BRANCH SHUT DOWN /RESTORE COURT RECORD /LEGAL LAND TITLES AND DEBT OWNERSHIP.......1QT-NOT WELCOME IN NASHVILLE....TRIBUTE TO BRANDON & BILL AND THE CHEIF & 60 MINUTES

- #14- INTRO & ISSUES -- BACKGROUND OF THE INVESTMENT/TAX SHELTER /FLORIDA ESTATE FRAUD PENSION PONZIE SCHEME Parliament needs to act to close the loophole that allowed the situation to occur FORGED INCORPORATED OFFSHORE ,US, BC ALBERTA ONTARIO,LTD companie

- #15-PONZIE CRIME IN PROGRESS -INTERNATIONAL CROWN PONZIE INCORPORATED TRAIL /DIRTY DEEDS OF TRUST DONE DIRT CHEAP/ /NEW HEALTH AND SAFETY ISSUE ON OR OFF THE JOB -BC WEST COAST SOVEREIGN CITIZEN MOVEMENT DESTROYING COASTAL COMMUNITIES AND INDUSTRY-TARGETE

- #16- CALGARY -ALGER TRUSTEE BANKRUPTCY FRAUD -SOVEREIGN EX SIGNS AS JUDGE HORNER

- #17- -SERIOUS THREAT TO LIFE/TARGETED VICTIM 0F MASSIVE LEVELS OF IDENTITY THEFT ALBERTA -SELLER OF AN RESIDENTIAL COMPLEX FOR $600,000

- #18- -2011- LIFE INSURANCE FRAUD OVER INSURED COMPANY INTEREST - ALBERTA PERSONAL PROPERTY REGISTRY CORRUPTION- REMOVE FRAUD FROM ALBERTA P

- #20- BC MINISTRY OF SOCIAL SERVICES DROPPED THE BALL -public safety =JERVIS DEADMANS CONNECTION TO DAVIS /LAWYER/ CHILDREN VICTIMS - LETHAL SPIN OFF EFFECTS OF A SOVEREIGN RUN PONZIE

- #21- public safety =CRA / MAXIMUS WELFARE sovereign QUEENS PAPER WRIT PONZIE TERRORISM US MAXIMUS ponzie -across state linesCANADIAN FEDS/US

- #22- PLAINTIFFS -GLENMOUNT

- #23- KINGSCROFT UNIT PURCHASE AGREEMENT

- #24- 1999 ONTARIO LTD 658051

- #25- -JOYCE KENDAL AFFADAVIT -KENDAX

- #40- 17-JUN02- PRINCIPLE TERRY L. DODWELL SENTENCED FOR 15 YEARS The Vavasseur programme was operated and controlled by an American citizen named Terry Dowdell who purported to be able to generate substantial profits by trading in bonds.

- #26- GRANTEE.........1998 (“Vavasseur”), a Bahamian corporation owned beginning in April 1998 and continuing through 2001,

- #27- GRANTEE...........ATCO DEED KATHLEEN MARIE ALVES

- #27b- =cease and desist - CROWN ATTORNEY GENERALS MINISTRY//US MAXIMUS/CRA -NAME GAME/ESTATE FRAUD/COLD CALCULATED ACCOUNTING FRAUD

- #28- -cease and desist -1969 -2011 PONZIE WAR - FORGED & VIOLATED CONSENT BC ESTATE DEED OF TRUST -- CIBC /DAVIS CONNECTION TO BC SUPREME COURT-DIVORCE /FORECLOSURE LIFE BENCHER BC SUPREME COURT JUSTICE GRANT BURNYEAT

- #30- =cease and desist -BISG sovereign investors payout on insurance fraud

- #31- cease and desist -2009-ATB FINANCIAL-CROWN SECURITIES FRAUD/IDENTITY CREDIT THEFT ,ESTATE FRAUD

- #32- A ISSUE OUTSOURCING GOVERMENT CONTRACTS - US MAXIMUS INC IN HOUSE SOVERIGN CROWN FORGED CONTRACT Structurists-BC ATTORNEY GENERALS OFFICE BRENT HIRD/SUSAN CARR AGENT FOR THEMIS /MAXIMUS/FMEP

- #33- MERS ASSIGNED/FORGED 1988 BMO -1ST MORTGAGE/DEED OF TRUST - APPENDIX #A WAS ADDED SEP23 1993

- #34-----EVIDENCE-1995 BC SUPREME STATEMENT OF CLAIM FOR FINAL ORDER

- #35- FLORIDA TRUST BOND BRANCHES- Who bought bonds issued by different trusts that were set up by a particular bank or mortgage company, ?

- #36- -SMOKING GUN........ 1989 INDUSTRY CANADA FRAUD

- #37- -SOVEREIGN INTERNATIONAL COMMUNITY APPEAL COURT --------- RE :BC DIVORCE FRAUD BC SUPREME COURT FINAL ORDER

- #38- -1969-2011 IN THE PATH OF A HMS BRIXON GROUP BC WESTCOAT/ALBERTA PONZIE with business advantages/perks and lifestyle appeal.[4]

- #39- -KINGSCROFT BONAVENTURE ILLEGAL FINANCIAL SERVICES COMPANY

- #40 -Maximus /BC HEALTH CORRUPTION/IDENITY THEFT FRAUD RING/ SOVEREIGN CITIZEN MOVEMENT ACCOUNTING

- #41- -LEGAL OATHBREAKERS IN COLLUSION W/INDUSTRY CANADA/ PERJURY INFESTATION AND - SOVERIEGN WALL STREET CONTRACT STRUCTULISTS TAKE OVER-

- #42 -1997- THE IMPERIAL SOVEREIGNS QUEEN IN THE RIGHT OF CANADA-ILLEGAL ATTACHMENT

- #43- -CEASE AND DESIST SOVERIEGN BSIG INVESTOR POOL AGENT PERU LINDA DIXON

- #44- -2011- CIBC CEASE AND DESIST BONAVENTURE COURT CROWN- /WALL STREET SOVERIEGN CREDITORS INTENDED TO DEFRAUD DEBTOR

- #45-MCKEE BC FIRST NATIONS insurance MASTERMINDS CROWN CIBC/ATB FINANCIAL ALBERTA CROWN BANKinvestigation-

- #46 --public safety/FEDERAL WATERS/HARBOUR BASED -illegal MONEY MOVERS /estates via forged federal liens/attachments FINANCING OFFSHORE VENTURE CAPITAL/PRIVATE WEALTH/INDUSTRY INVESTORS IE:GOLD IN PERU

- #47- -SW CALGARY LEGAL SOVEREIGN CITIZEN AID HIGH INTEREST RETURN PONZIE HOUSE- BONAVENTURE COURT FINANCED BY FRAUD

- #48- -INTERNATIONAL PROSECUTIONS NEEDED TO STOP MERS COMMON LAW COURT CLEAN UP ASAP----- COMMON LAW INTERNATIONAL SOVEREIGN LEGISLATION/ SLAYER LAWS

- #49- US NATIVE SOVEREIGN MASTERMIND IN JAIL IN CALIFORNIA -JANICE WEEKS KATONA SEEKING TO REOPEN A 1992 CHAPTER 11 FLORIDA BANKRUPTCY CASE-TO ALLOW TRUSTEE/ADMINISTER TO RELEASE TRUST ASSETS-NO GO SHOT DOWN BY FLORIDA ORLANDO BANKRUPTCY COURT- JUDGE K

- #50- -SOVEREIGN BC QUEEN/PENSION MINISTRY OF SOCIAL SERVICES /FMP FRAUD GRAB

- #51- -CANADIAN LEGAL AID IMPERIAL CROWN MASTERMINDS OF US/CANADA SOVERIEGN STRUCTULISTS MASTERMINDS ENGINEERED CONTRACTS ARE KILLING WEST MEMPHIS POLICE AND POLITCALLY TARGETED WHISTLEBLOWER EASY TARGETS

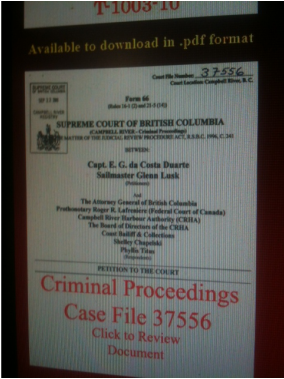

- #52- -1995- PERJURING PLAINTIFF BC SUPREME/FAMILY COURT - PONZIE/PERJURY /BONAVENTURE SECRET SOVERIEGN COURT/TRANSFER OF A FORGED ESTATE 1993

- #53- -PERJURY FINANCED CRIMES AGAINST HUMANITY = SOVEREIGN WRONGDOERS FAILED TO INFORM JUSTICE MEIKLEM OF THE BC SUPREME COURT ON JUNE 19 1995 -THAT THE BMO 1ST MATRIMONIAL MORTGAGE IN QUESTION HAD ACTUALLY BEEN FORECLOSED - EXPLAINS MIA/ BMO 1ST MATR

- #54- -PUBLIC SAFETY - CRA/MAXIMUS CROWN /CITIZEN SOVERIEGNS PENSION PONZIE/

- #55- --MONEY MOVER HIJACKED STEELWORKERS PENSION ACCOUNT TAKEOVER/SEIZED BY ILLEGAL ATTACHMENTS

- #56- -CONTEMPT/TREASON SERVICE ALBERTA CROWN DEBT COLLECTIONS

- #57- -QUEENS BENCH AUTHOR NOT IS NOT A JUDGE BUT SOVEREIGN EX WIFE OR EX GITLFRIEN-AKA FLORIDAS LINDA GREENS

- #58- -BROKEN COURT RECORD -1995 LORDSHIP ISSUE IGNORED BY BIG CORP/BIG BANK CROWN SOVEREIGN LEGAL COMMUNITY =DEBTOR STATEMENT OF CLAIM BEFORE THE SUPREME COURT OF BC

- #59- -FORGED COURT RECORD -INSERT BLANK AMOUNT MERS MORTGAGE BANK/WIRE FRAUD FOR FINAL BC SUPREME COURT ORDER owed to the Queen FOR THE 1ST MORTGAGE

- #60- -MERS IMPERIAL CROWN SOVEREIGN DEBT SLAVE MASTERMINDS

- #61- TRUSTEE BURNETT-TRUST ACCOUNT BANK ACT-

- #62- -1995-DEFENDANT BC SUPREME/FAMILY COURT - TARGETED DEBTOR AFFADAVIT

- #63- -1995 FINAL BC SUPREME COURT TAMPERED TRANSCRIPTS -ORDER

- #64- -BC LAND TITLES CORRUPTION/FORGED DEED MILL

- #65- -INTRO BROKEN CHAIN OF TITLE 1989-2011 CIBC/BC &AB LAND TITLES -FORGED CHAIN OF OWNERSHIP

- #66- -1993 VICTRO REGISTRY BIG CORP COMPANY REGISTRY VICTORIA BC

- #67- -TREASON ALBERTA CROWN -JUDGE HORNER-HARPER-DAVIS-BURNYEAT

- #68- --1992 BC SUPREME COURT FINAL ORDER/SEPERATION AGREEMENT SIGNED UNDER FALSE PRETENCES/

- #69- MAXIMUS IGNORED BC SUPREME COURT FOR BIG BANKS AND BIG CORP

- #70- --MASTERMIND JUSTICE KAREN HORNER BANKRUPTCY FORECLOSURE FRAUD HARPER HORNER bloodline calgary queens bench court orders

- #71- -illegal FLORIDA LEGAL AID IMPERIAL CROWN ESCROWED DEPOSITS /ponzie bank/wire fraud

- #72- -NATIVE SOVEREIGN BC MASTERMIND MCKEE CDS INSURANCED FRAUD -MASTERMIND MCKEE CONNECTION TO TARGETED VICTIM/WHISTLEBLOWER - FIRST NATION IMMUNITY /TAX FREE/ROYAL LAW

- #73- -WHO IS THE REAL LINDA GREEN- AGENTS TRANSFER OF ESTATE INCLUDING /MORTGAGED PROPERTY OR FOR SALE OR CONYENANCE

- #74- --ESTATE ATTACHMENTS MERS DEED OWNERS INCLUDE PENSIONS

- #75- -2011-SOVERIEGN QUEEN IN THE RIGHT OF CANADA VERSUS US ROYAL LAW COURT

- #76- -CROWN SOVERIEGNS COURT ADMINISTRATOR ENFORCING ROYAL LAW -public safety risk assesment

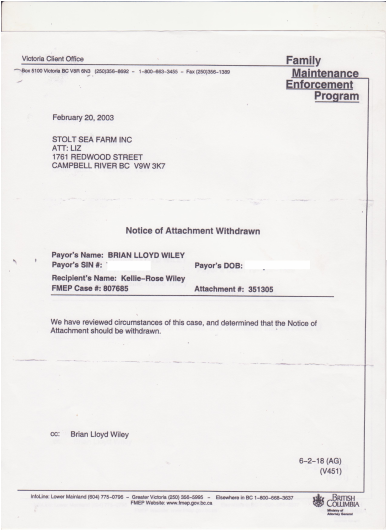

- #77- -2003 -JUSTICE DEPARTMENT ATTACHMENT WITHDRAWL

- #78- -1995- BUISNESS TRUST ACCOUNTING FRAUD/TRUSTEE FRAUD ALABAMA THE BIRTH OF HMS PONZIE SECURITIES FRAUD AMERICAN HERITGAGE CHURCH LOANS/BONDS PONZIE HEADQUARTERS

- #79- -1973-2011 BC WEST COAST BIG CORP/WALL STREET CITY HALL CORRUPTION

- #80- 2005-QUEBEC LINDA DIXON

- #81- -MAXIMUS US NATIVE INDIAN SOVEREIGN CITIZEN TRUSTS ESTATES US AND CANADA WELFARE QUEENS/BC BMO MORGICIDE

- #82- -2011 CIBC/ JANICE WEEKS KATONA

- #83- =ILLEGAL Canadian BONDS SEIZED BY IRS

- #84- -1992 IRS SEIZED CANADIAN BONDS SOVERIEGN GROUP RECOVERY CORRUPTION -PREMEIR CAPTITALTRUST -JANCICE WEEKS KATONA

- 61-US NATIVE INDIAN SOVEREIGN TRUSTS 8-Premier Benefit Capital Trust CONNECTED TO CIBC DAVIS scheme, which defrauded investors of more than $7.5 million; two of the principles

- 62-NATIVE SOVEREIGN -BC/ALBERTA/SAN FRAN JAIL SIGNATURES-FLORIDA'S MERS LINDA GREEN/BC CLERK/ALBERTA JUDGE AGENT/OWNER OF ILLEGAL CANADIAN COMPANIES KINGSCROFT/KENDAX/658 AKA LINDA GREEN/JOYCE KENDALL

- #85- -AB =REGISTARS CORRUPTION OF SOUTH ALBERTA LAND TITLES

- #86- --BC/ALBERTA WELFARE MERS QUEENS SOVEREIGN DOUBLE deed forgers

- #87- --CANADA TRUST LIEN 1973-1ST MORTGAGE /DEED OF TRUST SUN LIFE OF CANADA GROUP MORTGAGE CANADIAN APPENDIX #AHISTORY

- #88- --BC FORGED WRITS/CREDITORS FEDERAL ATTACHMENTS

- #89- --2010 ACCOUNTING FRAUD COLLIERS INTERNATIONAL BONAVENTURE COURT SOLD NOV

- #90- -RBC MUTUAL FUNDS SIEZED

- #91- -SUNLIFE PENSION SEIZED-SUNLIFE 1ST MORTGAGE FRAUD

- #92- -2009 SUNLIFE OF CANADA/RBC/BMO/CIBC /ATB CROWN/BANK OF CANADA/ organized mortgage fraud

- #93- TORONTO DOMINION MORTGAGE FRAUD DISCHARGE CLAIM GARTH BAILEY

- #94- -1992 3 PARTY LIABILITY LEGAL AID/ CIBC -FALSE LIEN /FAKE INJURY SETTLEMENT(3RD PARTY)

- #95 a- illegal atttach TELEVECTOR

- #95b- --illegal atttach EVERGREEN CREDIT UNION/

- #95c- -illegal atttach CIBC

- #95d- --illegal atttach -BMO

- #95-e -illegal atttach MAXIMUS

- #95f- -illegal atttach STOLT SEAFARMS

- #95g- -2003--illegal atttach WITHDRAWN STOLT SEAFARMS ATTACH

- #96 - =ILLEGAL writs

- #96a- -LEGAL AID ALBERTA/BC AUTO ATTACHED WRITS OF FRAUD

- #96b- AJ- ILLEGAL WRIT 1989 34-38 SUNLIFE OF CANADA

- #96c- -FX ILLEGAL WRIT 1989 44-48

- #96d- -BM ILLEGAL WRIT 1989 39-43

- #96e- -CQ ILLEGAL WRIT 1989 49-53

- #96f- -DH ILLEGAL WRIT 1989 54-63

- #96g- -DX ILLEGAL WRIT 1989 64-68

- #96h- -ER ILLEGAL WRIT 1989 69 -73

- #96i- -EW ILLEGAL WRIT 1989 74-78

- #96 j- FX ILLEGAL WRIT 1989 84- 88

- #96k- -GD ILLEGAL WRIT 1989 89- 93

- #97- -EARL H PACE TRUSTS investigation

- #97b- 93-WHO IS THE REAL FLORIDA MR BRUCE GRANT BONAVENTURE

- #98- -WHO IS THE REAL FLORIDA E ERNEST HARPSTER ??? IS HE ALIVE OR DEAD

- #99- -2007 LEHMAN BROTHERS HOLDING

- #100- -BC MAXIMUS /MEP ALBERTA IN CONTEMPT OF JUTICE MEIKLEMS FINAL ORDER

- #101- -CANADA /US MERS ROBO SIGNERS MERS/MAXIMUS LINDA GREENS SIGNATURES OF EXTORATION

- #101b- - MERS CRA/WELFARE LINDA DIXON AFFADAVIT

- #101c- -FLORIDA TRUST SUN LIFE PENSION WRIT 1989- AJ LINDA GREEN-DIXON

- #101d- -PASCO COUNTY FLORIDA EARL H PACE TRUST

- #102- S CALIFORNIA DISTRICT COURT JUDGE MILLER

- #103- ORLANDO FLORIDA BANKRUPTCY COURT

- #104- CANADA JUDICIAL SECURITIES SOVEREIGN - JUDGE KAREN HORNER PRIME MINISTER HARPERS COUSIN

- #105- IMPERIAL CRA WELFARE MERS QUEEN SOVEREIGN LEHMAM LINDA GREEN CREDIT DEFAULT SWAPS GOAT POO

- #106- WHO IS THE REAL MR BRUCE GRANT BONAVENTURE? THE TRUTH BEHIND SW CALGARY REAL ESTATE TAX SHELTER BONAVENTURE COURT AKA COMPLEX AND GARTH BAILEY HMS/BRIXON GROUP PONZIE

- #107- KENDAX WHO IS THE REAL JOYCE KENDAL ?????New Page

- #108- JOYCE KENDAL KENDAX LTD ROBO SIGNED florida judge jennerman

- #109- 1969 BC LAND TITLES CHAIN OF TITLE BROKEN BY FORGERY DATING BACK TO 1969JUDICIAL FEDERAL LIENS AND ATTACHMENTS OF INCOME AND PENSIONS ON INTERNATIONAL WATERS INCLUDING FUTURE CONSIDERATIONS AND INTEREST CHARGES

- CROWN SOVERIEGNS IN COLLUSION WITH US MAXIMUS HMS/BRIXON GROUP ponzie MERS PAPER CRA/maximus/BIG CORP PAPER TERRORISM -across state lines

- #110- ALBERTA SOVEREIGN TRUSTEE FRAUD

- #111- 2003-WILEY prefab home -albertaDIAMOND VALLEY MANUFACTURING

- #112- 95-INTRO 1973/ 1974 - CAMPBELL RIVER TD/CANADA TRUST MORTGAGE FRAUD TITLE C1229- BC GOVERMENT FORGED LIEN PURSUANT TO BC PROVINCIAL HOME AQUISTION ACT

- #113- BRIAN WILEY AND MELANIE WILEY ALBERTA CONDO SELLERS

- #114- -LEGAL SOVEREIGN AID SOCIETY 2011 MAXIMUS LTD LEGAL SOVEREIGN AID SOCIETY ponzie PAPER CRA TERRORISM -across state linesCANADIAN FEDS/USPENSION PONZIE SOVEREIGN REAL ESTATE INVESTMENT CLEAN UP FUND

- #115- -Trust law From Wikipedia, the free encyclopedia

- SOVEREIGN BUNGA

- #116- -LEGAL SOVEREIGN AID SOCIETY SOVEREIGN CITY HALL MASTERMINDED GOAT POO SECURITIES CONTRACT SOVEREIGN ROYAL LAW 1988 BMO 1ST MORTGAGE UNDER OATH THE CANADIAN SOVEREIGN MERS WELFARE QUEENS CROWN CLERK PONZIE

- #117- -LEGAL SOVEREIGN AID SOCIETY SOVEREIGN CITY HALL SWINDLEGATE INTERNATIONAL LEGAL SOVEREIGN AID SOCIETY

- #118- -LEGAL SOVEREIGN AID SOCIETY ILLEGAL CROWN BANKRUPTCY AND CROWN FORECLOSURE FRAUD 100% GOAT POO CREDIT DEFAULT SWAPS USING US FLORIDA DISTRICT COURTS AS THEIR SOVEREIGN GET AWAY CARS FLORIDA 25MAY1995 CAPITAL JANICE WEEKS KATONA church ponzie BC

- #119- 1995 BC SUPREME COURT JUDGE MEIKLEM'S FINAL DEAL-JUNE 19

- #120- -JUDICIAL CROWN SOVERIEGNS -THE CLERK

- #121- MAXIMUS INSURANCE INDUSTRY NEEDS IMMEDIATE SOVEREIGN REFORM AND STRICTER LAWS

- US JUDGES WHO ACTUALLY GETS IT

- FLORIDA EARL PACE TRUST

- FORGED TRANSFER OF JOINT COMPANY ESTATE

- 2009-ALBERTA GRANTEE-GAS COMPANY OWNS WILE-Y ESTATE

- 2010- CEASE AND DESIST -BSIG BONAVENTURE / CHURCH PONZIE INVESTORS GROUP

- I WANT THIS JUDGES OPINION

- WEST COAST INTERNATIONAL community corruption

- DRUGS/WASHINGTON STATE/BC CONNECTION

- VAAS

- 2002 PROPERTY CALGARY

- 2002 ALBERTA IO ACRES

- SOVEREIGN CITIZENS INTERNATIONAL REGULATORS /PROSECUTORS NEEDED ASAP

- SCARED AND HIDING

- 56.1. Identity documents 56.1 (1) Every person commits an offence who, without lawful excuse, procures to be made, possesses, transfers, sells or offers for sale an identity document that relates or purports to relate, in whole or in part, to another pers

- 58. Fraudulent use of certificate of citizenship 58. (1) Every one who, while in or out of Canada,

- 46. (1) High treason Every one commits high treason who, in Canada,

- 46. (3) Canadian citizen (3) Notwithstanding subsection (1) or (2), a Canadian citizen or a person who owes allegiance to Her Majesty in right of Canada,

- •83.02 - Financing of Terrorism •83.02. Providing or collecting property for certain activities

- 83.03. Providing, making available, etc., property or services for terrorist purposes

- 83.04. Using or possessing property for terrorist purposes

- 83.18. Participation in activity of terrorist group 83.18 (1) Every one who knowingly participates in or contributes to, directly or indirectly, any activity of a terrorist group for the purpose of enhancing the ability of any terrorist group to facilitat

- 83.19. Facilitating terrorist activity 83.19 (1) Every one who knowingly facilitates a terrorist activity is guilty of an indictable offence and liable to imprisonment for a term not exceeding fourteen years.

- 83.2. Commission of offence for terrorist group 83.2 Every one who commits an indictable offence under this or any other Act of Parliament for the benefit of, at the direction of or in association with a terrorist group is guilty of an indictable offence

- 83.21. Instructing to carry out activity for terrorist group 83.21 (1) Every person who knowingly instructs, directly or indirectly, any person to carry out any activity for the benefit of, at the direction of or in association with a terrorist group, for

- 83.22. Instructing to carry out terrorist activity 83.22 (1) Every person who knowingly instructs, directly or indirectly, any person to carry out a terrorist activity is guilty of an indictable offence and liable to imprisonment for life.

- 83.23. Harbouring or concealing 83.23 Every one who knowingly harbours or conceals any person whom he or she knows to be a person who has carried out or is likely to carry out a terrorist activity, for the purpose of enabling the person to facilitate or c

- 182. Dead body 182. Every one who(b) improperly or indecently interferes with or offers any indignity to a dead human body or human remains, whether buried or not,

- New Page

- 181. Spreading false news 181. Every one who wilfully publishes a statement, tale or news that he knows is false and that causes or is likely to cause injury or mischief to a public interest is guilty of an indictable offence and liable to imprisonment fo

- 131. Perjury 131. (1) Subject to subsection (3), every one commits perjury who, with intent to mislead, makes before a person who is authorized by law to permit it to be made before him a false statement under oath or solemn affirmation, by affidavit, sol

- 133. Corroboration 133. No person shall be convicted of an offence under section 132 on the evidence of only one witness unless the evidence of that witness is corroborated in a material particular by evidence that implicates the accused.

- 136. Witness giving contradictory evidence 136. (1) Every one who, being a witness in a judicial proceeding, gives evidence with respect to any matter of fact or knowledge and who subsequently, in a judicial proceeding, gives evidence that is contrary to

- 137. Fabricating evidence 137. Every one who, with intent to mislead, fabricates anything with intent that it shall be used as evidence in a judicial proceeding, existing or proposed, by any means other than perjury or incitement to perjury is guilty of a

- 138. Offences relating to affidavits

- 139. Obstructing justice 139. (1) Every one who wilfully attempts in any manner to obstruct, pervert or defeat the course of justice in a judicial proceeding,(2) Every one who wilfully attempts in any manner other than a manner described in subsection (1)

- New Page

- 140. Public mischief 140. (1) Every one commits public mischief who, with intent to mislead, causes a peace officer to enter on or continue an investigation by (a) making a false statement that accuses some other person of having committed an offence;

- New Page

- 142. Corruptly taking reward for recovery of goods 142. Every one who corruptly accepts any valuable consideration, directly or indirectly, under pretence or on account of helping any person to recover anything obtained by the commission of an indictable

- 119. Bribery of judicial officers, etc. 119. (1) Every one is guilty of an indictable offence and liable to imprisonment for a term not exceeding fourteen years who

- New Page

- the fish rots from the head

- New Page

- PBCT CONTRACTS DURHAM TRUST JANICE KATONA WEEKS

- New Page

- 2011 -NOV -VKD RESPONDS RE: DURHAM TRUST="Deliberate Bankrupting" "National Security Agency" and "NASA" associated with Ariel Life Systems (of the astronaut-space program) further connecting into the BASEBALL and FOOTBALL groups with a John D' Aquisto and

- New Page

- New Page

- New Page

- New Page

- New Page

- New Page

- New Page

- international body dedicated to information-sharing and an international court

- New Page

- New Page

- New Page

- De Schutter also warned Canada would face tough questions when it gets a peer review of its human rights record next year at the United

- the account was a sweeping facilaty

- New Page

- New Page

- Preet Bharara, the U.S. Attorney in Manhattan,

- New Page

- New Page

- New Page

- New Page

- United States Patriot; wife of murdered Colonel AKA WESTCOAST MAXIMUS WELFARE QUEEN /CITY HALL ESCORT

- New Page

- coast guard

- Secret “Occult Economy” Coming Out of the Shadows?

- New Page

- creation of special committees to address the "legal risks."

- John Aloyisius Dolan, 1850s-1890s, Iowa

- And $288 million is a lot to lose on one investment. Especially when it’s money that Canadians are expecting to retire on.

- VK DURHAM INTERNATIONAL CORRUPTIONa policy not approved by Congress remainS UNacceptable. when your own members flirt with mutiny, you have to know you’ve touched a raw nerve.

- JUDGE BONNER

- The Crown is not bound by laws passed in Parliament.

- INDIAN AFFAIRS- NWT NEW AGE ECONOMY

contracts assigned to the (QUEEN) on behalf on the CROWN by way of OPERATION OF THE LAW.

RCMP where required PURSUANT TO THE BC HOME AQUISTION ACT to transfer LAND/ESTATE documents and contracts assigned to the (QUEEN) on behalf on the CROWN by way of OPERATION OF THE LAW.

Is it the RCMP'S job to FORENSICALLY investigated the legallity of the transaction under assignment to the QUEEN? Or for that matter the document/PATENT itself ?

Is it the RCMP job to investigate whether a company or A NOT FOR PROFIT authorized by the DEPUTY MINISTER of INDUSTRY CANADA is actually the same author as the authorship granting paper authorization.?

Not all RCMP are aware of what is going on behind the walls in the CROWN Prosecutors Ministries. This was BAIT AND HOOK the police by those POLICE are suppose to trust.

The CROWN then forces the POLICE down the fraud rabbit hole.

IE: The ATTORNEY GENERAL"S MINISTRY.

It's not the mandate of RCMP to fix a corrupted CRIMINAL JUDICIAL ENTERPRISE. What realistic chance do the officers have when they have to ask the CRIMINALS if they can start prosecution to throw them in JAIL for robbing the PUBLIC.

I have witnessed the first hand frustration of the RCMP BEING SENT ROAD BLOCK AFTER ROAD BLOCK BY THE CROWN.

Is it the RCMP'S job to FORENSICALLY investigated the legallity of the transaction under assignment to the QUEEN? Or for that matter the document/PATENT itself ?

Is it the RCMP job to investigate whether a company or A NOT FOR PROFIT authorized by the DEPUTY MINISTER of INDUSTRY CANADA is actually the same author as the authorship granting paper authorization.?

Not all RCMP are aware of what is going on behind the walls in the CROWN Prosecutors Ministries. This was BAIT AND HOOK the police by those POLICE are suppose to trust.

The CROWN then forces the POLICE down the fraud rabbit hole.

IE: The ATTORNEY GENERAL"S MINISTRY.

It's not the mandate of RCMP to fix a corrupted CRIMINAL JUDICIAL ENTERPRISE. What realistic chance do the officers have when they have to ask the CRIMINALS if they can start prosecution to throw them in JAIL for robbing the PUBLIC.

I have witnessed the first hand frustration of the RCMP BEING SENT ROAD BLOCK AFTER ROAD BLOCK BY THE CROWN.

Filed:

July 10, 2009

Court:

Florida Middle District Court

Office:

Orlando Office

County:

Orange

Presiding Judge:

Senior Judge G. Kendall Sharp

Referring Judge:

Magistrate Judge Karla R. Spaulding

Nature of Suit:

Real Property - Foreclosure

Cause:

42:1983 Civil Rights Act

Jurisdiction:

Federal Question

Jury Demanded By:

None

July 10, 2009

Court:

Florida Middle District Court

Office:

Orlando Office

County:

Orange

Presiding Judge:

Senior Judge G. Kendall Sharp

Referring Judge:

Magistrate Judge Karla R. Spaulding

Nature of Suit:

Real Property - Foreclosure

Cause:

42:1983 Civil Rights Act

Jurisdiction:

Federal Question

Jury Demanded By:

None

BC MAXIMUS HELD THE MORTGAGE DEBT UNDER LEGAL ASSIGNMENT TO THE BENIFIT OF THE QUEEN IN THE RIGHT OF BC

Violet Robertson Green is just one of her many alias.

last we heard she was living in the States/florida with her lawyer boyfriend

Violet claimed to all that knew her to work for Canada REVENUE as a auditor/accountant

Violet worked for many friends and had access to mountains of person info

THE WEAPON OF CHOICE -MERS AND QUEEN ATTACHMENTS BASED ON DEED AND MORTGAGE FRAUD AND CONSENT TO THE QUEEN

35 YEARS OF BANKRUPT COMPANIES/ CREDIT default SWAPS

THE FAKE COMPANIES CREATED ARE

BONAVENTURE COURT SW CALGARY-MR HARPERS RIDING

GLENMOUNT LTD

RANCHERSBEEF

PRECISION DRILLING

KENDAX

ONTARIO 658

THE LIST GOES ON ON.......

gold standard basis for currency

the "specific intent" required for the murder charge could be proven due

They could be dismissed as a nuisance, a loose network of individuals living in the United States who call themselves “sovereign citizens” and believe that federal, state, and local governments operate illegally. Some of their actions, although quirky, are not crimes. The offenses they do commit seem minor: They do not pay their taxes and regularly create false license plates, driver’s licenses, and even

currency.

They could be dismissed as a nuisance, a loose network of individuals living in the United States who call themselves “sovereign citizens” and believe that federal, state, and local governments operate illegally. Some of their actions, although quirky, are not crimes. The offenses they do commit seem minor: They do not pay their taxes and regularly create false license plates, driver’s licenses, and even

currency.

Taxation—Legislative jurisdiction—"B.N.A. Act, 1867," s. 92.

1973 FORGED CERTIFICATE OF INDEFEASIBLE TITLE -MORTGAGE FRAUD

Slavery was and still is hereditary,

the DEBT slaves being prisoners of war and their descendants

Slavery was hereditary, the slaves being prisoners of war and their descendants

The RCMP probe into alleged corruption among Canada Revenue Agency officials in Montreal has ballooned to other offices of the tax-collection agency across Quebec, sources say.

Sgt. Dale Glydon with the RCMP Commercial Crime Section, said it would be difficult to retrieve what people lost because the money in this kind of scam kept moving, most of the time out of the country.

Charged with fraud over $5,000 are (Harold) Murray Stark, 73, of Three Hills, Robert Fyn aka Col. Robbie Fyn, 62, of Linden, and Garth S. Bailey, 57 of Okotoks.

More related to this story

Slavery was hereditary, the slaves being prisoners of war and their descendants

The RCMP probe into alleged corruption among Canada Revenue Agency officials in Montreal has ballooned to other offices of the tax-collection agency across Quebec, sources say.

Sgt. Dale Glydon with the RCMP Commercial Crime Section, said it would be difficult to retrieve what people lost because the money in this kind of scam kept moving, most of the time out of the country.

Charged with fraud over $5,000 are (Harold) Murray Stark, 73, of Three Hills, Robert Fyn aka Col. Robbie Fyn, 62, of Linden, and Garth S. Bailey, 57 of Okotoks.

More related to this story

- Ottawa chastised for handling of TFSA tax rules

- New links found between tax auditors and Montreal’s construction industry

- RCMP alleges ex-CRA auditor received payment

public interest is a defence based on a general principle of common law

impressive judgment given by Ungoed-Thomas J in Beloff v Pressdram Ltd,8 which first affirmed that the public interest defence is available to an action for infringement of copyright.

Ungoed-Thomas J stated that “public interest is a defence outside and independent of statutes, is not limited to copyright cases and is based on a general principle of common law.”9

Beloff v Pressdram Ltd was the first case to recognise clearly the public interest defence for the infringement of copyright.

http://www.law.ed.ac.uk/ahrc/script-ed/issue2/china.asp

Ungoed-Thomas J stated that “public interest is a defence outside and independent of statutes, is not limited to copyright cases and is based on a general principle of common law.”9

Beloff v Pressdram Ltd was the first case to recognise clearly the public interest defence for the infringement of copyright.

http://www.law.ed.ac.uk/ahrc/script-ed/issue2/china.asp

Aboriginal Affairs: A new name with an uncertain meaning

Aboriginal Affairs: Redemption Theory, which claims the U.S. government went bankrupt when it abandoned the gold standard basis for currency in 1933

Aboriginal Affairs: Redemption Theory, which claims the U.S. government went bankrupt when it abandoned the gold standard basis for currency in 1933

American Revolutionary War

One prevalent sovereign-citizen theory is the Redemption Theory, which claims the U.S. government went bankrupt when it abandoned the gold standard basis for currency in 1933 and began using citizens as collateral in trade agreements with foreign governments.

2 These beliefs can provide a gateway to illegal activity because such individuals believe the U.S. government does not act in the best interests of the American people. By announcing themselves as sovereign citizens, they are emancipated from the responsibilities of being a U.S. citizen, including paying taxes, possessing a state driver’s license, or obeying the law.

One prevalent sovereign-citizen theory is the Redemption Theory, which claims the U.S. government went bankrupt when it abandoned the gold standard basis for currency in 1933 and began using citizens as collateral in trade agreements with foreign governments.

2 These beliefs can provide a gateway to illegal activity because such individuals believe the U.S. government does not act in the best interests of the American people. By announcing themselves as sovereign citizens, they are emancipated from the responsibilities of being a U.S. citizen, including paying taxes, possessing a state driver’s license, or obeying the law.

Ideology and Motivation

The FBI considers

sovereign-citizen

extremists as

comprising a domestic

terrorist movement… The FBI considers sovereign-citizen extremists as comprising a domestic terrorist movement, which, scattered across the United States, has existed for decades, with well-known members, such as Terry Nichols, who helped plan the Oklahoma City, Oklahoma, bombing. Sovereign citizens do not represent an anarchist group, nor are they a militia, although they sometimes use or buy illegal weapons. Rather, they operate as individuals without established leadership and only come together in loosely affiliated groups to train, help each other with paperwork, or socialize and talk about their ideology. They may refer to themselves as “constitutionalists” or “freemen,” which is not necessarily a connection to a specific group, but, rather, an indication that they are free from government control. They follow their own set of laws. While the philosophies and conspiracy theories can vary from person to person, their core beliefs are the same: The government operates outside of its jurisdiction. Because of this belief, they do not recognize federal, state, or local laws, policies, or regulations.1

The FBI considers

sovereign-citizen

extremists as

comprising a domestic

terrorist movement… The FBI considers sovereign-citizen extremists as comprising a domestic terrorist movement, which, scattered across the United States, has existed for decades, with well-known members, such as Terry Nichols, who helped plan the Oklahoma City, Oklahoma, bombing. Sovereign citizens do not represent an anarchist group, nor are they a militia, although they sometimes use or buy illegal weapons. Rather, they operate as individuals without established leadership and only come together in loosely affiliated groups to train, help each other with paperwork, or socialize and talk about their ideology. They may refer to themselves as “constitutionalists” or “freemen,” which is not necessarily a connection to a specific group, but, rather, an indication that they are free from government control. They follow their own set of laws. While the philosophies and conspiracy theories can vary from person to person, their core beliefs are the same: The government operates outside of its jurisdiction. Because of this belief, they do not recognize federal, state, or local laws, policies, or regulations.1

British agents

British agents worked to make the first nations into military allies of the British, providing supplies, weapons, and encouragement.

Illegal Activity

Alfred P. Murrah Federal Building,

Oklahoma City. The Redemption Theory belief leads to their most prevalent method to defraud banks, credit institutions, and the U.S. government: the Redemption Scheme. Sovereign citizens believe that when the U.S. government removed itself from the gold standard, it rendered U.S. currency as a valueless credit note, exchanging one credit document (such as a dollar bill) for another. They assert that the U.S. government now uses citizens as collateral, issuing social security numbers and birth certificates to register people in trade agreements with other countries. Each citizen has a monetary net worth, which they believe is kept in a U.S. Treasury Direct account, valued from $630,000 to more than $3 million. These accounts, they claim, are in a third-party’s name, a “strawman,” that they can access, which they commonly refer to as “freeing money from the strawman.” In essence, it is extorting money from the U.S. Treasury Department. Sovereign citizens file legitimate IRS and Uniform Commercial Code forms for illegitimate purposes, believing that doing so correctly will compel the U.S. Treasury to fulfill its debts, such as credit card debts, taxes, and mortgages.3

At a minimum, these activities create a voluminous influx of documents that clog the courts and other government agencies. But, the idea behind the Redemption Theory also leads sovereign citizens to find criminal sources of income as they travel the country, teach fraudulent tactics to others for a fee, and participate in white collar crimes. The latter offenses include mail, bank, mortgage, and wire fraud; money laundering; tax violations; and illegal firearms sales and purchases.

At seminars, sovereign citizens charge participants a fee in exchange for information on Redemption Theory schemes and other methods to avoid paying taxes, sometimes even selling materials, such as CDs or DVDs. They also sell fraudulent documents—including drivers’ licenses, passports, diplomat identification, vehicle registrations, concealed firearms permits, law enforcement credentials, and insurance forms—to other sovereign citizens and illegal immigrants and charge fees for “consultant services” to prepare sovereign-citizen paperwork. Several recent incidents highlight their activities.

- In Sacramento, California, two sovereign-citizen extremists were convicted of running a fraudulent insurance scheme, operating a company completely outside of state insurance regulatory authorities. The men sold “lifetime memberships” to customers and promised to pay any accident claims against members. The company collected millions of dollars, but paid only small auto insurance claims and ignored large ones.4

- In Kansas City, Missouri, three sovereign-citizen extremists were convicted in a phony diplomatic credential scandal. They charged customers between $450 and $2,000 for a diplomatic identification card that bestowed “sovereign status,” supposedly to enjoy diplomatic immunity from paying taxes and from stops and arrests by law enforcement.5

- In Las Vegas, Nevada, four men affiliated with the sovereign-citizen-extremist movement were arrested by the Nevada Joint Terrorism Task Force on federal money laundering, tax evasion, and weapons charges. The undercover investigation revealed that two of the suspects allegedly laundered more than a million dollars and collected fees for their services.6

However, even when sovereign citizens go to prison for crimes, they continue criminal activity behind bars. Inmates provide a new population for them to sway to adopt the sovereign-citizen ideology; they then can train these inmates to help them defraud banks, credit institutions, and the U.S. government. They can create fraudulent businesses from inside prison walls and complete fraudulent financial documents to receive lines of credit from legitimate banks. The learning system goes both ways—inmates can teach sovereign citizens new criminal methods that they can use either from inside the prison or when they are released.

Indicators

It is important

to realize sovereign

citizens’ tactics to

harass and intimidate

law enforcement,

court, and government

officials, as well as

financial institution

employees. Sovereign citizens often produce documents that contain peculiar or out-of-place language. In some cases, they speak their own language or will write only in certain colors, such as in red crayon. Several indicators can help identify

these individuals.

- References to the Bible, The Constitution of the United States, U.S. Supreme Court decisions, or treaties with foreign governments8

- Personal names spelled in all capital letters or interspersed with colons (e.g., JOHN SMITH or Smith: John)

- Signatures followed by the words “under duress,” “Sovereign Living Soul” (SLS), or a copyright symbol (©)

- Personal seals, stamps, or thumb prints in red ink

- The words “accepted for value”9

Intimidation, Obstruction, and Protection

It is important to realize sovereign citizens’ tactics to harass and intimidate law enforcement, court, and government officials, as well as financial institution employees. Methods can range from refusing to cooperate with requests, demanding an oath of office or proof of jurisdiction, filming interactions with law enforcement that they later post on the Internet, and filing frivolous lawsuits or liens against real property. They convene their own special courts that issue fake but realistic-looking indictments, warrants, and other documents. They also can use real government documents, including suspicious activity reports, in an attempt to damage the credit or financial history of specific individuals.

While these efforts may seem obviously fraudulent, it is important to address these actions, which can have devastating outcomes for the individuals they target. The sovereign citizens’ efforts also can be a gateway for them to harass, terrorize, and target others in hopes of changing behaviors that they perceive as threatening.

The Court Security Improvement Act of 2007 is one protection for officials who the sovereign citizens could target. The provisions under Title 18 created a new criminal offense for false liens against the real or personal property of officers or federal government employees, including judges and prosecutors. It also created as a new crime the disclosure of personal, identifying information to intimidate or incite violence against these individuals.10

Conclusion

Although the

sovereign-citizen

movement does not

always rise to violence,

its members’…

activities…make it

a group that should

be approached with

knowledge and

caution. Although the sovereign-citizen movement does not always rise to violence, its members’ illegal activities and past violent—including fatal—incidents against law enforcement make it a group that should be approached with knowledge and caution. It is important that law enforcement be aware of sovereign citizens’ tactics so agencies can warn the public of potential scams, spot illegal activity and understand its potential severity, and be prepared for and protect against violent behavior or backlash through intimidation and harassment.

Endnotes

1 U.S. Department of Justice, Federal Bureau of Investigation, Domestic Terrorism Operations Unit and Domestic Terrorism Analysis Unit, Sovereign Citizen Danger to Law Enforcement (Washington, DC, 2010).

2 U.S. Department of Justice, Federal Bureau of Investigation, Domestic Terrorism Operations Unit II, Sovereign Citizens: An Introduction for Law Enforcement (Washington, DC, 2010).

3 U.S. Department of Justice, Federal Bureau of Investigation, Domestic

Terrorism Analysis Unit, Sovereign Citizen Extremist Movement (Washington, DC, 2011).

4 U.S. Attorney’s Office, Eastern District of California, “Two ‘Sovereign Citizens’ Sentenced in Illegal Insurance Scam,” press release, 2/24/2010; http://sacramento.fbi.gov/dojpressrel/pressrel10/sc022410.htm (accessed June 14, 2011).

5 U.S. Attorney’s Office, Western District of Missouri, “Three Men Sentenced for Conspiracy to Use Fake Diplomatic Identification,” press release, 2/8/2010; http://kansascity.fbi.gov/dojpressrel/pressrel10/kc020810.htm (accessed June 14, 2011).

6 U.S. Department of Justice, U.S. Attorney, District of Nevada, “Members of Anti-Government Movement Arrested on Federal Money Laundering, Tax Evasion and Weapons Charges,” press release, 3/6/2009; http://www.justice.gov/usao/nv/press/march2009/davis030609.htm (accessed June 14, 2011).

7 U.S. Department of Justice and U.S. Attorney’s Office-District of New Hampshire, press releases, 1/18/2007 and 7/9/2009, “Jury Convicts Lebanon Dentist and Husband in Tax Case,” and “Edward and Elaine Brown Convicted”; http://www.justice.gov/tax/usaopress/2007/txdv07WEM_Browns.pdf and http://www.atf.gov/press/releases/2009/07/070909-bos-edward-and-elaine-brown-convicted.html (accessed June 14, 2011).

8 The authors wish to stress that the majority of individuals who carry or refer to these resources are law-abiding citizens. However, in some instances, possession of these items may serve as one indicator of a sovereign-citizen extremist.

9Sovereign Citizens: An Introduction for Law Enforcement.

10 Court Security Improvement Act of 2007; http://www.gpo.gov/fdsys/pkg/PLAW-110publ177/pdf/PLAW-110publ177.pdf (accessed June 14, 2011).

Mr. Hunter is an intelligence analyst in the FBI’s Counterterrorism Analysis Section.

Dr. Heinke is the counterterrorism coordinator for the State Ministry of the Interior in Bremen, Germany

In 1779, the Americans launched a campaign to burn the villages of the Iroquois in New York State.[62] The refugees fled to Fort Niagara and other British posts, and remained permanently in Canada.

Although the British ceded the Old Northwest to the United States in the Treaty of Paris in 1783, it kept fortifications and trading posts in the region until 1795. The British then evacuated American territory, but operated trading posts in British territory, providing weapons and encouragement to tribes that were resisting American expansion into such areas as Ohio, Indiana, Michigan, Illinois and Wisconsin.[63] Officially, the British agents discouraged any warlike activities or raids on American settlements, but the Americans were increasingly angered, and this became one of the causes of the War of 1812.[64]

In the war, the great majority of First Nations supported the British, and many fought under the aegis of Tecumseh.[65] But Tecumseh was killed in 1813 in battle, and the Indian coalition collapsed. The British have long wished to create a neutral Indian state in the American Old Northwest,[66] and made this demand as late as 1814 at the peace negotiations at Ghent. The Americans rejected the idea, the British dropped it, and Britain's Indian allies lost British support. In addition, the Indians were no longer able to gather furs and American territory. Abandoned by their powerful sponsor, Great Lakes-area natives ultimately assumilated into American society, migrated to the west or to Canada, or were relocated onto reservations in Michigan and Wisconsin.[67] Historians have unanimously agreed that the Indians were the major losers in the War of 1812.[68]

Although the British ceded the Old Northwest to the United States in the Treaty of Paris in 1783, it kept fortifications and trading posts in the region until 1795. The British then evacuated American territory, but operated trading posts in British territory, providing weapons and encouragement to tribes that were resisting American expansion into such areas as Ohio, Indiana, Michigan, Illinois and Wisconsin.[63] Officially, the British agents discouraged any warlike activities or raids on American settlements, but the Americans were increasingly angered, and this became one of the causes of the War of 1812.[64]

In the war, the great majority of First Nations supported the British, and many fought under the aegis of Tecumseh.[65] But Tecumseh was killed in 1813 in battle, and the Indian coalition collapsed. The British have long wished to create a neutral Indian state in the American Old Northwest,[66] and made this demand as late as 1814 at the peace negotiations at Ghent. The Americans rejected the idea, the British dropped it, and Britain's Indian allies lost British support. In addition, the Indians were no longer able to gather furs and American territory. Abandoned by their powerful sponsor, Great Lakes-area natives ultimately assumilated into American society, migrated to the west or to Canada, or were relocated onto reservations in Michigan and Wisconsin.[67] Historians have unanimously agreed that the Indians were the major losers in the War of 1812.[68]

British agents

The TFSA complements existing registered savings plans like the Registered Retirement Savings Plans (RRSP) and the Registered Education Savings Plans (RESP).

Saving just got a whole lot easier

The new Tax-Free Savings Account (TFSA) is a flexible, registered general-purpose savings vehicle that allows Canadians to earn tax-free investment income to more easily meet lifetime savings needs. The TFSA complements existing registered savings plans like the Registered Retirement Savings Plans (RRSP) and the Registered Education Savings Plans (RESP).

How the Tax-Free Savings Account Works

The new Tax-Free Savings Account (TFSA) is a flexible, registered general-purpose savings vehicle that allows Canadians to earn tax-free investment income to more easily meet lifetime savings needs. The TFSA complements existing registered savings plans like the Registered Retirement Savings Plans (RRSP) and the Registered Education Savings Plans (RESP).

How the Tax-Free Savings Account Works

- Canadian residents age 18 or older can contribute up to $5,000 annually to a TFSA.

- Investment income earned in a TFSA is tax-free.

- Withdrawals from a TFSA are tax-free.

- Unused TFSA contribution room is carried forward and accumulates in future years.

- Full amount of withdrawals can be put back into the TFSA in future years. Re-contributing in the same year may result in an over-contribution amount which would be subject to a penalty tax.

- Choose from a wide range of investment options such as mutual funds, Guaranteed Investment Certificates (GICs) and bonds.

- Contributions are not tax-deductible.

- Neither income earned within a TFSA nor withdrawals from it affect eligibility for federal income-tested benefits and credits, such as Old Age Security, the Guaranteed Income Supplement, and the Canada Child Tax Benefit.

- Funds can be given to a spouse or common-law partner for them to invest in their TFSA.

- TFSA assets can generally be transferred to a spouse or common-law partner upon death.

RCMP investigation British agents

“An RCMP investigation into these matters is ongoing, and CRA officials are co-operating fully.”

“Our government cannot tolerate the types of activities that are alleged,”

Revenue Minister Gail Shea refused to comment on the situation. Her office released a written statement on her behalf.

“Our government appreciates that this is a very serious issue and we cannot tolerate the types of activities that are alleged,” she said in the statement.

“Our government appreciates that this is a very serious issue and we cannot tolerate the types of activities that are alleged,” she said in the statement.

. Henry T. Fairbairn, P. E., is the princi- pal of SDC/Structural Engineering in Alameda. He’s one of several people who used very unfavorable review postings on Yelp.com to get in touch with other vic- tims, which is how I found him.

He e-mailed me about his experience: “Our office manager saw Ferdie on Jan. 5; he seemed uneasy, and surprised to see her banging on the 98th Avenue door.

He said ‘I cannot lie to you, Shirley; we are going out of business.’ When she asked him if the payments have been made he said, ‘Yes, the payments have been made.’ ” But when Fairbairn checked the forms he received from Clickbooks against the IRS’s records, he found out that Ferdie wasn’t telling the whole truth.

He discov- ered that Clickbooks had been filing false returns on his behalf. Payments had been made, but they were much less than owed, just as ours had been.

Another Yelp poster, owner of a small landscaping business, said that he had used Clickbooks for many years to process his payroll and make all the required payments as required by law, but now couldn’t reach them to get the W-2 forms for 2009, which every employ- er was supposed to file in January 2010.

When we compared notes with Fair- bairn, he used the word “heinous” a lot. He’s well aware that for many struggling enterprises in this shaky economy, unex- pected liabilities could land them in bank- ruptcy.

And the victims were not all unsophis- ticated small-time operators. A bit more research on my part turned up a busy Berkeley law office and the longtime pro- prietor of Bucci’s, a well-regarded Emeryville restaurant, both taken in by the elaborate scam.

Like most very small businesses with limited clerical staff, they needed to rely on outside payroll services. Amelia Bucci told me she’d had a hard time finding one willing to handle the small payroll of a new café she’d started.

It seems that in all the cases I investi- gated, the IRS had simply not noticed, for periods of up to two years, that the pay- ment amounts they’d gotten from Click- books didn’t match the reports of what was supposed to have been sent. What can be done now?

We’ve retained Berkeley attorney Don Jelinek to file a civil suit against Click- books, GLOBALeSTAFF, Norgren and his unidentified associates (“DOES 1- 200”), for theft, conversion, fraud, deceit, breach of fiduciary duty, and breach of oral agreement.

We’d welcome other vic- tims to join us as plaintiffs, and we’re also filing criminal charges. That ought to cover the territory if the villains are ever found. But it’s a big if. Where might they be? Ferdie told the publisher in December that Bill and his wife, remembered by one of the clients as a Filipina, had gone to the Philippines for the holidays.

Perhaps they’re still there. Or maybe not. And where has the money gone? If you multiply the potential losses of each cus- tomer by 100, it adds up to a tidy sum. The Planet alone stands to lose a mini- mum of tens of thousands with the possi- bility of hundreds of thousands of dollars depending on what back taxes need to be paid.

Henry Fairbairn said he’d coincidental- ly encountered someone who said he’d invested about $15,000 in Clickbooks.com Inc., and had been receiving “profits” a few hundred dollars at a time. That sounds like it might have been a Ponzi scheme, where new marks must constantly be found to pay off the earlier ones until the whole thing collaps- es.

That could be where the skimmed-off tax money went. Every employer I talked to who was hit by the Clickbooks scam wondered why the IRS hadn’t told them that their taxes were underpaid.

Well, the first problem is the back- wards process by which the agency col- lects its money. As reported on AccountingWEB.com on Jan. 14, the National Taxpayer Advo- cate, Nina E. Olson, submits a report every year to Congress that takes a criti- cal look at the IRS.

One serious problem, she said in her latest report, is that the IRS processes tax returns before they process information returns such as W-2s and 1099s. That’s what happened in our case. The IRS did- n’t notice that the amounts remitted in 2009 were dramatically less than owed because the IRS hadn’t yet gotten the W- 2 information which was filed in January 2010.

We’ve been told by our tax lawyer that there can be a two-year lag before the agency discovers that payments are short, and they might never notice. It turns out that during the Bush years the number of IRS agents took a dramat- ic dive, and now there don’t seem to be enough of them in the agency to collect all the money owed.

The nonprofit group OMGwatch ana- lyzes this situation in a 2008 report, “Bridging the Tax Gap.” The tax gap, the difference between what is owed in taxes and what is paid, amounted to over $300 billion annually at the time of the report. For comparison purposes, that much money would pay for two more wars as large as our two current ruinously expen- sive ones, plus covering all of the cost of the president’s currently unfunded health care plan.

Dramatic evidence about why this gap exists is the decrease between 1995 and 2006 in the total number of IRS employ- ees, down 18 percent, and in the number of IRS employees who perform audits, down by 30 and 40 percent in crucial cat- egories.

And what’s happened to the state’s tax collectors? No one seems to be home in the California government anymore. Our tax guy when we last heard hadn’t even been able to get the Franchise Tax Board on the phone to ask what they’d collected on our account.

“Furloughs!” he said dis- gustedly. Underfunded tax agencies have made it possible for dishonest citizens to avoid paying their fair share of taxes—that’s been well documented by now. But they’ve also made it possible for crooks like these to prey on honest employers and employees who try to pay their taxes like good citizens.

We hope that the magnitude of this particular fraud will persuade the IRS to expend some of its scarce resources to catch those responsible. Perhaps the criminal investigation will find them. We sure could use some help. We hope our fellow victims will see this and contact us, so we can work together to catch the culprits and possibly to recover the stolen money.

Sources said that Operation Critique has been set up to look into allegations of irregularities outside of Montreal, fed in part by tips from CRA officials who say they engaged in or witnessed irregularities and from taxpayers. A source said that some of the cases involve allegations that CRA officials sought compensation in exchange for the favourable treatment of tax filings.

Sources have told The Globe and Mail and Radio-Canada that the RCMP has referred several files to prosecutors as part of Operation Coche. Federal prosecutors are acting on behalf of their provincial colleagues in the matter to accelerate the process, a source said.

RCMP search warrants allege that CRA officials in Montreal helped firms in Quebec’s construction industry to evade taxes. In addition, some of the CRA officials targeted by Operation Coche allegedly collected kickbacks from businessmen, such as restaurant owners, in exchange for lax audits or for turning a blind eye to unreported income.

Census data list about 1.2 million Canadians as aboriginal, but only about half of those (53 per cent) are registered Indians under the Indian Act. The rest are Métis (30 per cent), non-status Indians (11 per cent) and Inuit (4 per cent). Ottawa is responsible for providing services otherwise supplied by the provinces – such as health care and education – to status Indians living on reserves. The rest of Canada’s aboriginal population gets them largely from the provinces and territories.

The Conservative government insists the name change will not affect these legal relationships, but some have questions. First nations chiefs fear Ottawa’s increasing use of the term “aboriginal” will undermine their legal relationship with the Crown via historic treaties, which used the word “Indian.”

The Conservative government insists the name change will not affect these legal relationships, but some have questions. First nations chiefs fear Ottawa’s increasing use of the term “aboriginal” will undermine their legal relationship with the Crown via historic treaties, which used the word “Indian.”

Vancouver Island’s John Duncan is still in charge

The Indian Act and its definition of Indian remain.

The term lives on because of its legal value.

It also carries major financial implications for federal spending.

Even before the name change, the Harper government was working on changing the relationship with natives. Across Canada, aboriginal groups have been drafting proposals for new “citizenship” rules and Indian Affairs is in discussions with native groups on an “exploratory process on Indian Registration, Band Membership and Citizenship.”

But the department’s talks and the name change suggest an incremental approach.

Vancouver Island’s John Duncan is still in charge, but he’s now the minister of Aboriginal Affairs and Northern Development. The term Indian Affairs will eventually be removed from the department’s website, stationery and signage. http://www.theglobeandmail.com/news/politics/whats-in-a-name-indian-affairs-is-no-more/article2026696/

But the department’s talks and the name change suggest an incremental approach.

Vancouver Island’s John Duncan is still in charge, but he’s now the minister of Aboriginal Affairs and Northern Development. The term Indian Affairs will eventually be removed from the department’s website, stationery and signage. http://www.theglobeandmail.com/news/politics/whats-in-a-name-indian-affairs-is-no-more/article2026696/

A former CRA official is currently in court trying to invalidate search warrants that were used in 2009 to seize documents, computers and pictures from his home

The RCMP has also alleged in search warrants that CRA officials received gifts or compensation from a construction firm, including free home renovations, trips to Las Vegas and the Bahamas, and an upscale evening at a Montreal Canadiens home game.

A former CRA official is currently in court trying to invalidate search warrants that were used in 2009 to seize documents, computers and pictures from his home. In court documents, former team leader Adriano Furgiuele says the CRA and the RCMP obtained information on suspected wrongdoing via tax audits instead of through full-blown police investigations, which is prohibited under tax laws.

A former CRA official is currently in court trying to invalidate search warrants that were used in 2009 to seize documents, computers and pictures from his home. In court documents, former team leader Adriano Furgiuele says the CRA and the RCMP obtained information on suspected wrongdoing via tax audits instead of through full-blown police investigations, which is prohibited under tax laws.

construction of a luxury yacht

According to guilty pleas in a tax-evasion case last year, shell companies belonging to Mr. Bruno supplied fake invoices to construction firms operated by Antonio Accurso.

Last year, two construction companies that Mr. Accurso had administered pleaded guilty to committing $4-million in tax fraud by claiming non-deductible expenses such as the construction of a luxury yacht and jewellery purchases. Mr. Bruno has pleaded guilty to tax evasion.

Last year, two construction companies that Mr. Accurso had administered pleaded guilty to committing $4-million in tax fraud by claiming non-deductible expenses such as the construction of a luxury yacht and jewellery purchases. Mr. Bruno has pleaded guilty to tax evasion.

Two CRA auditors, including Mr. Furgiuele, were fired in 2009 after investigators alleged that they shared a bank account containing $1.7-million in the Bahamas with Francesco Bruno, owner of construction firm B.T. Céramique.

No charges have been laid as part of the RCMP investigation and none of the allegations in the search warrants have been proven in court.

Two CRA auditors, including Mr. Furgiuele, were fired in 2009 after investigators alleged that they shared a bank account containing $1.7-million in the Bahamas with Francesco Bruno, owner of construction firm B.T. Céramique. At least seven other officials in the CRA’s offices in Montreal have since been disciplined in relation to various files, including allegedly fraudulent research-and-development tax credits.

Two CRA auditors, including Mr. Furgiuele, were fired in 2009 after investigators alleged that they shared a bank account containing $1.7-million in the Bahamas with Francesco Bruno, owner of construction firm B.T. Céramique. At least seven other officials in the CRA’s offices in Montreal have since been disciplined in relation to various files, including allegedly fraudulent research-and-development tax credits.

Dozens of US corporations paid no federal taxes in recent years, and many received government subsidies despite earning healthy profits

WASHINGTON - Dozens of US corporations paid no federal taxes in recent years, and many received government subsidies despite earning healthy profits, a new study showed Thursday.

The report by Citizens for Tax Justice and the Institute on Taxation and Economic Policy, which examined 280 US firms, found 78 of them paid no federal income tax in at least one of the last three years.

It found 30 companies enjoyed a negative income tax rate - which in some cases means getting tax rebates - over the three-year period, despite combined pre-tax profits of $160 billion.

"These 280 corporations received a total of nearly $223 billion in tax subsidies," said the report's lead author, Robert McIntyre, director at Citizens for Tax Justice.

Read more: http://www.montrealgazette.com/news/Many+firms+avoid+taxes/5651060/story.html#ixzz1cekTMI1c

The report by Citizens for Tax Justice and the Institute on Taxation and Economic Policy, which examined 280 US firms, found 78 of them paid no federal income tax in at least one of the last three years.

It found 30 companies enjoyed a negative income tax rate - which in some cases means getting tax rebates - over the three-year period, despite combined pre-tax profits of $160 billion.

"These 280 corporations received a total of nearly $223 billion in tax subsidies," said the report's lead author, Robert McIntyre, director at Citizens for Tax Justice.

Read more: http://www.montrealgazette.com/news/Many+firms+avoid+taxes/5651060/story.html#ixzz1cekTMI1c