- Welcome to the DEN Contact Us-------PUBLIC INTEREST defense FOR INFRINGMENT OF COPYRIGHT 'ALBERTA & BC ONTARIO SHADOW CIA VK DURHAM CROWN Whale'

- DEBTORS IN A SECRET FOREIGN PROCEEDING

- Booming BC natural-gas sector

- The indictment (1) that the defendants had engaged in a common plan or conspiracy (2) to commit crimes against peace, (3) war crimes, and (4) crimes against humanity. The third count, that of committing war crimes, had ten subdivisions, in the fifth of wh

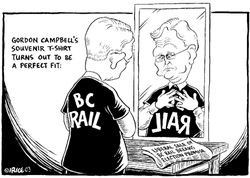

- bc rail inquiry=Convertible Gold Debentures

-

s1778 -THE ROOT OF HMS CROWNS PONZIE

- DEED 189934 in "TRUST (99 YEARS)."

- SHADOW CIA Maximus- Isreal

- Crown of England. STATUTORY INSTRUMENT 1997 No. 1778--MAXIMUS GOLD ESTATE CORRUPTIONThis Order may be cited as the Social Security (United States of America)

- THE PRESIDENT'S CENTURIONS such as those men President Harry S.

- 83.27. Punishment for terrorist activity 83.27 (1) Notwithstanding anything in this Act, a person convicted of an indictable offence, other than an offence for which a sentence of imprisonment for life is imposed as a minimum punishment, where the act or

-

The key word is control of the individual.

- USELESS EATERS are broke and dumbed down -two $120 Billion Dollar“Unauthorized Gold

- some time in 1987-88.

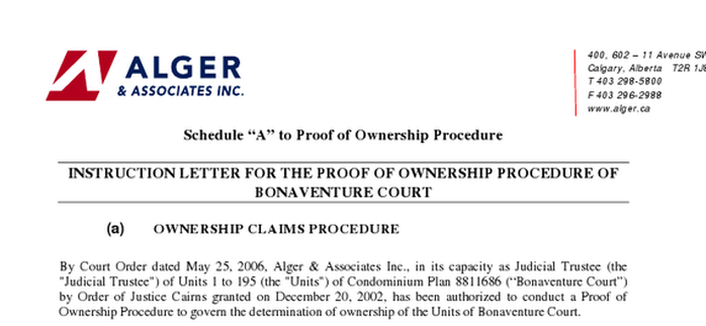

- BREAKING OF THE CODE OF SILENCE is an absolute.-PUBLIC SAFETY MINISTER FAILING TO PROTECT CITIZENS ..........PICKTON THESIS ACCORDING TO THE DEADMAN IN JERVIS INLETS JOURNAL

- U.S.DEBT INSTRUMENTS.... GAIAForgery 1957 PREUVIAN GOLD BOND TIMELINE & CHAIN OF TITLE

- DEED OF ASSIGNMENT FOR CONSIDERATION EQUITY GOLD COLLATERAL INTEREST SEAL 1 & 2

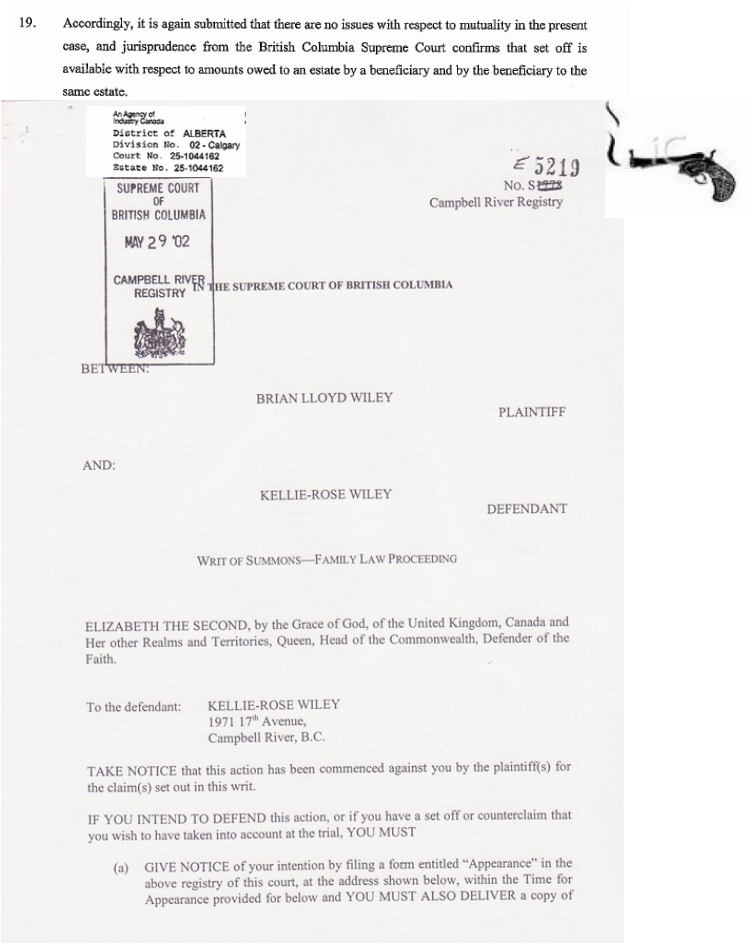

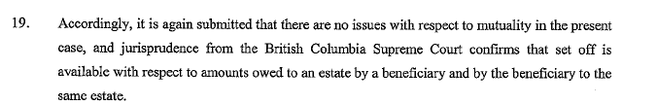

- $17 Trillion DOLLARS GOLD

- U.S.DEBT INSTRUMENTS....Forgery...and "Orders from the TOP:"DO NOT INVESTIGATE."

- Social Security Purchased by Crown

- We underwrote another $6.5 Trillion Dollars for the Global Humanitarian

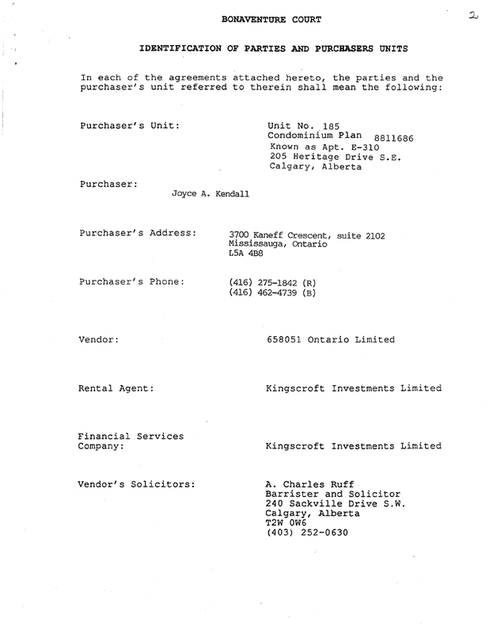

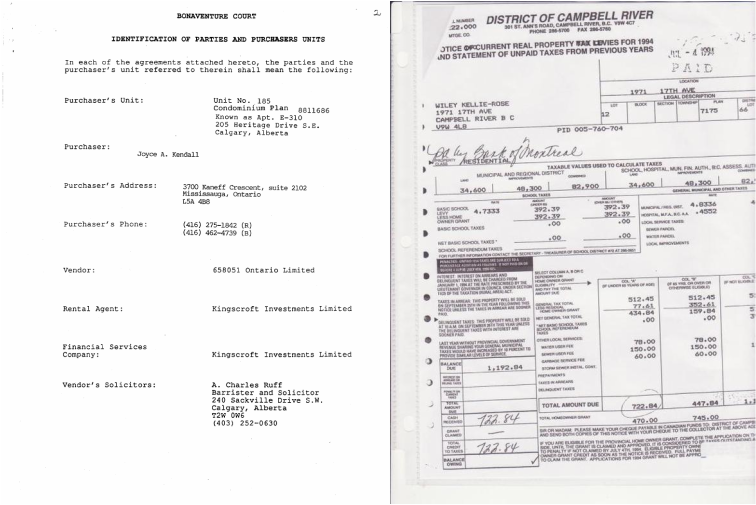

- 1988 DURHAM TRUST INTERNATIONAL -ASSIGNMENT OF INTEREST

- 1991 -BRADY BONDS OWED TO DURHAM TRUST INTERNATIONAL

- 1994-LEO WANTA FORGERY -VK DURHAM AUTHOR US WELFARE QUEEN ---Russell Herman's Boatmens Bank Account.

- 1994 RICK MARTIN -LAST WILL AND TESTAMENT OF RUSSELL HERMAN &COSMOS SEAFOOD ENERGY MARKETING

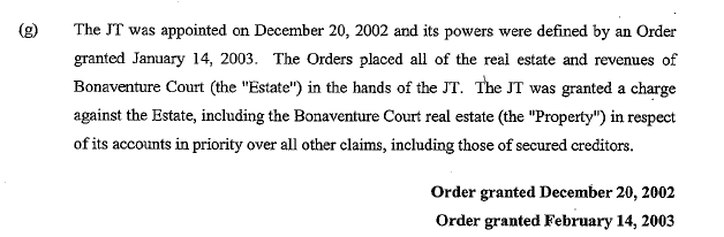

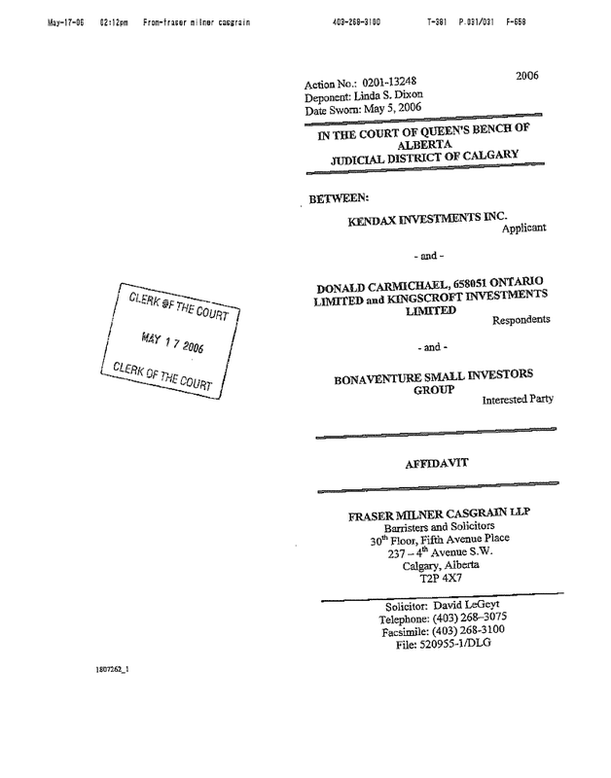

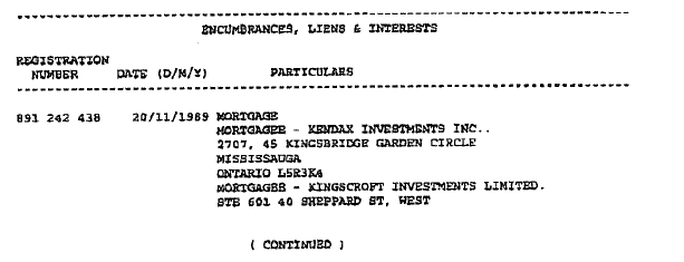

- 2003 KINGSCROFT INVESTMENT FRAUD -DURHAM TRUST

- 2011- FBI SOVEREIGN CITIZENS MOVEMENT CRIMINAL CROWN PROSECUTORS FRAUD MILL - PACIFIC WEST COST UNDER ATTACK BY CROWN PIRATES BC marine based WARCRIMES FINANCED A GLOBAL WALL STREET/CROWN/SOVEREIGN DIRECTING MINDS /FREEMASON SOCIETY BY SUSPECTED ILLEGAL C

- BC FEDERAL WATERS ARE A DANGEROUS PLAYGROUND FOR VICTIMS -IMPERIAL OIL WORLD CORRUPTION -DID CAMPBELL RIVER CITY HALL SELL THE FORGED DEEDS TO WILLY PICTON'S ESTATE

- breaking news CR CITY HALL & MAXIMUS US Counterfeiting of US Debt =HEADQUARTERS OF THE NWO- GROUND ZERO 9-11 May 2012

- AG MINISTRIES------------------ILLEGAL ROYAL QUEEN'S CROWN REVENUE -DISCLAIMER :

- MINISTER OF JUSTICE OF CANADA NEEDS TO BE HELD ACCOUNTABLE FOR CROWN PROSECUTORS IDENITY CREDIT THEFT CRIMES

- 83.28 (1) Judge Definition of “judge”

- public safety - LAWYER- FEDERAL MINISTER OF PUBLIC SAFETY IS FAILING CANADIANS AND AMERICANS -FBI WANTED INTERNATIONAL PONZIE PIRATES attack in communities throughout PACFIC WEST COAST

- 1997-2011 -INDIAN ACT BRITISH TYRANNY - USING ABORIGINAL CULTURE TO LAUNDER ILLEGAL GAINS FOR BRITISH AGENTS -Campbell River Harbours & Homeland DFO security CROWN DEATH POOL INSURANCE INDUSTRY -REGULATORS NEEDED ASAP

- CRA----------FEDERAL PRIVACY BREACHES -2700 missing CRA FILES

- CRA ,,,,READ FIRST -COPYCAT PONZIE -everybody got hit. The safety net was ripped out.” FORGER BOB WHITE

- 2011 PONZIE WARNING - HMS PONZIE IS BACK -IRS/CRA US/CANADA MILITARY MEMBERS Alaska gold fever PONZIE = ROYAL Canadian Mint forges a new path to cash in on gold fever

- intro -CAPITAL HMS Junk CANADIAN bonds

- THE QUEENS ROYAL SOVEREIGN CROWN FRAMED SITTING MLA BOB WILSON

- THE FRAUD ISSUE: UK CROWN estate freehold property rights

- 1997-2011 DFO & NORWEGIAN AQUACULTURE INDUSTRY CULTURE OF PONZIE GOLD CORRUPTION sovereign citizens FELLOWSHIP movement may be manipulating US homeland security

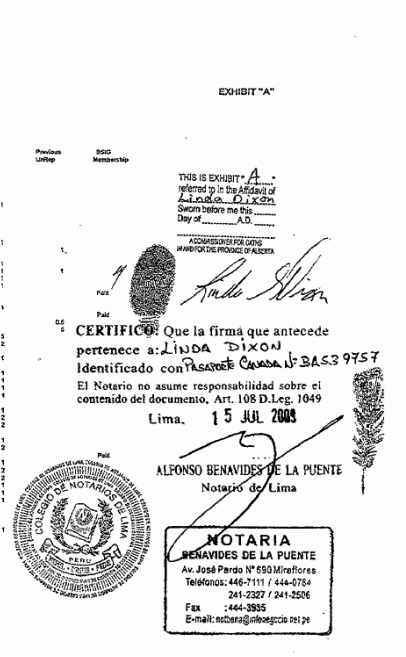

- KENTUCKY ED & WEST MEMPHIS CHIEF BOB ARE LOOKING FOR THE MASTERMINDS

- corporate fraud NORWAY/CHILE AQUACULTURE INDUSTRY

- HMS MOTHERLOAD DEED/MORTGAGE FRAUD PONZIE ESTATE ASSESTS AND DEBTS -ISSUE:MIA BC SUPREME COURT FINAL ORDER FOR A 1988 BMO MORTGAGE

- 1969-2011 CROWN PROSECUTORS PONZIE ROBOSIGNERS LIST - CROWN ESTATE- DFO MARINE - ALBERTA QUEENS BENCH -HMS PONZIE

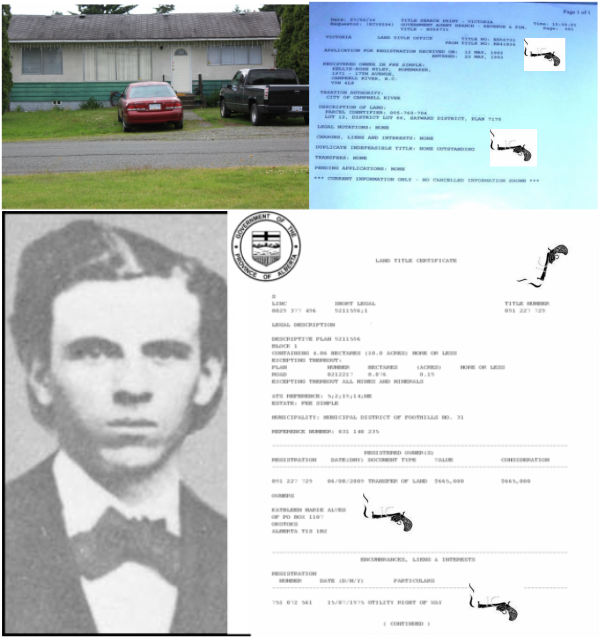

- 1974- CROWN MINISTERS FORGED INFEASABLE TITLE /OWNERSHIP THE CROWN PROSECUTORS FORGED ESTATE AND LAND TRANSFER

- SPIN DOCTORING Is a LETHAL MEDIA DISEASE

- POWELL RIVER CIBC= WALLS STREET MERS PAPER TERRORISM

- intro Breaking news--------smoking gun...........July 23 2011

- #1 UPDATE OCT 2011 -4 MONTHS LATER UPDATE- OCT 2011 WALL STREET UNDER ATTACK

- #2 EMERGENCY INJUCTIVE ORDER =cease and desist -Life insurance -over insured/SERIOUS PERSONAL SAFETY THREAT -over company insured-2003 TD ILLEGALLY INSURED PENSION BENIFICARY /NO WET INK DOCUMENT

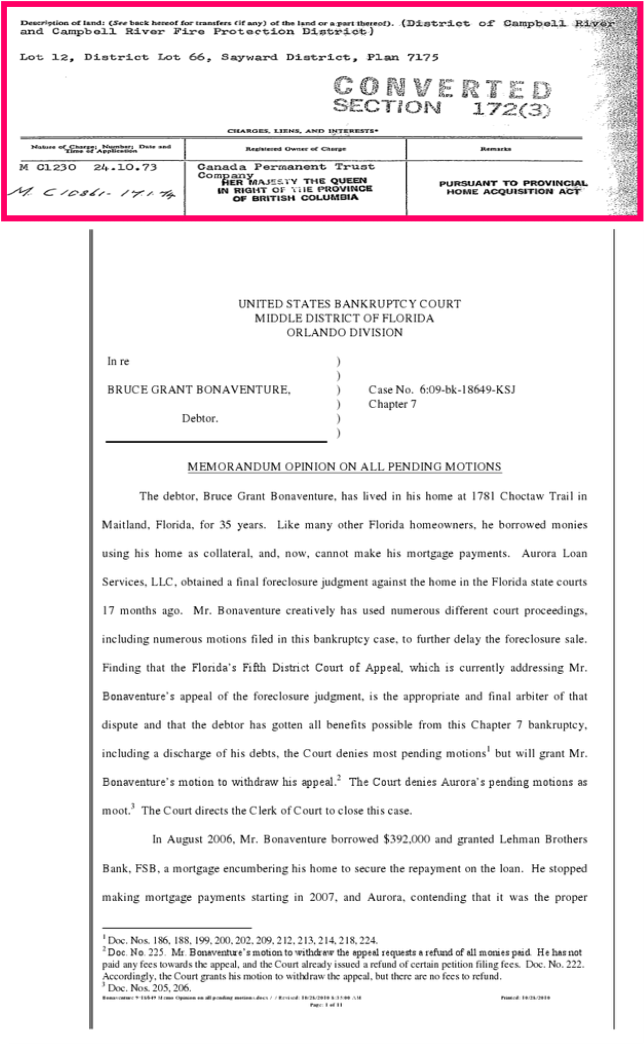

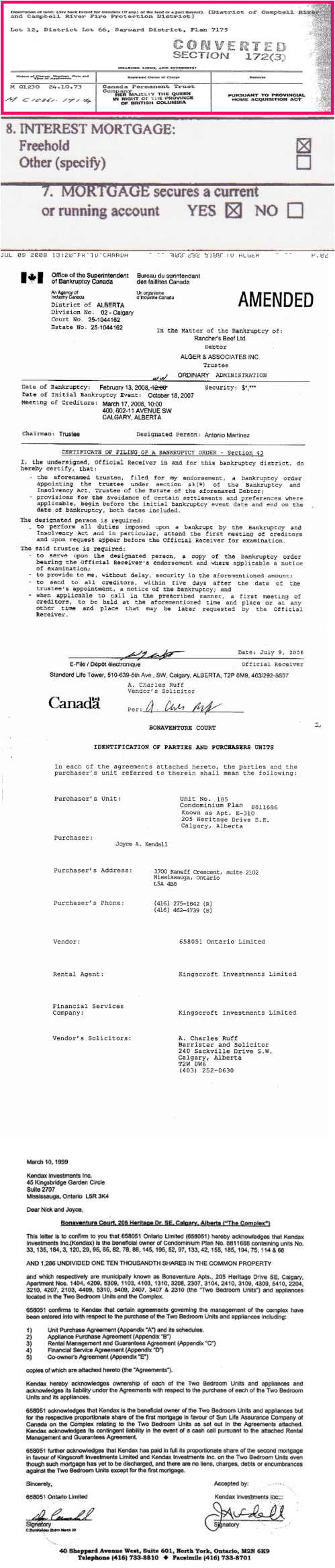

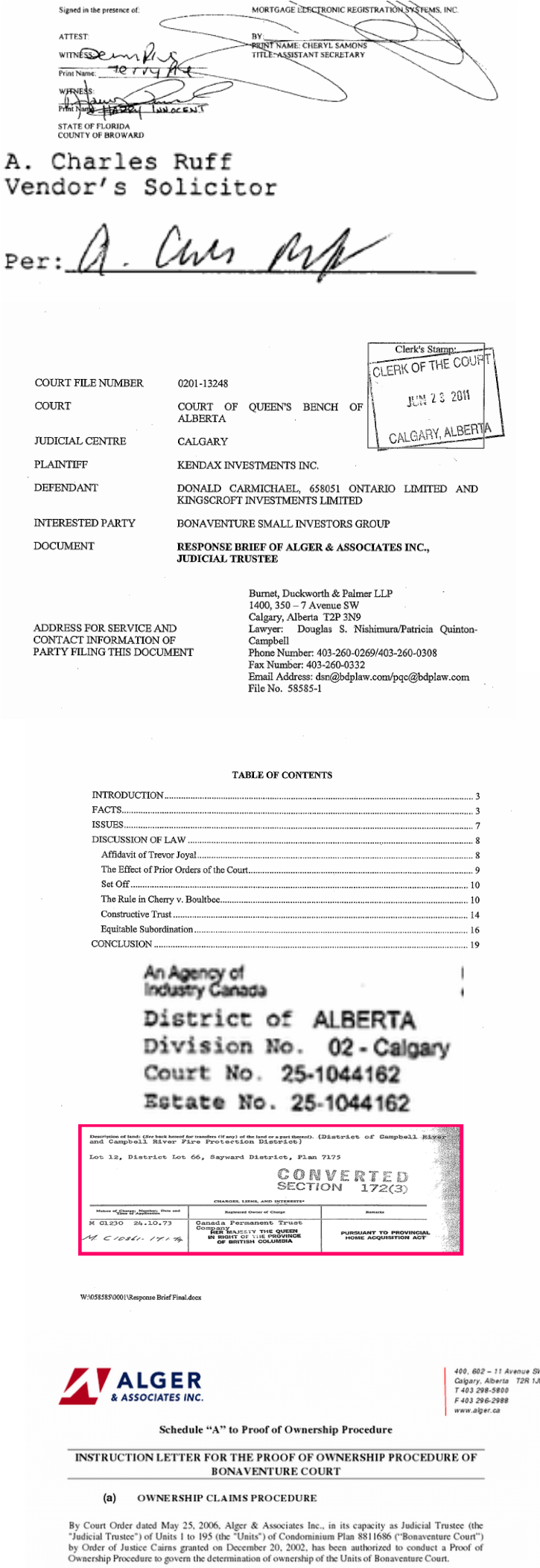

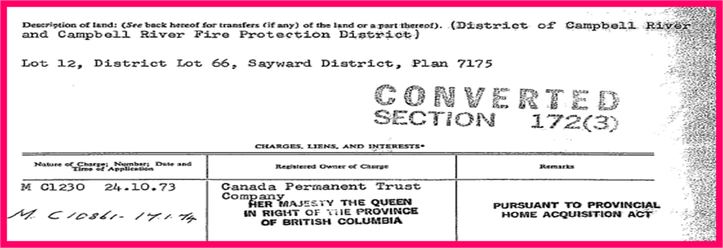

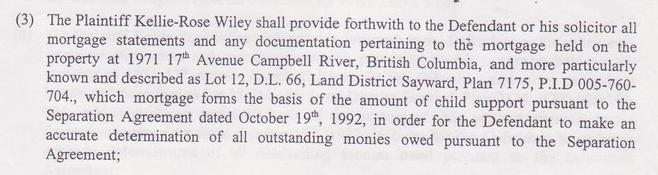

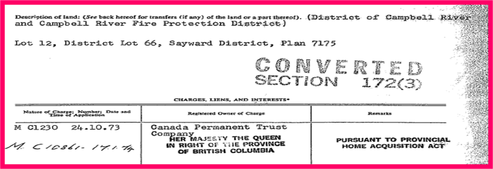

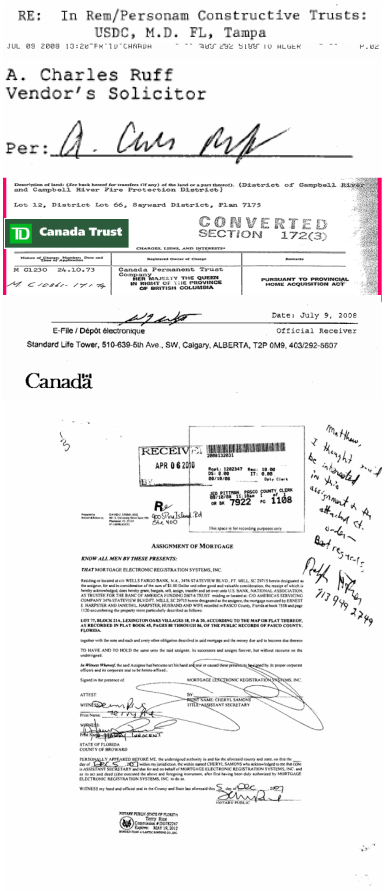

- #3 intro -ILLEGAL CROWN ASSIGNMENT- ILLEGAL CREDITORS AND FORGE GOVERMENT LEINS.-BC HOME AQUISTION ACT FALSE CHARGE ON CLEAR TITLE

- #4 11MAY11-affadavit of PONZIE -JOYCE KENDALL LOST RECORDS -MARY WILLIAMS/JOYCE KENDAL FORGED AUTHORSHIP

- #5- IN THE LINE OF PUBLIC FAMILY SAFETY DUTY

- #6- 1973- BC DOUBLE DEED FRAUD CANADA TRUST/TD MORTGAGE FRAUD BIRTH OF ASCALADE INC.. & CROWN PONZIE

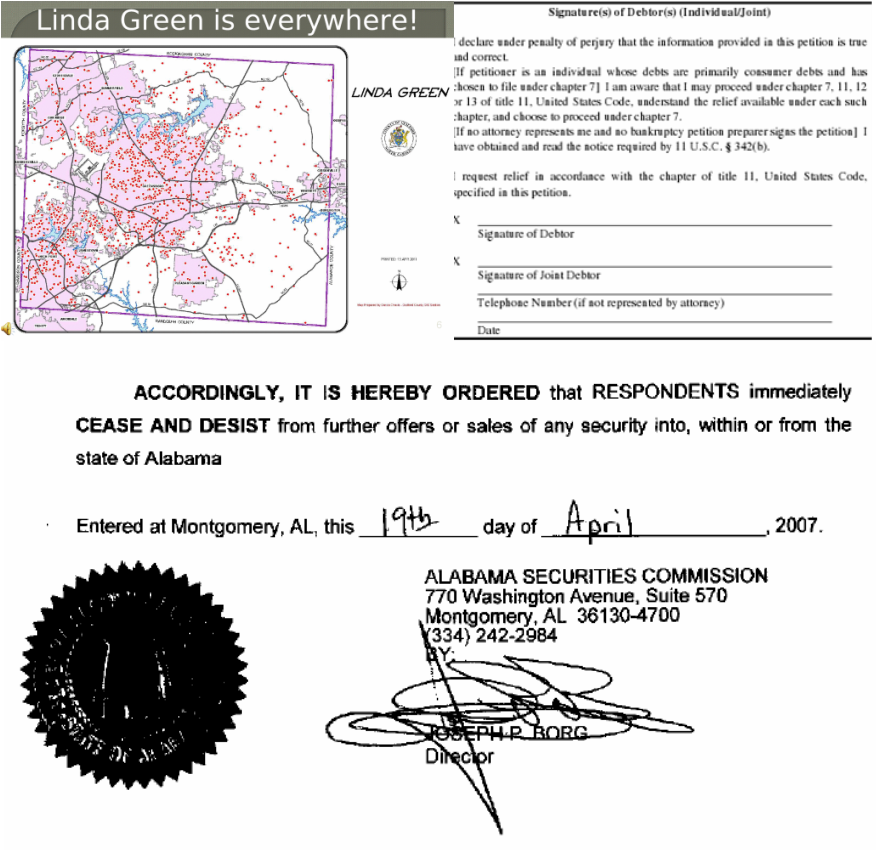

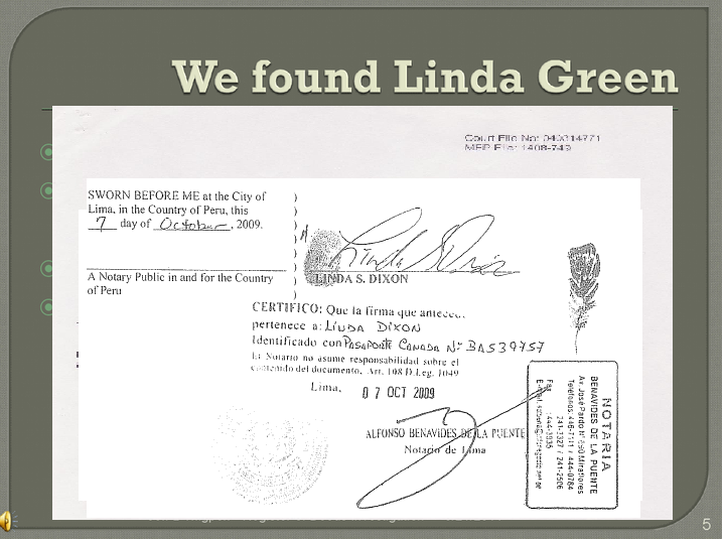

- #7 2011 MAY -SOVEREIGN BSIG AGENT -TREVOR JOYAL - NORTH ISLAND HMS PONZIE INVESTORS GROUP

- #8 -COURT AUTHORSHIP-WITNESSES ACCUSED-HANDWRITING FINGERPRINTS FROM PERU LED TO CAMPBELL RIVER ,CALGARY,FLORIDA ,CALIF CRIMINALS EGO LED TO SLOPPY FORGING

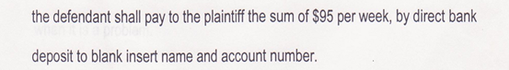

- #9 -intro -PROF COX FROM DUKES UNVERSITY EXPLAINS OUR FORGED imperial QUEEN ESTATES NIGHTMARE

- Innovative Aquaculture MARINE/FEDERAL WATER BASED Projects SOVEREIGN /CHRISTIAN FELLOWSHIP /PONZIE clean up fund

- ISSUE :SOVEREIGN INVESTORS FORGED ESTATE TAKEOVERS /FELLOWSHIP FRAUD

- FACEBOOK UNIVERSITY/JUDCIAL ETHICS COURT

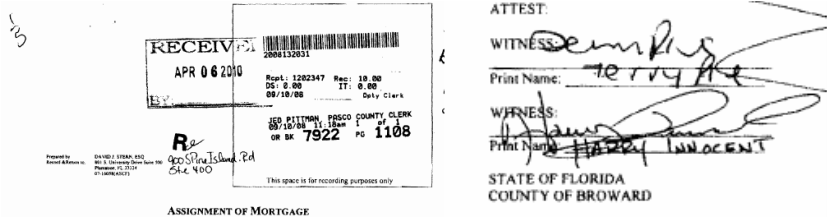

- #10- LEHMAN BROTHERS -THE REAL FLORIDA- MR BRUCE GRANT BONAVENTURE/

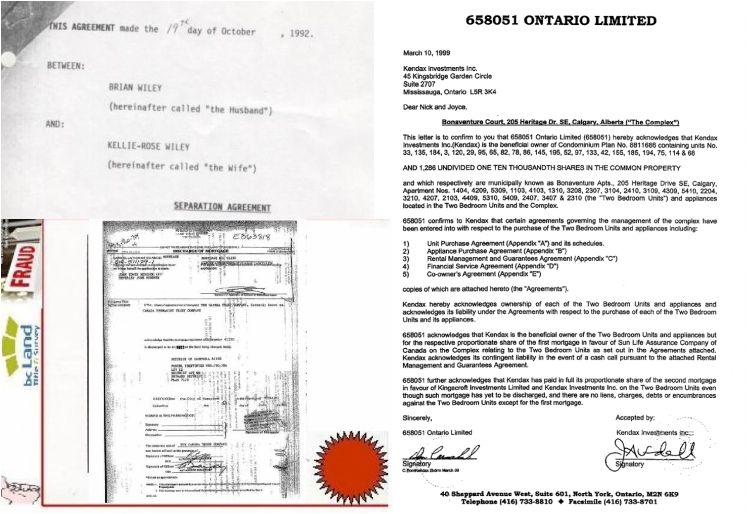

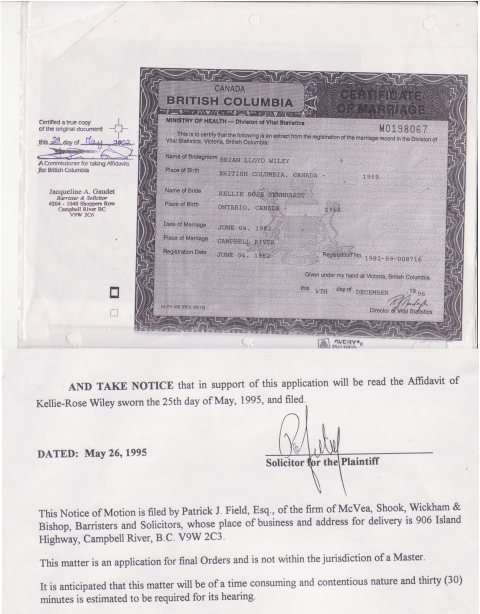

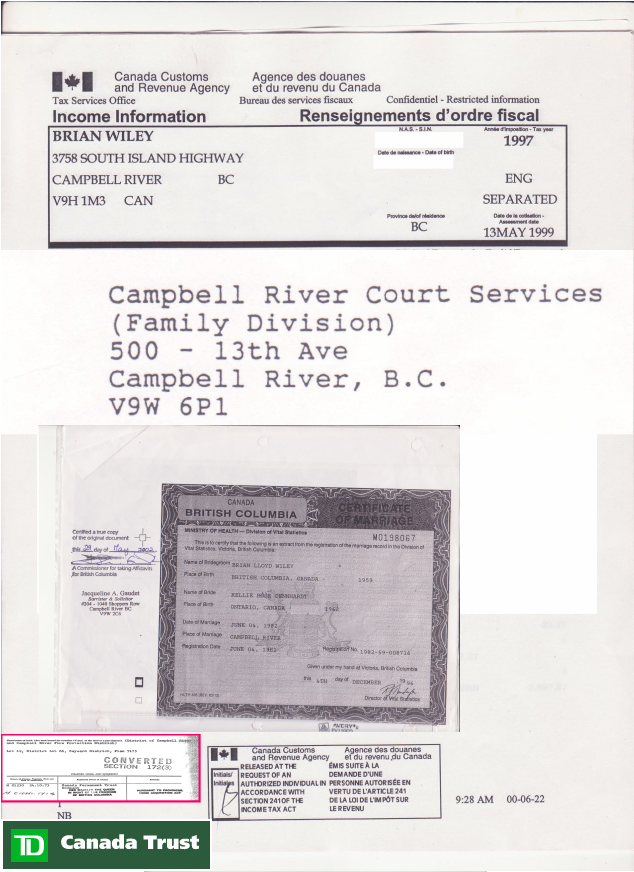

- #11 - IDENTITY THEFT DUE TO FORGED BC MARRIAGE CERTIFICATE CREATING 2 FORGED JOINT MATRIMONIAL LIFE STATES -ALBERTA WILEYS

- #13-- INTERNATIONAL MERS SOVEREIGN SOVEREIGN PONZIE BRANCH SHUT DOWN /RESTORE COURT RECORD /LEGAL LAND TITLES AND DEBT OWNERSHIP.......1QT-NOT WELCOME IN NASHVILLE....TRIBUTE TO BRANDON & BILL AND THE CHEIF & 60 MINUTES

- #14- INTRO & ISSUES -- BACKGROUND OF THE INVESTMENT/TAX SHELTER /FLORIDA ESTATE FRAUD PENSION PONZIE SCHEME Parliament needs to act to close the loophole that allowed the situation to occur FORGED INCORPORATED OFFSHORE ,US, BC ALBERTA ONTARIO,LTD companie

- #15-PONZIE CRIME IN PROGRESS -INTERNATIONAL CROWN PONZIE INCORPORATED TRAIL /DIRTY DEEDS OF TRUST DONE DIRT CHEAP/ /NEW HEALTH AND SAFETY ISSUE ON OR OFF THE JOB -BC WEST COAST SOVEREIGN CITIZEN MOVEMENT DESTROYING COASTAL COMMUNITIES AND INDUSTRY-TARGETE

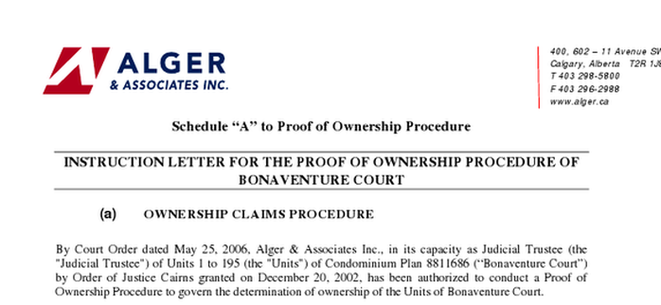

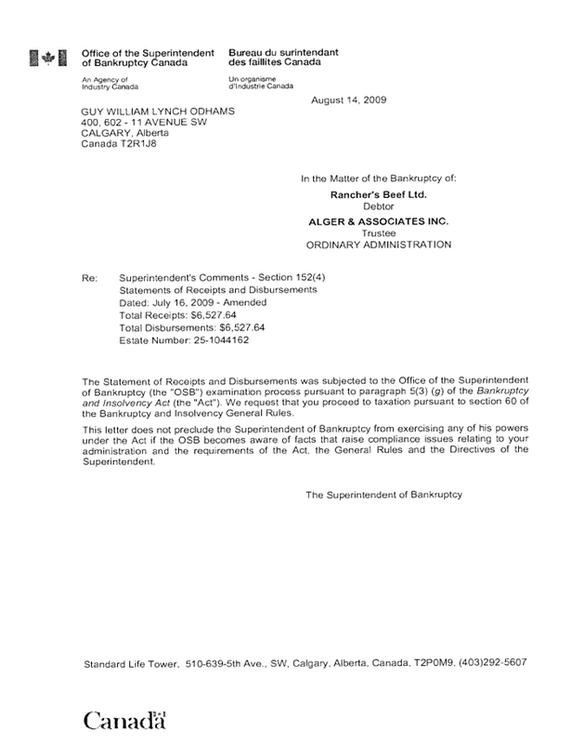

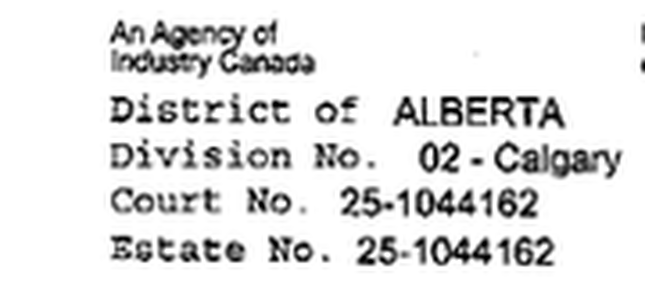

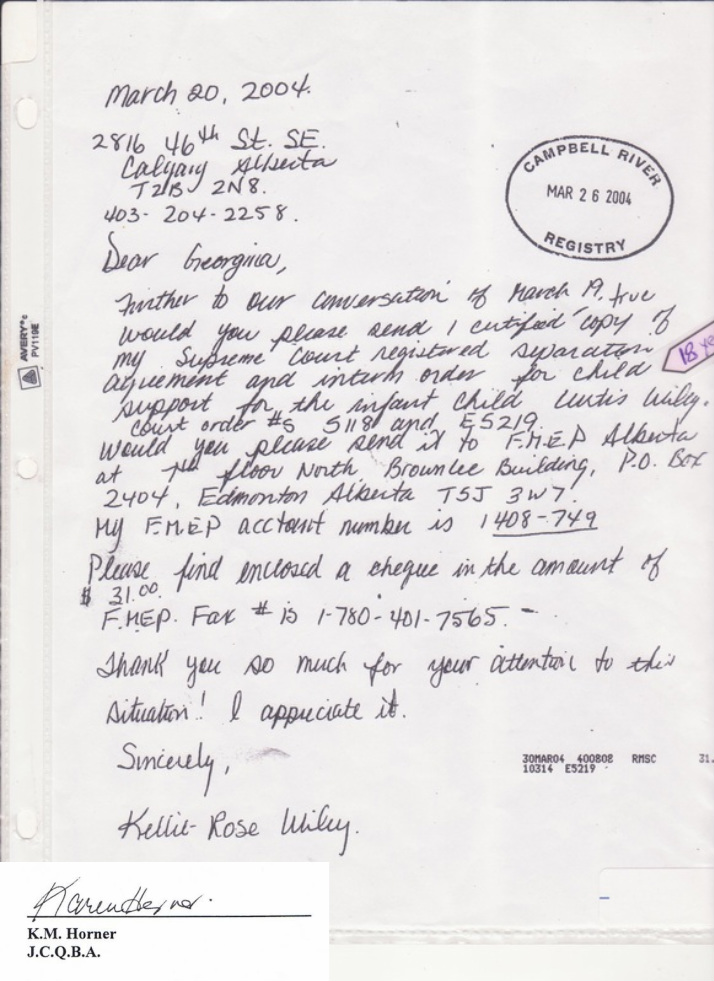

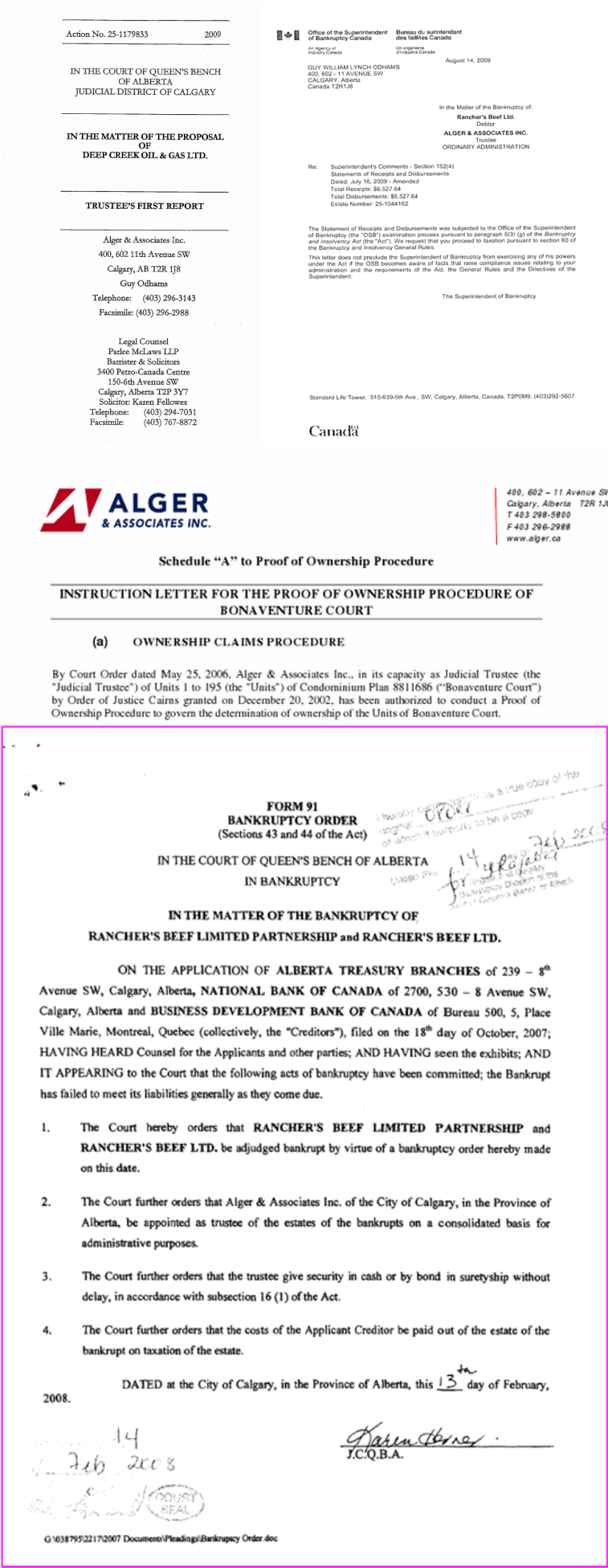

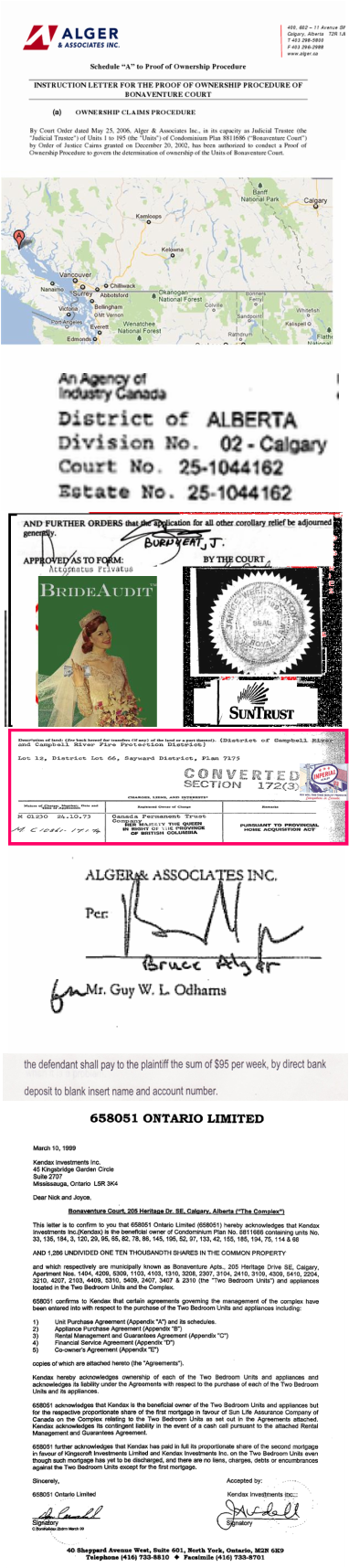

- #16- CALGARY -ALGER TRUSTEE BANKRUPTCY FRAUD -SOVEREIGN EX SIGNS AS JUDGE HORNER

- #17- -SERIOUS THREAT TO LIFE/TARGETED VICTIM 0F MASSIVE LEVELS OF IDENTITY THEFT ALBERTA -SELLER OF AN RESIDENTIAL COMPLEX FOR $600,000

- #18- -2011- LIFE INSURANCE FRAUD OVER INSURED COMPANY INTEREST - ALBERTA PERSONAL PROPERTY REGISTRY CORRUPTION- REMOVE FRAUD FROM ALBERTA P

- #20- BC MINISTRY OF SOCIAL SERVICES DROPPED THE BALL -public safety =JERVIS DEADMANS CONNECTION TO DAVIS /LAWYER/ CHILDREN VICTIMS - LETHAL SPIN OFF EFFECTS OF A SOVEREIGN RUN PONZIE

- #21- public safety =CRA / MAXIMUS WELFARE sovereign QUEENS PAPER WRIT PONZIE TERRORISM US MAXIMUS ponzie -across state linesCANADIAN FEDS/US

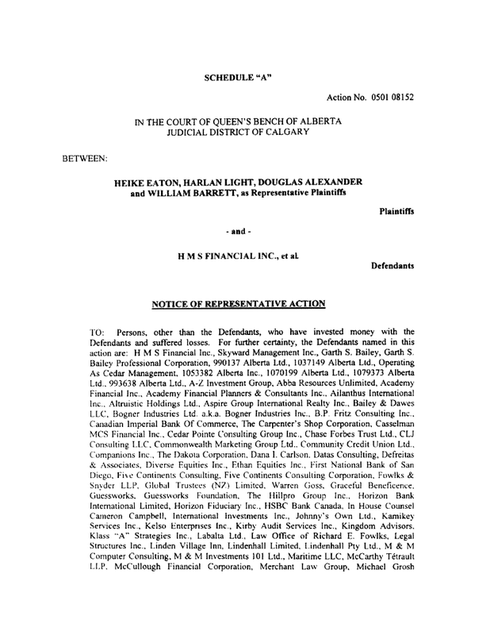

- #22- PLAINTIFFS -GLENMOUNT

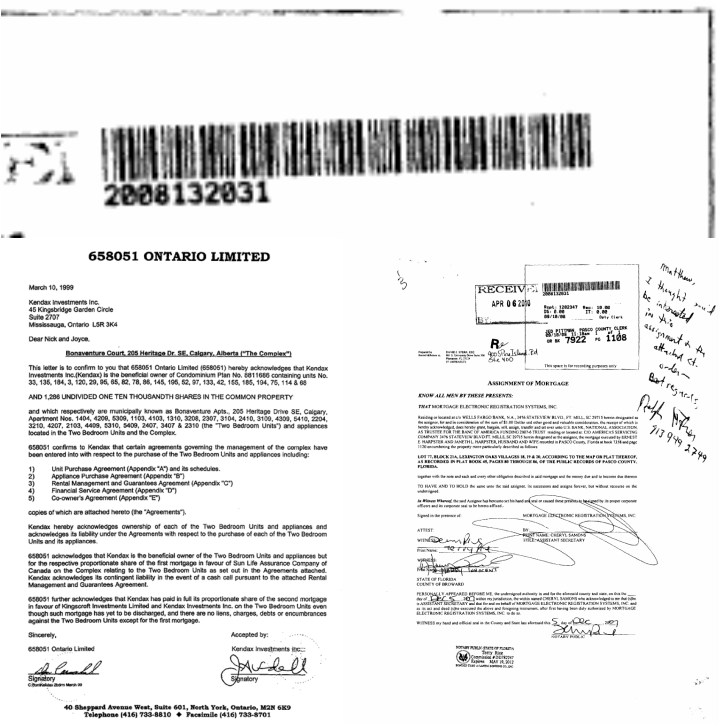

- #23- KINGSCROFT UNIT PURCHASE AGREEMENT

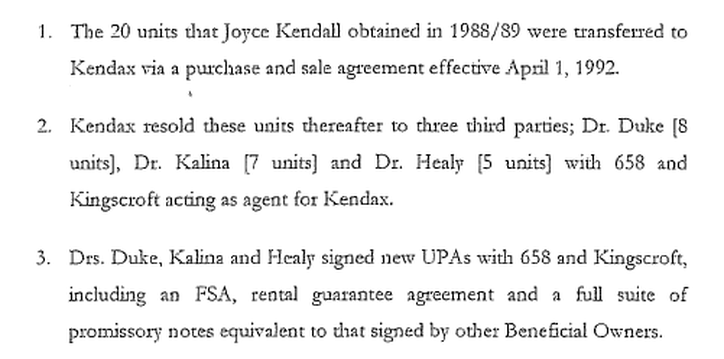

- #24- 1999 ONTARIO LTD 658051

- #25- -JOYCE KENDAL AFFADAVIT -KENDAX

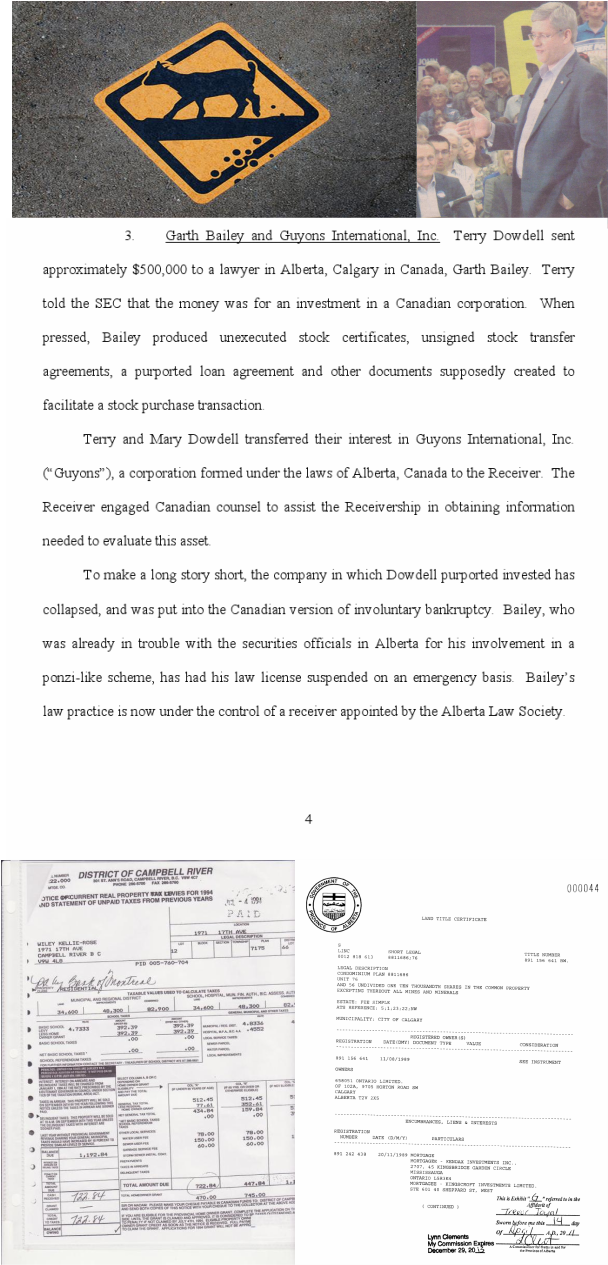

- #40- 17-JUN02- PRINCIPLE TERRY L. DODWELL SENTENCED FOR 15 YEARS The Vavasseur programme was operated and controlled by an American citizen named Terry Dowdell who purported to be able to generate substantial profits by trading in bonds.

- #26- GRANTEE.........1998 (“Vavasseur”), a Bahamian corporation owned beginning in April 1998 and continuing through 2001,

- #27- GRANTEE...........ATCO DEED KATHLEEN MARIE ALVES

- #27b- =cease and desist - CROWN ATTORNEY GENERALS MINISTRY//US MAXIMUS/CRA -NAME GAME/ESTATE FRAUD/COLD CALCULATED ACCOUNTING FRAUD

- #28- -cease and desist -1969 -2011 PONZIE WAR - FORGED & VIOLATED CONSENT BC ESTATE DEED OF TRUST -- CIBC /DAVIS CONNECTION TO BC SUPREME COURT-DIVORCE /FORECLOSURE LIFE BENCHER BC SUPREME COURT JUSTICE GRANT BURNYEAT

- #30- =cease and desist -BISG sovereign investors payout on insurance fraud

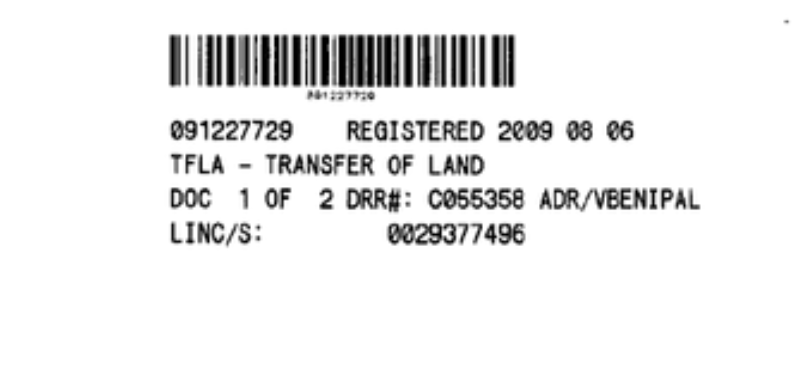

- #31- cease and desist -2009-ATB FINANCIAL-CROWN SECURITIES FRAUD/IDENTITY CREDIT THEFT ,ESTATE FRAUD

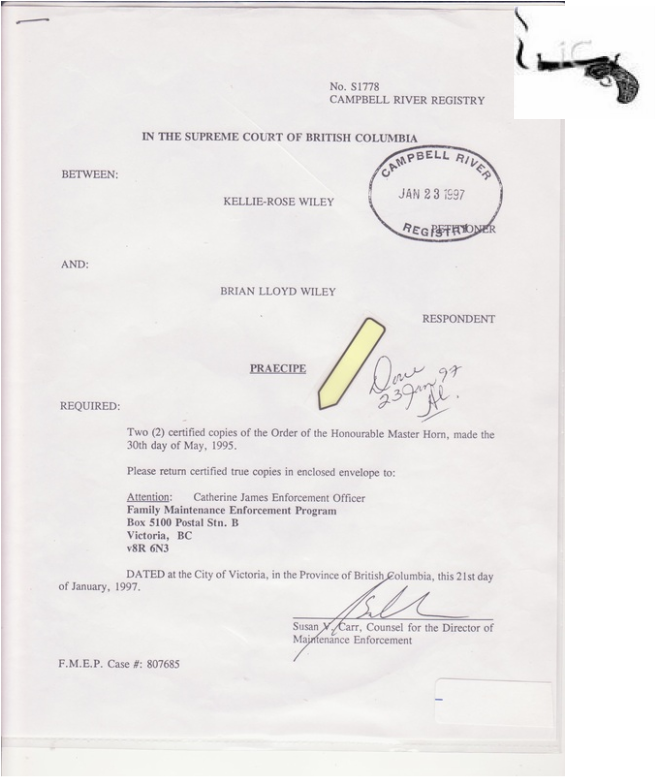

- #32- A ISSUE OUTSOURCING GOVERMENT CONTRACTS - US MAXIMUS INC IN HOUSE SOVERIGN CROWN FORGED CONTRACT Structurists-BC ATTORNEY GENERALS OFFICE BRENT HIRD/SUSAN CARR AGENT FOR THEMIS /MAXIMUS/FMEP

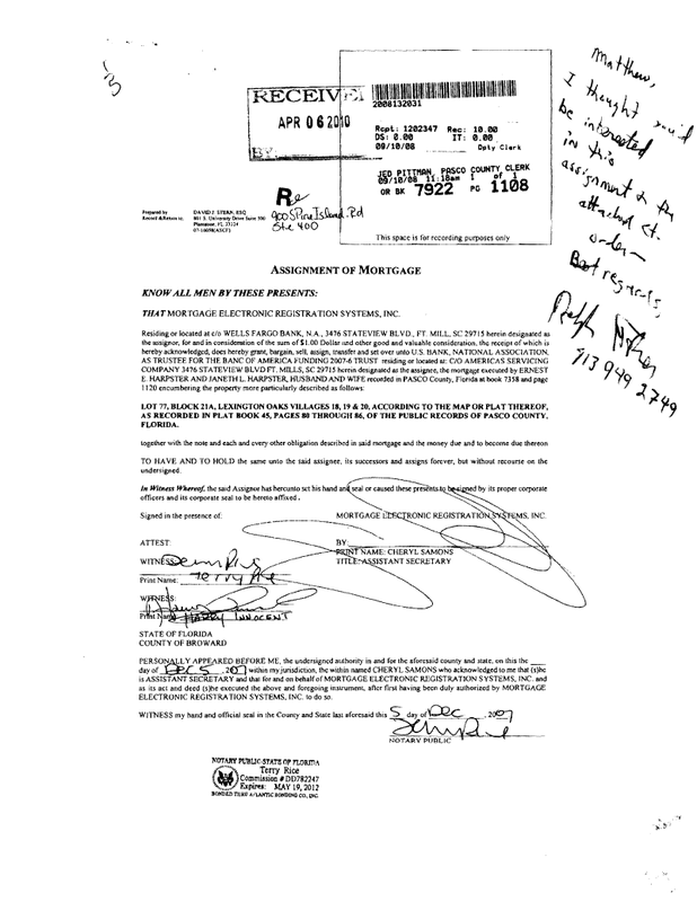

- #33- MERS ASSIGNED/FORGED 1988 BMO -1ST MORTGAGE/DEED OF TRUST - APPENDIX #A WAS ADDED SEP23 1993

- #34-----EVIDENCE-1995 BC SUPREME STATEMENT OF CLAIM FOR FINAL ORDER

- #35- FLORIDA TRUST BOND BRANCHES- Who bought bonds issued by different trusts that were set up by a particular bank or mortgage company, ?

- #36- -SMOKING GUN........ 1989 INDUSTRY CANADA FRAUD

- #37- -SOVEREIGN INTERNATIONAL COMMUNITY APPEAL COURT --------- RE :BC DIVORCE FRAUD BC SUPREME COURT FINAL ORDER

- #38- -1969-2011 IN THE PATH OF A HMS BRIXON GROUP BC WESTCOAT/ALBERTA PONZIE with business advantages/perks and lifestyle appeal.[4]

- #39- -KINGSCROFT BONAVENTURE ILLEGAL FINANCIAL SERVICES COMPANY

- #40 -Maximus /BC HEALTH CORRUPTION/IDENITY THEFT FRAUD RING/ SOVEREIGN CITIZEN MOVEMENT ACCOUNTING

- #41- -LEGAL OATHBREAKERS IN COLLUSION W/INDUSTRY CANADA/ PERJURY INFESTATION AND - SOVERIEGN WALL STREET CONTRACT STRUCTULISTS TAKE OVER-

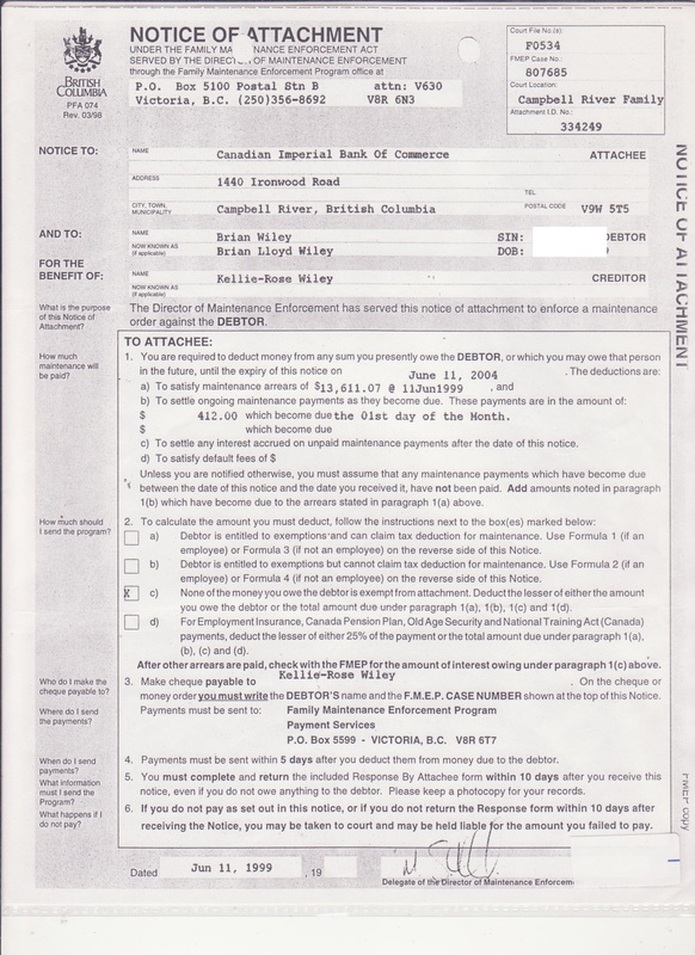

- #42 -1997- THE IMPERIAL SOVEREIGNS QUEEN IN THE RIGHT OF CANADA-ILLEGAL ATTACHMENT

- #43- -CEASE AND DESIST SOVERIEGN BSIG INVESTOR POOL AGENT PERU LINDA DIXON

- #44- -2011- CIBC CEASE AND DESIST BONAVENTURE COURT CROWN- /WALL STREET SOVERIEGN CREDITORS INTENDED TO DEFRAUD DEBTOR

- #45-MCKEE BC FIRST NATIONS insurance MASTERMINDS CROWN CIBC/ATB FINANCIAL ALBERTA CROWN BANKinvestigation-

- #46 --public safety/FEDERAL WATERS/HARBOUR BASED -illegal MONEY MOVERS /estates via forged federal liens/attachments FINANCING OFFSHORE VENTURE CAPITAL/PRIVATE WEALTH/INDUSTRY INVESTORS IE:GOLD IN PERU

- #47- -SW CALGARY LEGAL SOVEREIGN CITIZEN AID HIGH INTEREST RETURN PONZIE HOUSE- BONAVENTURE COURT FINANCED BY FRAUD

- #48- -INTERNATIONAL PROSECUTIONS NEEDED TO STOP MERS COMMON LAW COURT CLEAN UP ASAP----- COMMON LAW INTERNATIONAL SOVEREIGN LEGISLATION/ SLAYER LAWS

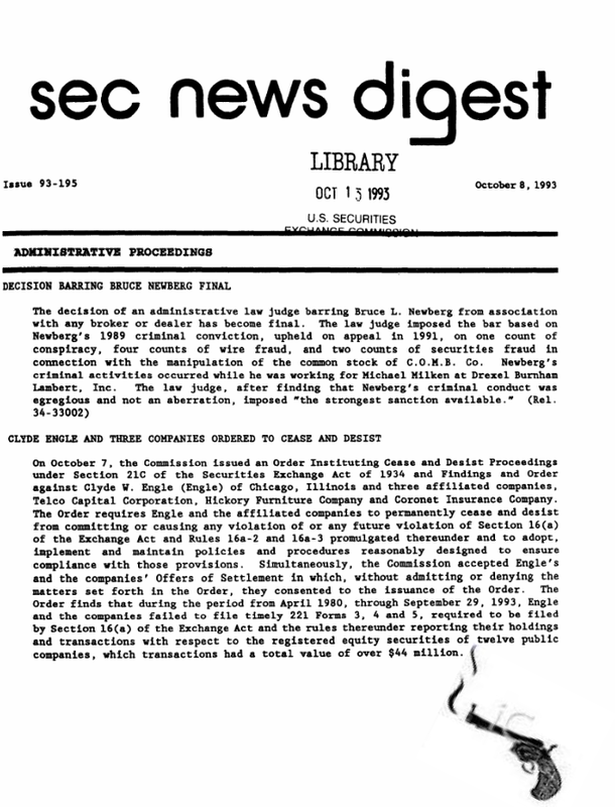

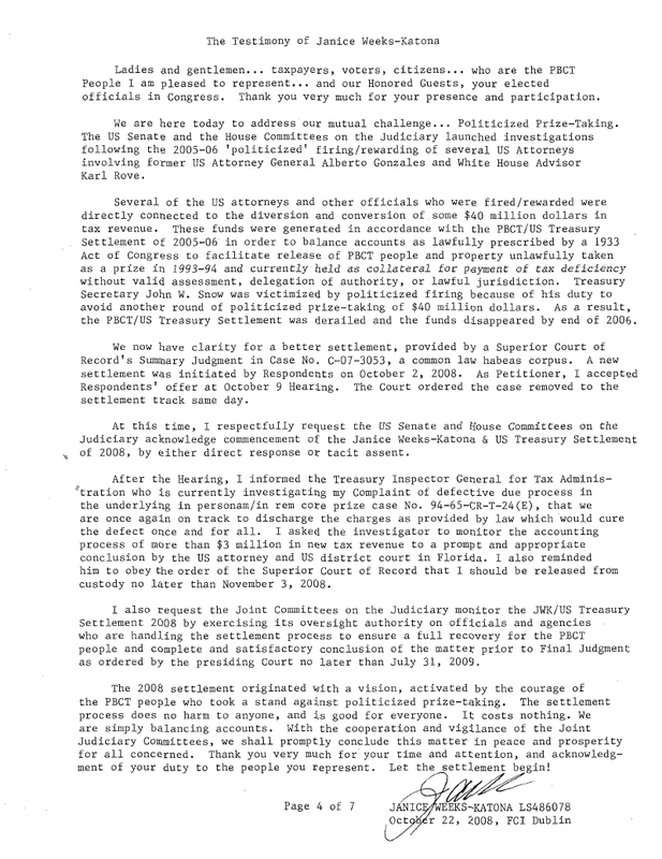

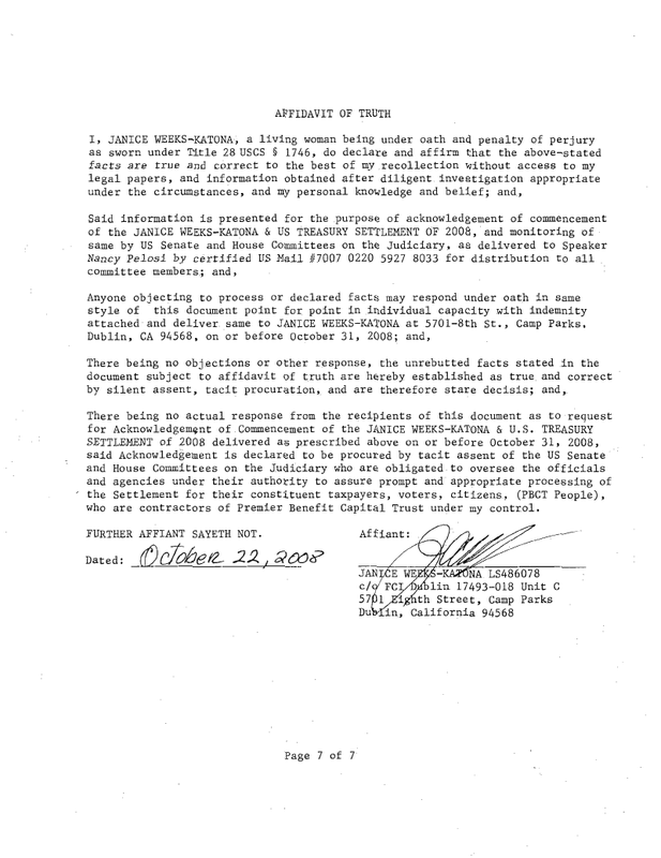

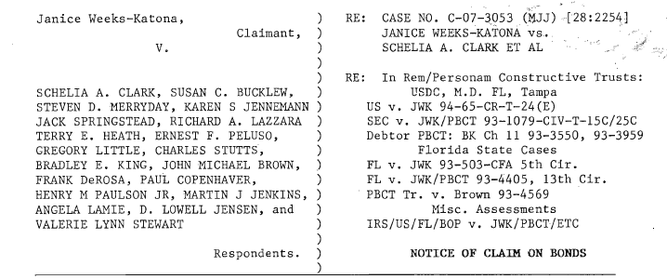

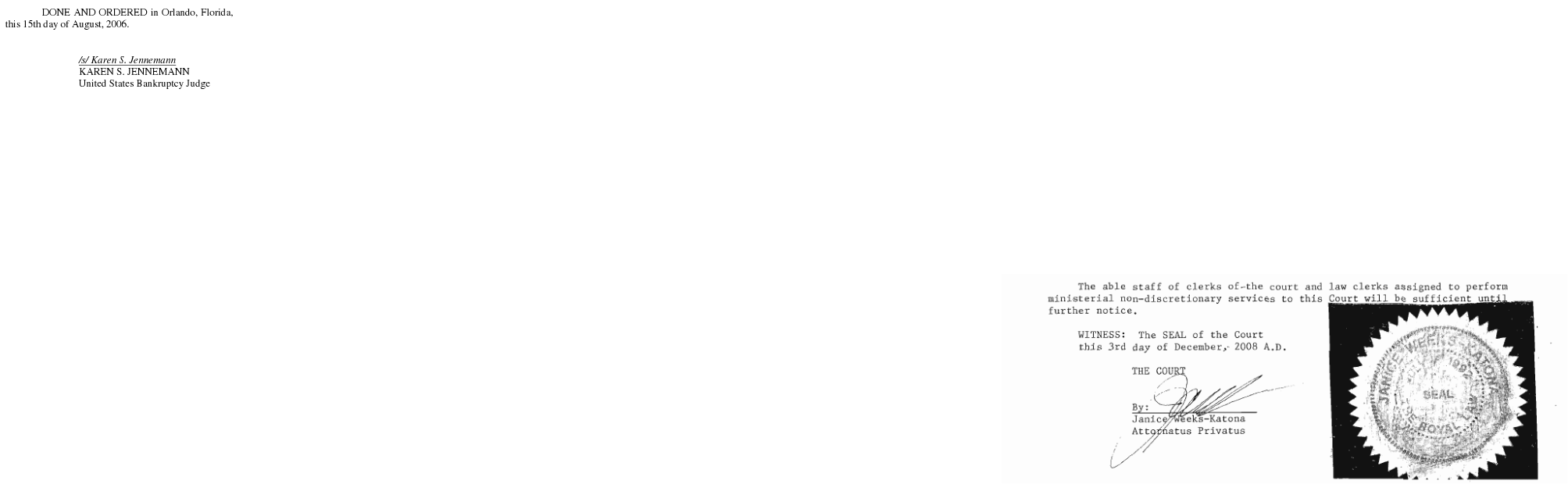

- #49- US NATIVE SOVEREIGN MASTERMIND IN JAIL IN CALIFORNIA -JANICE WEEKS KATONA SEEKING TO REOPEN A 1992 CHAPTER 11 FLORIDA BANKRUPTCY CASE-TO ALLOW TRUSTEE/ADMINISTER TO RELEASE TRUST ASSETS-NO GO SHOT DOWN BY FLORIDA ORLANDO BANKRUPTCY COURT- JUDGE K

- #50- -SOVEREIGN BC QUEEN/PENSION MINISTRY OF SOCIAL SERVICES /FMP FRAUD GRAB

- #51- -CANADIAN LEGAL AID IMPERIAL CROWN MASTERMINDS OF US/CANADA SOVERIEGN STRUCTULISTS MASTERMINDS ENGINEERED CONTRACTS ARE KILLING WEST MEMPHIS POLICE AND POLITCALLY TARGETED WHISTLEBLOWER EASY TARGETS

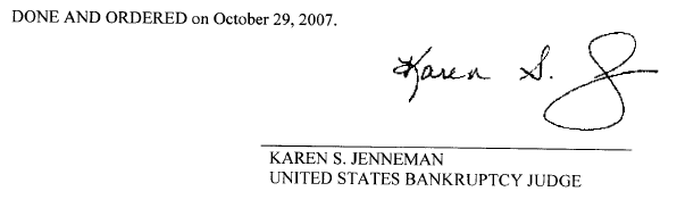

- #52- -1995- PERJURING PLAINTIFF BC SUPREME/FAMILY COURT - PONZIE/PERJURY /BONAVENTURE SECRET SOVERIEGN COURT/TRANSFER OF A FORGED ESTATE 1993

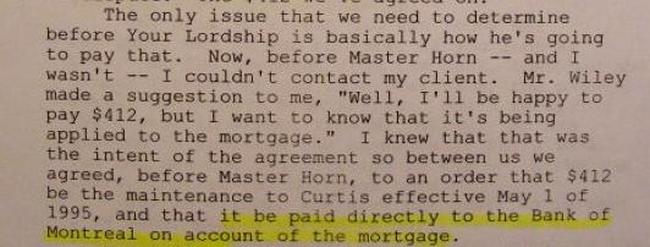

- #53- -PERJURY FINANCED CRIMES AGAINST HUMANITY = SOVEREIGN WRONGDOERS FAILED TO INFORM JUSTICE MEIKLEM OF THE BC SUPREME COURT ON JUNE 19 1995 -THAT THE BMO 1ST MATRIMONIAL MORTGAGE IN QUESTION HAD ACTUALLY BEEN FORECLOSED - EXPLAINS MIA/ BMO 1ST MATR

- #54- -PUBLIC SAFETY - CRA/MAXIMUS CROWN /CITIZEN SOVERIEGNS PENSION PONZIE/

- #55- --MONEY MOVER HIJACKED STEELWORKERS PENSION ACCOUNT TAKEOVER/SEIZED BY ILLEGAL ATTACHMENTS

- #56- -CONTEMPT/TREASON SERVICE ALBERTA CROWN DEBT COLLECTIONS

- #57- -QUEENS BENCH AUTHOR NOT IS NOT A JUDGE BUT SOVEREIGN EX WIFE OR EX GITLFRIEN-AKA FLORIDAS LINDA GREENS

- #58- -BROKEN COURT RECORD -1995 LORDSHIP ISSUE IGNORED BY BIG CORP/BIG BANK CROWN SOVEREIGN LEGAL COMMUNITY =DEBTOR STATEMENT OF CLAIM BEFORE THE SUPREME COURT OF BC

- #59- -FORGED COURT RECORD -INSERT BLANK AMOUNT MERS MORTGAGE BANK/WIRE FRAUD FOR FINAL BC SUPREME COURT ORDER owed to the Queen FOR THE 1ST MORTGAGE

- #60- -MERS IMPERIAL CROWN SOVEREIGN DEBT SLAVE MASTERMINDS

- #61- TRUSTEE BURNETT-TRUST ACCOUNT BANK ACT-

- #62- -1995-DEFENDANT BC SUPREME/FAMILY COURT - TARGETED DEBTOR AFFADAVIT

- #63- -1995 FINAL BC SUPREME COURT TAMPERED TRANSCRIPTS -ORDER

- #64- -BC LAND TITLES CORRUPTION/FORGED DEED MILL

- #65- -INTRO BROKEN CHAIN OF TITLE 1989-2011 CIBC/BC &AB LAND TITLES -FORGED CHAIN OF OWNERSHIP

- #66- -1993 VICTRO REGISTRY BIG CORP COMPANY REGISTRY VICTORIA BC

- #67- -TREASON ALBERTA CROWN -JUDGE HORNER-HARPER-DAVIS-BURNYEAT

- #68- --1992 BC SUPREME COURT FINAL ORDER/SEPERATION AGREEMENT SIGNED UNDER FALSE PRETENCES/

- #69- MAXIMUS IGNORED BC SUPREME COURT FOR BIG BANKS AND BIG CORP

- #70- --MASTERMIND JUSTICE KAREN HORNER BANKRUPTCY FORECLOSURE FRAUD HARPER HORNER bloodline calgary queens bench court orders

- #71- -illegal FLORIDA LEGAL AID IMPERIAL CROWN ESCROWED DEPOSITS /ponzie bank/wire fraud

- #72- -NATIVE SOVEREIGN BC MASTERMIND MCKEE CDS INSURANCED FRAUD -MASTERMIND MCKEE CONNECTION TO TARGETED VICTIM/WHISTLEBLOWER - FIRST NATION IMMUNITY /TAX FREE/ROYAL LAW

- #73- -WHO IS THE REAL LINDA GREEN- AGENTS TRANSFER OF ESTATE INCLUDING /MORTGAGED PROPERTY OR FOR SALE OR CONYENANCE

- #74- --ESTATE ATTACHMENTS MERS DEED OWNERS INCLUDE PENSIONS

- #75- -2011-SOVERIEGN QUEEN IN THE RIGHT OF CANADA VERSUS US ROYAL LAW COURT

- #76- -CROWN SOVERIEGNS COURT ADMINISTRATOR ENFORCING ROYAL LAW -public safety risk assesment

- #77- -2003 -JUSTICE DEPARTMENT ATTACHMENT WITHDRAWL

- #78- -1995- BUISNESS TRUST ACCOUNTING FRAUD/TRUSTEE FRAUD ALABAMA THE BIRTH OF HMS PONZIE SECURITIES FRAUD AMERICAN HERITGAGE CHURCH LOANS/BONDS PONZIE HEADQUARTERS

- #79- -1973-2011 BC WEST COAST BIG CORP/WALL STREET CITY HALL CORRUPTION

- #80- 2005-QUEBEC LINDA DIXON

- #81- -MAXIMUS US NATIVE INDIAN SOVEREIGN CITIZEN TRUSTS ESTATES US AND CANADA WELFARE QUEENS/BC BMO MORGICIDE

- #82- -2011 CIBC/ JANICE WEEKS KATONA

- #83- =ILLEGAL Canadian BONDS SEIZED BY IRS

- #84- -1992 IRS SEIZED CANADIAN BONDS SOVERIEGN GROUP RECOVERY CORRUPTION -PREMEIR CAPTITALTRUST -JANCICE WEEKS KATONA

- 61-US NATIVE INDIAN SOVEREIGN TRUSTS 8-Premier Benefit Capital Trust CONNECTED TO CIBC DAVIS scheme, which defrauded investors of more than $7.5 million; two of the principles

- 62-NATIVE SOVEREIGN -BC/ALBERTA/SAN FRAN JAIL SIGNATURES-FLORIDA'S MERS LINDA GREEN/BC CLERK/ALBERTA JUDGE AGENT/OWNER OF ILLEGAL CANADIAN COMPANIES KINGSCROFT/KENDAX/658 AKA LINDA GREEN/JOYCE KENDALL

- #85- -AB =REGISTARS CORRUPTION OF SOUTH ALBERTA LAND TITLES

- #86- --BC/ALBERTA WELFARE MERS QUEENS SOVEREIGN DOUBLE deed forgers

- #87- --CANADA TRUST LIEN 1973-1ST MORTGAGE /DEED OF TRUST SUN LIFE OF CANADA GROUP MORTGAGE CANADIAN APPENDIX #AHISTORY

- #88- --BC FORGED WRITS/CREDITORS FEDERAL ATTACHMENTS

- #89- --2010 ACCOUNTING FRAUD COLLIERS INTERNATIONAL BONAVENTURE COURT SOLD NOV

- #90- -RBC MUTUAL FUNDS SIEZED

- #91- -SUNLIFE PENSION SEIZED-SUNLIFE 1ST MORTGAGE FRAUD

- #92- -2009 SUNLIFE OF CANADA/RBC/BMO/CIBC /ATB CROWN/BANK OF CANADA/ organized mortgage fraud

- #93- TORONTO DOMINION MORTGAGE FRAUD DISCHARGE CLAIM GARTH BAILEY

- #94- -1992 3 PARTY LIABILITY LEGAL AID/ CIBC -FALSE LIEN /FAKE INJURY SETTLEMENT(3RD PARTY)

- #95 a- illegal atttach TELEVECTOR

- #95b- --illegal atttach EVERGREEN CREDIT UNION/

- #95c- -illegal atttach CIBC

- #95d- --illegal atttach -BMO

- #95-e -illegal atttach MAXIMUS

- #95f- -illegal atttach STOLT SEAFARMS

- #95g- -2003--illegal atttach WITHDRAWN STOLT SEAFARMS ATTACH

- #96 - =ILLEGAL writs

- #96a- -LEGAL AID ALBERTA/BC AUTO ATTACHED WRITS OF FRAUD

- #96b- AJ- ILLEGAL WRIT 1989 34-38 SUNLIFE OF CANADA

- #96c- -FX ILLEGAL WRIT 1989 44-48

- #96d- -BM ILLEGAL WRIT 1989 39-43

- #96e- -CQ ILLEGAL WRIT 1989 49-53

- #96f- -DH ILLEGAL WRIT 1989 54-63

- #96g- -DX ILLEGAL WRIT 1989 64-68

- #96h- -ER ILLEGAL WRIT 1989 69 -73

- #96i- -EW ILLEGAL WRIT 1989 74-78

- #96 j- FX ILLEGAL WRIT 1989 84- 88

- #96k- -GD ILLEGAL WRIT 1989 89- 93

- #97- -EARL H PACE TRUSTS investigation

- #97b- 93-WHO IS THE REAL FLORIDA MR BRUCE GRANT BONAVENTURE

- #98- -WHO IS THE REAL FLORIDA E ERNEST HARPSTER ??? IS HE ALIVE OR DEAD

- #99- -2007 LEHMAN BROTHERS HOLDING

- #100- -BC MAXIMUS /MEP ALBERTA IN CONTEMPT OF JUTICE MEIKLEMS FINAL ORDER

- #101- -CANADA /US MERS ROBO SIGNERS MERS/MAXIMUS LINDA GREENS SIGNATURES OF EXTORATION

- #101b- - MERS CRA/WELFARE LINDA DIXON AFFADAVIT

- #101c- -FLORIDA TRUST SUN LIFE PENSION WRIT 1989- AJ LINDA GREEN-DIXON

- #101d- -PASCO COUNTY FLORIDA EARL H PACE TRUST

- #102- S CALIFORNIA DISTRICT COURT JUDGE MILLER

- #103- ORLANDO FLORIDA BANKRUPTCY COURT

- #104- CANADA JUDICIAL SECURITIES SOVEREIGN - JUDGE KAREN HORNER PRIME MINISTER HARPERS COUSIN

- #105- IMPERIAL CRA WELFARE MERS QUEEN SOVEREIGN LEHMAM LINDA GREEN CREDIT DEFAULT SWAPS GOAT POO

- #106- WHO IS THE REAL MR BRUCE GRANT BONAVENTURE? THE TRUTH BEHIND SW CALGARY REAL ESTATE TAX SHELTER BONAVENTURE COURT AKA COMPLEX AND GARTH BAILEY HMS/BRIXON GROUP PONZIE

- #107- KENDAX WHO IS THE REAL JOYCE KENDAL ?????New Page

- #108- JOYCE KENDAL KENDAX LTD ROBO SIGNED florida judge jennerman

- #109- 1969 BC LAND TITLES CHAIN OF TITLE BROKEN BY FORGERY DATING BACK TO 1969JUDICIAL FEDERAL LIENS AND ATTACHMENTS OF INCOME AND PENSIONS ON INTERNATIONAL WATERS INCLUDING FUTURE CONSIDERATIONS AND INTEREST CHARGES

- CROWN SOVERIEGNS IN COLLUSION WITH US MAXIMUS HMS/BRIXON GROUP ponzie MERS PAPER CRA/maximus/BIG CORP PAPER TERRORISM -across state lines

- #110- ALBERTA SOVEREIGN TRUSTEE FRAUD

- #111- 2003-WILEY prefab home -albertaDIAMOND VALLEY MANUFACTURING

- #112- 95-INTRO 1973/ 1974 - CAMPBELL RIVER TD/CANADA TRUST MORTGAGE FRAUD TITLE C1229- BC GOVERMENT FORGED LIEN PURSUANT TO BC PROVINCIAL HOME AQUISTION ACT

- #113- BRIAN WILEY AND MELANIE WILEY ALBERTA CONDO SELLERS

- #114- -LEGAL SOVEREIGN AID SOCIETY 2011 MAXIMUS LTD LEGAL SOVEREIGN AID SOCIETY ponzie PAPER CRA TERRORISM -across state linesCANADIAN FEDS/USPENSION PONZIE SOVEREIGN REAL ESTATE INVESTMENT CLEAN UP FUND

- #115- -Trust law From Wikipedia, the free encyclopedia

- SOVEREIGN BUNGA

- #116- -LEGAL SOVEREIGN AID SOCIETY SOVEREIGN CITY HALL MASTERMINDED GOAT POO SECURITIES CONTRACT SOVEREIGN ROYAL LAW 1988 BMO 1ST MORTGAGE UNDER OATH THE CANADIAN SOVEREIGN MERS WELFARE QUEENS CROWN CLERK PONZIE

- #117- -LEGAL SOVEREIGN AID SOCIETY SOVEREIGN CITY HALL SWINDLEGATE INTERNATIONAL LEGAL SOVEREIGN AID SOCIETY

- #118- -LEGAL SOVEREIGN AID SOCIETY ILLEGAL CROWN BANKRUPTCY AND CROWN FORECLOSURE FRAUD 100% GOAT POO CREDIT DEFAULT SWAPS USING US FLORIDA DISTRICT COURTS AS THEIR SOVEREIGN GET AWAY CARS FLORIDA 25MAY1995 CAPITAL JANICE WEEKS KATONA church ponzie BC

- #119- 1995 BC SUPREME COURT JUDGE MEIKLEM'S FINAL DEAL-JUNE 19

- #120- -JUDICIAL CROWN SOVERIEGNS -THE CLERK

- #121- MAXIMUS INSURANCE INDUSTRY NEEDS IMMEDIATE SOVEREIGN REFORM AND STRICTER LAWS

- US JUDGES WHO ACTUALLY GETS IT

- FLORIDA EARL PACE TRUST

- FORGED TRANSFER OF JOINT COMPANY ESTATE

- 2009-ALBERTA GRANTEE-GAS COMPANY OWNS WILE-Y ESTATE

- 2010- CEASE AND DESIST -BSIG BONAVENTURE / CHURCH PONZIE INVESTORS GROUP

- I WANT THIS JUDGES OPINION

- WEST COAST INTERNATIONAL community corruption

- DRUGS/WASHINGTON STATE/BC CONNECTION

- VAAS

- 2002 PROPERTY CALGARY

- 2002 ALBERTA IO ACRES

- SOVEREIGN CITIZENS INTERNATIONAL REGULATORS /PROSECUTORS NEEDED ASAP

- SCARED AND HIDING

- 56.1. Identity documents 56.1 (1) Every person commits an offence who, without lawful excuse, procures to be made, possesses, transfers, sells or offers for sale an identity document that relates or purports to relate, in whole or in part, to another pers

- 58. Fraudulent use of certificate of citizenship 58. (1) Every one who, while in or out of Canada,

- 46. (1) High treason Every one commits high treason who, in Canada,

- 46. (3) Canadian citizen (3) Notwithstanding subsection (1) or (2), a Canadian citizen or a person who owes allegiance to Her Majesty in right of Canada,

- •83.02 - Financing of Terrorism •83.02. Providing or collecting property for certain activities

- 83.03. Providing, making available, etc., property or services for terrorist purposes

- 83.04. Using or possessing property for terrorist purposes

- 83.18. Participation in activity of terrorist group 83.18 (1) Every one who knowingly participates in or contributes to, directly or indirectly, any activity of a terrorist group for the purpose of enhancing the ability of any terrorist group to facilitat

- 83.19. Facilitating terrorist activity 83.19 (1) Every one who knowingly facilitates a terrorist activity is guilty of an indictable offence and liable to imprisonment for a term not exceeding fourteen years.

- 83.2. Commission of offence for terrorist group 83.2 Every one who commits an indictable offence under this or any other Act of Parliament for the benefit of, at the direction of or in association with a terrorist group is guilty of an indictable offence

- 83.21. Instructing to carry out activity for terrorist group 83.21 (1) Every person who knowingly instructs, directly or indirectly, any person to carry out any activity for the benefit of, at the direction of or in association with a terrorist group, for

- 83.22. Instructing to carry out terrorist activity 83.22 (1) Every person who knowingly instructs, directly or indirectly, any person to carry out a terrorist activity is guilty of an indictable offence and liable to imprisonment for life.

- 83.23. Harbouring or concealing 83.23 Every one who knowingly harbours or conceals any person whom he or she knows to be a person who has carried out or is likely to carry out a terrorist activity, for the purpose of enabling the person to facilitate or c

- 182. Dead body 182. Every one who(b) improperly or indecently interferes with or offers any indignity to a dead human body or human remains, whether buried or not,

- New Page

- 181. Spreading false news 181. Every one who wilfully publishes a statement, tale or news that he knows is false and that causes or is likely to cause injury or mischief to a public interest is guilty of an indictable offence and liable to imprisonment fo

- 131. Perjury 131. (1) Subject to subsection (3), every one commits perjury who, with intent to mislead, makes before a person who is authorized by law to permit it to be made before him a false statement under oath or solemn affirmation, by affidavit, sol

- 133. Corroboration 133. No person shall be convicted of an offence under section 132 on the evidence of only one witness unless the evidence of that witness is corroborated in a material particular by evidence that implicates the accused.

- 136. Witness giving contradictory evidence 136. (1) Every one who, being a witness in a judicial proceeding, gives evidence with respect to any matter of fact or knowledge and who subsequently, in a judicial proceeding, gives evidence that is contrary to

- 137. Fabricating evidence 137. Every one who, with intent to mislead, fabricates anything with intent that it shall be used as evidence in a judicial proceeding, existing or proposed, by any means other than perjury or incitement to perjury is guilty of a

- 138. Offences relating to affidavits

- 139. Obstructing justice 139. (1) Every one who wilfully attempts in any manner to obstruct, pervert or defeat the course of justice in a judicial proceeding,(2) Every one who wilfully attempts in any manner other than a manner described in subsection (1)

- New Page

- 140. Public mischief 140. (1) Every one commits public mischief who, with intent to mislead, causes a peace officer to enter on or continue an investigation by (a) making a false statement that accuses some other person of having committed an offence;

- New Page

- 142. Corruptly taking reward for recovery of goods 142. Every one who corruptly accepts any valuable consideration, directly or indirectly, under pretence or on account of helping any person to recover anything obtained by the commission of an indictable

- 119. Bribery of judicial officers, etc. 119. (1) Every one is guilty of an indictable offence and liable to imprisonment for a term not exceeding fourteen years who

- New Page

- the fish rots from the head

- New Page

- PBCT CONTRACTS DURHAM TRUST JANICE KATONA WEEKS

- New Page

- 2011 -NOV -VKD RESPONDS RE: DURHAM TRUST="Deliberate Bankrupting" "National Security Agency" and "NASA" associated with Ariel Life Systems (of the astronaut-space program) further connecting into the BASEBALL and FOOTBALL groups with a John D' Aquisto and

- New Page

- New Page

- New Page

- New Page

- New Page

- New Page

- New Page

- international body dedicated to information-sharing and an international court

- New Page

- New Page

- New Page

- De Schutter also warned Canada would face tough questions when it gets a peer review of its human rights record next year at the United

- the account was a sweeping facilaty

- New Page

- New Page

- Preet Bharara, the U.S. Attorney in Manhattan,

- New Page

- New Page

- New Page

- New Page

- United States Patriot; wife of murdered Colonel AKA WESTCOAST MAXIMUS WELFARE QUEEN /CITY HALL ESCORT

- New Page

- coast guard

- Secret “Occult Economy” Coming Out of the Shadows?

- New Page

- creation of special committees to address the "legal risks."

- John Aloyisius Dolan, 1850s-1890s, Iowa

- And $288 million is a lot to lose on one investment. Especially when it’s money that Canadians are expecting to retire on.

- VK DURHAM INTERNATIONAL CORRUPTIONa policy not approved by Congress remainS UNacceptable. when your own members flirt with mutiny, you have to know you’ve touched a raw nerve.

- JUDGE BONNER

- The Crown is not bound by laws passed in Parliament.

- INDIAN AFFAIRS- NWT NEW AGE ECONOMY

AN OPEN LETTER OF INPUT,

The Criminal Code of Canada, meanwhile, says piracy “in or out of Canada” is an indictable offence subject to a sentence of life imprisonment.

INTERNATIONAL Citizens for Tax Justice.

MARINE BASED MOTHERSHIP:CAMPBELL RIVER BASED

in the public interest

"GOD SAVE OUR QUEEN' AND JAIL THE FAKES

The FAKE Queen's insurable interest-TARGET ESTATE VICTIM AND HEIRS AND SUCCESSORS

CULTURE OF DEFIANCE: SOVEREIGN CITIZENS PONZIE FRAUD OPPURTINITY/ZERO ACCOUNTABILTY

Dozens of US corporations paid no federal taxes

280 corporations received a total of nearly $223 billion in tax subsidies

in the public interest

"GOD SAVE OUR QUEEN' AND JAIL THE FAKES

The FAKE Queen's insurable interest-TARGET ESTATE VICTIM AND HEIRS AND SUCCESSORS

CULTURE OF DEFIANCE: SOVEREIGN CITIZENS PONZIE FRAUD OPPURTINITY/ZERO ACCOUNTABILTY

Dozens of US corporations paid no federal taxes

280 corporations received a total of nearly $223 billion in tax subsidies

The citizens of New France received slaves as gifts from their allies among First Nations peoples. Slaves were prisoners taken in raids against the villages of the Fox nation, a tribe that was an ancient rival of the Miami people and their Algonquian allies.[59] Native (or "pani", a corruption of Pawnee) slaves were much easier to obtain and thus more numerous than African slaves in New France, but were less valued. The average native slave died at 18, and the average African slave died at 25[58] (the average European could expect to live until the age of 35[60]). 1790, the abolition movement was gaining credence in Canada and the ill intent of slavery was evidenced by an incident involving a slave woman being violently abused by her slave owner on her way to being sold in the United States.[58] The Act Against Slavery of 1793 legislated the gradual abolition of slavery: no slaves could be imported; slaves already in the province would remain enslaved until death, no new slaves could be brought into Upper Canada, and children born to female slaves would be slaves but must be freed at age 25.[58] The Act remained in force until 1833 when the British Parliament's Slavery Abolition Act finally abolished slavery in all parts of the British Empire.[61] Historian Marcel Trudel has documented 4,092 recorded slaves throughout Canadian history, of which 2,692 were Aboriginal people, owned by the French, and 1,400 blacks owned by the British, together owned by approximately 1,400 masters.[58] Trudel also noted 31 marriages took place between French colonists and Aboriginal slaves.[58]

Types Unfree labour · Debt bondage

These transactions are typically structured where the insured sets up a trust as the QUEEN/CROWN as the ESTATE beneficiary. Then, after the policy is in place, both the policy and the beneficial interests in the trust are sold to the investor. The investor then continues paying the premiums until the insured dies.

Ok here’s the deal. The insurable interest requirement is only a requirement at the time the insured takes out the policy. That is an absolute fact. After that you can change the ownership and beneficiary to whomever you like. For instance if you change the beneficary to a charity which you most certainly can, their only interest in the policy is when the insured dies. There was a recent case about two weeks ago where Phoenix Life lost the very same type of case. Every policy is contestable for 2 years immediately following the issuance. After that a policy can not be contested by the insurance company as long as it’s in force and did not lapse at anytime and then reinstated. Also on another front, insurance companies such as AIG and Berkshire Hathaway have been in the past huge purchasers of these policies. The insurance contract governs this and it says that you as the owner can change the ownership to whomever you please and makes no mention to insurable interest when this is done. This is all insurance 101.

Ive been in this industry for 12 years and to my knowledge no insured who ever sold their policy has been murdered. In that situation the insurance company would withhold payingthe claim pending the outcome of any investigation and should a beneficiary be responsible for the insureds death they would not collect. They would go to jail.

http://volokh.com/2011/01/03/death-bet-insurance/

WASHINGTON - Dozens of US corporations paid no federal taxes in recent years, and many received government subsidies despite earning healthy profits, a new study showed Thursday.

The report by Citizens for Tax Justice and the Institute on Taxation and Economic Policy, which examined 280 US firms, found 78 of them paid no federal income tax in at least one of the last three years.

It found 30 companies enjoyed a negative income tax rate - which in some cases means getting tax rebates - over the three-year period, despite combined pre-tax profits of $160 billion.

"These 280 corporations received a total of nearly $223 billion in tax subsidies," said the report's lead author, Robert McIntyre, director at Citizens for Tax Justice.

Read more: http://www.montrealgazette.com/news/Many+firms+avoid+taxes/5651060/story.html#ixzz1cekTMI1c

The report by Citizens for Tax Justice and the Institute on Taxation and Economic Policy, which examined 280 US firms, found 78 of them paid no federal income tax in at least one of the last three years.

It found 30 companies enjoyed a negative income tax rate - which in some cases means getting tax rebates - over the three-year period, despite combined pre-tax profits of $160 billion.

"These 280 corporations received a total of nearly $223 billion in tax subsidies," said the report's lead author, Robert McIntyre, director at Citizens for Tax Justice.

Read more: http://www.montrealgazette.com/news/Many+firms+avoid+taxes/5651060/story.html#ixzz1cekTMI1c

Legislation & Rules Print Version The Law Society’s authority to license and regulate lawyers and paralegals in the public interest is granted by the Ontario government through the Law Society Act and regulations made under the act.

Law Society by-laws, Rules of Professional Conduct, Paralegal Rules of Conduct -- all based on the Law Society Act and made by Law Society benchers -- set out the professional and ethical obligations of lawyers and paralegals and the manner in which they are regulated by the Law Society. Lawyers and paralegals who fail to meet these standards are subject to the Law Society complaints and regulatory processes.

- Law Society Act

- Barristers Act

- Solicitors Act

- Class Proceedings O. Reg. 771/92

- County and District Law Associations R.R.O. 1990, Reg. 708

- Complaints Resolution Commissioner O. Reg. 31/99

- Hearings Before the Hearing and Appeal Panels O. Reg. 167/07

- Law Foundation R.R.O. 1990, Reg. 709

- e-Laws-Gov. of Ont.

- Statutes and Regs.-Dept. of Justice

Society Act [RSBC 1996] CHAPTER 433

Registrar has no obligation to ensure accuracy or compliance 94.1 Nothing in this Act requires the registrar to ensure that a record filed with the registrar, or the information contained in it, is accurate or complete or meets the requirements of this Act, the regulations or any other enactment.

Inspection and copies of documents 95 (1) On payment of the fees set out in Schedule C, a person may

(a) inspect the documents filed in the office of the registrar relating to a society,

(b) require a copy or extract of a document or part of it, and

(c) require a copy or extract to be certified as a true copy.

(2) A document purporting to be issued and signed by the registrar or a person designated as a signing officer by the Lieutenant Governor in Council or by the registrar must be received in evidence and, unless the contrary is shown, is deemed to have been so issued, and it is not necessary to prove the handwriting or official position of the registrar or person designated by the Lieutenant Governor in Council or by the registrar.

(3) If a person requests a society to provide a copy of a financial statement of the society referred to in section 64 or 65 and pays the fee charged for that copy under subsection (5) of this section, the society must provide that person with a copy of that financial statement promptly after receipt of the request and payment.

(4) A copy of a financial statement referred to in subsection (3) must be provided in the manner agreed to by the society and the person seeking to obtain the copy or, in the absence of such an agreement,

(a) must, if the person seeking to obtain the copy so requests, be provided by mailing it to that person, or

(b) may, in any other case, be provided to the person seeking to obtain the copy by making it available for pick-up at the address of the society.

(5) A society may, for any financial statement made available by it under subsection (3), charge a reasonable fee that is not greater than the prescribed amount.

Filing annual report 68 A society must, within 30 days after each annual general meeting, file with the registrar an annual report in the form established by the registrar.

Copies of constitution and bylaws 69 A society must provide to a member, on request, free of charge or, if so resolved by the directors, on payment of not more than $1, a copy of its constitution and bylaws.

Register of members 70 (1) A society must keep a register of its members.

(2) A society must enter in the register the names of the applicants for incorporation and the name of every other person admitted as a member of the society, together with the following particulars of each member:

(a) the full name and resident address;

(b) the date on which the person is admitted as a member;

(c) the date on which the person ceases to be a member;

(d) the class of membership, if provision is made for classes.

(3) A society that fails to comply with this section commits an offence.

Copies of constitution and bylaws 69 A society must provide to a member, on request, free of charge or, if so resolved by the directors, on payment of not more than $1, a copy of its constitution and bylaws.

Register of members 70 (1) A society must keep a register of its members.

(2) A society must enter in the register the names of the applicants for incorporation and the name of every other person admitted as a member of the society, together with the following particulars of each member:

(a) the full name and resident address;

(b) the date on which the person is admitted as a member;

(c) the date on which the person ceases to be a member;

(d) the class of membership, if provision is made for classes.

(3) A society that fails to comply with this section commits an offence.

Linda Dixon 's posse are wanted by the FBI

Human trafficking From Wikipedia, the free encyclopedia Jump to: navigation, search For the miniseries, see Human Trafficking (TV miniseries). Part of a series on Slavery Contemporary slavery

Types Unfree labour · Debt bondage

By June 2010, the Trafficking Protocol had been ratified by 117 countries and 137 parties.[3]

Human trafficking ·

e-Human trafficking is the illegal E-trade of human beings for the purposes of reproductive slavery, commercial sexual exploitation, forced labor, or a modern-day form of slavery.

The Protocol to Prevent, Suppress and Punish Trafficking in Persons,

especially Women and Children (also referred to as the Trafficking Protocol) was adopted by the United Nations in Palermo, Italy in 2000, and is an international legal agreement attached to the United Nations Convention against Transnational Organized Crime. The Trafficking Protocol is one of three Protocols adopted to supplement the Convention.[1]

The Protocol is the first global, legally binding instrument on trafficking in over half a century and the only one that sets out an agreed definition of trafficking in persons.

The purpose of the Protocol is to facilitate convergence in national cooperation in investigating and prosecuting trafficking in persons. An additional objective of the Protocol is to protect and assist the victims of trafficking in persons with full respect for their human rights.

The Trafficking Protocol defines human trafficking as:

(a) [...] the recruitment, transportation, transfer, harbouring or receipt of persons, by means of the threat or use of force or other forms of coercion, of abduction, of fraud, of deception, of the abuse of power or of a position of vulnerability or of the giving or receiving of payments or benefits to achieve the consent of a person having control over another person, for the purpose of exploitation.

Exploitation shall include, at a minimum, the exploitation of the prostitution of others or other forms of sexual exploitation, forced labour or services, slavery or practices similar to slavery, servitude or the removal of organs;

(b) The consent of a victim of trafficking in persons to the intended exploitation set forth in subparagraph (a) of this article shall be irrelevant where any of the means set forth in subparagraph (a) have been used;

(c) The recruitment, transportation, transfer, harbouring or receipt of a child for the purpose of exploitation shall be considered “trafficking in persons” even if this does not involve any of the means set forth in subparagraph (a) of this article;

(d) “Child” shall mean any person under eighteen years of age.[2] The Trafficking Protocol entered into force on 25 December 2003. By June 2010, the Trafficking Protocol had been ratified by 117 countries and 137 parties.[3]

ROYAL SOVEREIGN CITIZENS GLOBAL FRAUD

CRIMINAL GOLD MINING,OIL,INSURANCE INDUSTRY

REAL ESTATE INVESTORS ENTERPRISE

FIGHT ROYAL LAWYER CRIMES

BAY & WALLS STREET LEGAL LICE IN COLLUSION WITH UK QUEENS ESTATE

ROYAL LEHAMAN BROTHERS

ROYAL SOVEREIGN CITIZENS MOVEMENT

INTERNATIONAL BANK FOR A MONARCH IMPERIAL BIG CORP GROUP INVESTING

GOLD MINES

GOLF COURSES

FISHING LODGES

CONDO OWNERSHIP/GROUP INVESTORS MORTGAGES

GROUP INVESTORS

Fire River Gold Corp. Receives 2nd Concentrate Payment

On behalf of the Board of Directors, "Richard Goodwin"

Richard Goodwin

President and COO

advance payment of $1,020,375 from Glencore International

October 28, 2011 Vancouver, BC, Canada - Fire River Gold Corp. and Mystery Creek Resources Inc. (TSX.V: FAU), (OTCQX: FVGCF), (FSE: FWR) (collectively "the Company") is pleased to announce that it has received an advance payment of $1,020,375 from Glencore International PLC for the second shipment of gold-rich copper concentrate from the Nixon Fork Mine.

This payment is a provisional advance for the 24 bags comprising 21.2 dmt (dry metric tonnes) of gold-rich copper concentrate. The bags are palletized and flown from the Nixon Fork Mine aboard a Hercules L382G airplane. Shipping lots of 24 bags are assembled in Anchorage at Lynden Air Cargo's facility and barged in secure 40 ft. containers to Seattle for ocean transport to the PASAR smelter in Isabel, Philippines.

CRIMINAL GOLD MINING,OIL,INSURANCE INDUSTRY

REAL ESTATE INVESTORS ENTERPRISE

FIGHT ROYAL LAWYER CRIMES

BAY & WALLS STREET LEGAL LICE IN COLLUSION WITH UK QUEENS ESTATE

ROYAL LEHAMAN BROTHERS

ROYAL SOVEREIGN CITIZENS MOVEMENT

INTERNATIONAL BANK FOR A MONARCH IMPERIAL BIG CORP GROUP INVESTING

GOLD MINES

GOLF COURSES

FISHING LODGES

CONDO OWNERSHIP/GROUP INVESTORS MORTGAGES

GROUP INVESTORS

Fire River Gold Corp. Receives 2nd Concentrate Payment

On behalf of the Board of Directors, "Richard Goodwin"

Richard Goodwin

President and COO

advance payment of $1,020,375 from Glencore International

October 28, 2011 Vancouver, BC, Canada - Fire River Gold Corp. and Mystery Creek Resources Inc. (TSX.V: FAU), (OTCQX: FVGCF), (FSE: FWR) (collectively "the Company") is pleased to announce that it has received an advance payment of $1,020,375 from Glencore International PLC for the second shipment of gold-rich copper concentrate from the Nixon Fork Mine.

This payment is a provisional advance for the 24 bags comprising 21.2 dmt (dry metric tonnes) of gold-rich copper concentrate. The bags are palletized and flown from the Nixon Fork Mine aboard a Hercules L382G airplane. Shipping lots of 24 bags are assembled in Anchorage at Lynden Air Cargo's facility and barged in secure 40 ft. containers to Seattle for ocean transport to the PASAR smelter in Isabel, Philippines.

Descendants of ROYAL LAW debt slaves

THE UK QUEEN MUST FIND THIS CRIMINAL WHO IS ABUSING HER AUTHORITY!

BECAUSE OF THIS 2 DECADE LONG HMS/QUEEN IN THE RIGHT OF CANADA PONZIE ,WHICH IS STILL A FEDERAL CRIME IN PROGRESS,

THOUSANDS OF VICTIMS HAVE LOST THEIR LOVED ONES , THEIR JOBS ,HEALTH ,PENSIONS ,ESTATES,PRIVATE WEALTH/ASSETS,OPPURTUNITIES

LINDA DIXON IS A FRAUD AND SO IS HER CANADIAN PASSPORT.

LINDA DIXON IS A SOCIOPATH MUNICAPLITY CITY HALL HO HO.

LINDA DIXON IS NOT WHO SHE SAYS SHE IS.

WHO IS THE REAL LINDA DIXON?

IS SHE A CANADIAN WELFRARE FRAUD QUEEN WHO HAS MADE ALOT OF MONEY USING THE QUEEN OF THE UK'S AUTHORITY.

LINDA DIXON NEEDS TO BE CAUGHT AND THROWN IN JAIL,ALONG WITH HER POSSE WHO HAVE GIVEN HER AN OPEN BACK DOOR TO DESTROY FAMILIES ALL OVER US,CANADA AND UK

IS LINDA IDIXON A PROFESSIONAL LIAR/CON/AND IDANGEROUS TO ALL THOSE WHO CROSS HER PATH?

LINDA DIXON HAS A HUNT AND KILL FOR PROFIT AGENDA AND WALL STREET'S BIG BANKS HAVE AID AND ABETTED HER CRIMES FOR OVER 2 DECADES

LINDA DIXON'S GIVES THE JUDICIAL PEDOPHILES THEIR FIX IN RETURN THEY GIVE HER THEIR AUTHORITY TO CREATE BOGUS LIENS /COURT ORDERS TO FURTHER HER PONZIE ADDICTION.

LINDA DIXON IS A MENANCE TO SOCIETY ,THE COURTS, AND IS DESTROYNG THE RULE OF LAW ON BOTH SIDES OF THE BORDER.

LINDA DIXON LIVES ABOVE THE LAW WITH THE HELP OF ALBERTA'S QUEENS BENCH "OFFICERS OF THE COURT " WHO HAVE CREATED A CASHFLOW CASHCOW SLUSHFUND FOR A SECRET NETWORK OF ROYAL MONARCH NEW AGER INVESTORS.

BECAUSE OF THIS 2 DECADE LONG HMS/QUEEN IN THE RIGHT OF CANADA PONZIE ,WHICH IS STILL A FEDERAL CRIME IN PROGRESS,

THOUSANDS OF VICTIMS HAVE LOST THEIR LOVED ONES , THEIR JOBS ,HEALTH ,PENSIONS ,ESTATES,PRIVATE WEALTH/ASSETS,OPPURTUNITIES

LINDA DIXON IS A FRAUD AND SO IS HER CANADIAN PASSPORT.

LINDA DIXON IS A SOCIOPATH MUNICAPLITY CITY HALL HO HO.

LINDA DIXON IS NOT WHO SHE SAYS SHE IS.

WHO IS THE REAL LINDA DIXON?

IS SHE A CANADIAN WELFRARE FRAUD QUEEN WHO HAS MADE ALOT OF MONEY USING THE QUEEN OF THE UK'S AUTHORITY.

LINDA DIXON NEEDS TO BE CAUGHT AND THROWN IN JAIL,ALONG WITH HER POSSE WHO HAVE GIVEN HER AN OPEN BACK DOOR TO DESTROY FAMILIES ALL OVER US,CANADA AND UK

IS LINDA IDIXON A PROFESSIONAL LIAR/CON/AND IDANGEROUS TO ALL THOSE WHO CROSS HER PATH?

LINDA DIXON HAS A HUNT AND KILL FOR PROFIT AGENDA AND WALL STREET'S BIG BANKS HAVE AID AND ABETTED HER CRIMES FOR OVER 2 DECADES

LINDA DIXON'S GIVES THE JUDICIAL PEDOPHILES THEIR FIX IN RETURN THEY GIVE HER THEIR AUTHORITY TO CREATE BOGUS LIENS /COURT ORDERS TO FURTHER HER PONZIE ADDICTION.

LINDA DIXON IS A MENANCE TO SOCIETY ,THE COURTS, AND IS DESTROYNG THE RULE OF LAW ON BOTH SIDES OF THE BORDER.

LINDA DIXON LIVES ABOVE THE LAW WITH THE HELP OF ALBERTA'S QUEENS BENCH "OFFICERS OF THE COURT " WHO HAVE CREATED A CASHFLOW CASHCOW SLUSHFUND FOR A SECRET NETWORK OF ROYAL MONARCH NEW AGER INVESTORS.

Female's body parts found at Manitoba First Nation RCMP investigating homicide RCMP are investigating what appears to be a gruesome case on Manitoba's Sandy Bay Ojibway First Nation after parts of a female's body were found in two locations.

The Mounties said they were called Saturday morning to assist the Dakota Ojibway Police Service in their investigation of the death of a female.

A large area has been sealed off at Sandy Bay First Nation, on the west side of Lake Winnipeg.

Police have not released the name or age of the victim, nor have they released a cause of death, but the RCMP's major crimes unit and forensic identification services are handling the investigation.http://www.cbc.ca/news/canada/manitoba/story/2011/07/30/mb-female-body-parts-found345.html

The Mounties said they were called Saturday morning to assist the Dakota Ojibway Police Service in their investigation of the death of a female.

A large area has been sealed off at Sandy Bay First Nation, on the west side of Lake Winnipeg.

Police have not released the name or age of the victim, nor have they released a cause of death, but the RCMP's major crimes unit and forensic identification services are handling the investigation.http://www.cbc.ca/news/canada/manitoba/story/2011/07/30/mb-female-body-parts-found345.html

UK CROWN ESTATE TAX FREE TRUST

ROYAL SOVEREIGN CITIZENS CLIENTS

ROYAL LAW -USED BY RIGHT WING RELGIOUS SOCIETIES

BASED ON THE OATH OF BROTHERHOOD

FREEMASON ,CATHOLIC OPUS DEI/JESUITS,FELLOWSHIP-SCIENTOLOGY,NEW AGERS,FREEMASON ENVIROMENTALISTS

CONSUMERS: SLAVERY ERA INSURANCE REGISTRY In August 2000 the California legislature found that

"[I]nsurance policies from the slavery era have been discovered in the archives of several insurance companies, documenting insurance coverage for slaveholders for damage to or death of their slaves, issued by a predecessor insurance firm. These documents provide the first evidence of ill-gotten profits from slavery, which profits in part capitalized insurers whose successors remain in existence today." SB2199 Sec. 1(a).

- SB 2199: Slavery Era Insurance Policies: Statute

CHAPTER 5. SLAVERY ERA INSURANCE POLICIES

13810. The commissioner shall request and obtain information from insurers licensed and doing business in this state regarding any records of slaveholder insurance policies issued by any predecessor corporation during the slavery era.

13811. The commissioner shall obtain the names of any slaveholders or slaves described in those insurance records, and shall make the information available to the public and the Legislature.

13812. Each insurer licensed and doing business in this state shall research and report to the commissioner with respect to any records within the insurer's possession or knowledge relating to insurance policies issued to slaveholders that provided coverage for damage to or death of their slaves.

13813. Descendants of slaves, whose ancestors were defined as private property, dehumanized, divided from their families, forced to perform labor without appropriate compensation or benefits, and whose ancestors' owners were compensated for damages by insurers, are entitled to full disclosure.

When a society of judicial officers of the LEGAL SOCIETY ignore securities laws and break every criminal law in the book including allowing UK ESTATE & CROWN banks (ATB financial ) to reap returns on the deaths of victims insured by way of REAL ESTATE fraud by the MAPLE GROUPS BIG WALL STREET BANKS NETWORK IN COLLUSION WITH BAY STREET is violating International criminal court laws.

This is CORRUPTION at the highest levels.

the Doral Golf Resort is a $967.2 million commercial CMBS loan that includes four other KSL Hotel properties. The portion of the mortgage that applies specifically to the Doral property is $98.5 million.

A DANGEROUS postion to put not just CANADIANS finanacial security/health/families in, but the safety of all citizens on a global level.

This take over is the beginnings of the end for any future land ownership,pensions,assets as these MAPLE MASONS/ SKULL AND BONES GROUP MEMBERS have somewhat mastered the PONZIE cashflow. This has been done through laundering mortgage and estate frauds through the ALBERTA QUEENS BENCH "administration of ESTATE act " which allowed these Maple GROUP players to PIMP the Queens name and authority for their own INVESTORS WEALTH/ PEDOHILIA GREED AS WELL AS STEALING TAXPAYERS MONIES .

THE HAMMER HAS FALLEN ON WALL STREET WHICH means Bank criminals need to create another route to hardwire their illegal investments ,income,start up capital in a way that won't be dectected by the VICTIM Taxpayers OR oathtaking goverment civil servants.

Until the Queen deals with the corruption in Canada as EXPOSED IN THE PUBLIC DOMAIN THROUGH THIS WEBSITE including others such as

www.WATERWARSCRIME.com

www.SEALEGAGCY.com

www.eddie achtem.blog

and of course............the state of Kentucky----HMS victims CANADA will remain under crown cartel ILLEGAL QUEENS Judicial tyranny.

The rule of order for the MAPLE MASON/OPUS DEI GROUP is wealth takeover using the ROYAL military ,which of course the wording "ROYAL", means belonging to UK CROWN ESTATE.

Until the Queen sorts out this land ESTATE tax loophole which is stealing from Canadians/AMERICANs, who for the most part are not a part of the NOBALE MONARCH ELITE SOCIETY

To allow the TAKE-OVER by the MAPLE GROUP is nothing more than aiding and abetting criminal federal forgeries frauds and murder cover-ups in order to make the MAXIMUM return for shareholders/investors and illegally created corporations.

let me make myself clear once again

We have international paper terrorism federal/transnational PONZIE corruption RING happening at this very moment.

Every one of the MAPLE GROUPS MEMBERS AND BIG WALLS STREET BANKS have a direct traceable fraud claims which can be found through out this website.

This website is proof of what is instore if you, the securities commisions ,approve this takeover.

All those in an official capacity to restore law and order who fail to prosecute wire fraud/idenity fraud,PONZIE FRAUD will eventually find yourselves in the same postition as the QUEEN.

Until RULE OF LAW & ORDER is restored and court record,land ownership record is restored to it's legal chain of title/ownership across the US/CANADA, this is setting taxpayers up for another financial meltdown and more and more families ESTATE wealth will be stolen by this GROUP of likeminded PONZIE MASTERMINDS.

tHE MAPLE GROUP IS A SECRET SOCIETY OF FREEMASON/Catholic OPUS DEI/FELLOWSHIP/new agers think tank.

THE STYLE OF THE MAPLE GROUP CAPITAL RAISING IS OVER 70 YEARS OLD

The maple group marketing approach is dangerous.

This is nothing more than a powerhouse to procure fraud which with a monopoly can be covered up by the BROTHERHOOD.

IF the Maple Groups succeeds with this hostile bid you can mark my words and watch BC turn into PARIDISE IN HELL.

The Maple group with it's history for unethical venture capital raising proves my point. see www.sealegacy.com

venture capital financing by way of ALBERTA Queens Bench IMPERIAL CORRUPTION ,PERJURY AND FORGERY INCLUDING MORTGAGE FRAUD UNDER A FORGED SPECIAL ACT OF PARLIMENT

The MAPLE group can not be trusted to work within realms of lawful venture capital raising.

There is thousands of lawsuits heading towards the Queen of the UK .

Thanks to most of the MAPLE GROUP big banks ,including Bank of Canada thousands investors were robbed by directing minds of the MAPLE groups CEO's.

Using the QUEEN'S AUTHORITY TO COMMIT FRAUD IS CRIME AND AN INSULT TO THE UK QUEEN and her family!

NOBODY like's having their identity,good name,assets,income future or present ,PENSIONS ,ESTATES OR LIFE INSURANCE SETTLEMENTS OR LAND,fathers,family and friends used AND STOLEN by PONZIE BANK criminals to create ILLEGAL CASHFLOWS for their illegal companies.

BC WEST COAST PLEASURE CRAFT

ROYAL ACCIDENTAL CARBON MONOXIDE DEATH

NEEDED FOR ROYAL HMS /BRIXON/FIRE RIVER GOLD

CASHFLOW INCOME DESPERATELY NEEDED TO REPLACE STOLEN PENSION FUNDS LOSTS THROUGH SHADEY/US FBI WANTED CONVICTED CONS IN COLLUSION WITH ROYAL WELFARE QUEEN RECRUITERS

WHAT WERE LOCAL GOVERMENT CITY COUNCIL ON IN 1997?

,HY WOULD LOCAL GOVERMENT ELECTED OFFICIALS ALLOW HOME GROWN WELFARE QUEENS THE FREEDOM TO COMMIT SUCH VILE VIOLATIONS OF THE CRIMINAL CODE

CRONY LOCAL,PROVINCIAL AND FEDERAL GOVERMENT DEALS PROCURED THROUGH LOCAL,PROVINCIAL AND FEDERAL CRONY NETWORK OF US MERS QUEENS

WHO ARE CANADIAN WELFARE- MAXIMUS CLIENTS

ABUSIVE 3RD PARTY AGENT/3RD PARTY DEBIT COLLECTOR

DFO 'S NOT FOR profit “crimes of moral turpitude”

"SPIN &COVER UP ORCHESTRATED BY WELFARE QUEENS OF CANADA ,DFO CROWN MINISTERS , MP,PREMIERS,CRA &JUSTICE DEPARTMENT/FINANCE,PUBLIC SAFETY B.C. Good Samaritan dies BECAUSE OF CR CITY HALL CITY HALL'S FORGERY IN COLLUSION WITH THE QUEEN IN THE RIGHT OF DFO BC AND ROYAL US MAXIMUS CONTRACTOR

B.C. Good Samaritan WHISTLEBLOWER

dies of A SLOPPY TARGETED ROYAL DEATH

ROYAL DFO /ROYAL NOT FOR PROFIT CORPORATION AND NUMERIOUS ROYAL SOCIETY'S PLOTTED ROYAL MONARCH POLITICAL TAKEDOWN

ROYAL BC CORONOR'S DEATH CERTIFICATE UNPLAUSIBLE REBUTTED

WIRE FRAUD

VENTURE DOUBLE FUNDING FRAUD

CAPITAL CASH FLOW PONZIE DEATH CONTRACTS

Includes “assister, abettor, conspirator, or colluder”

OCTOBER 7, 2011, 12:20 P.M. ET

OSC Invites Public Comment For Review Of Maple/TMX Bid press release

Alberta and B.C. Securities Regulators Seek Comment on Maple Group Acquisition Corporation's Offer to Acquire the TMX Group CALGARY, ALBERTA, Specifically, the Commissions would like comment on the impact of Maple Group's offer on the TSX Venture, the venture capital markets, and other stakeholders involved in venture capital financing.

stakeholders involved in forged venture capital financing.

$967.2 million commercial loan

INTERNATIONAL E- ROYAL SOVEREIGN CITIZENS REGULATOR/PROSECUTORS NEEDED GLOBALLY!!!!!

MARINE BASED FEDERAL/ PRIVATE PROSECUTIONS

project manage a strong record for justice, administrative efficiency.

U.S. Code TITLE 18 > PART I > CHAPTER 47 >§ 1028. Fraud and related activity in connection with identification documents, authentication features, and information

(a) Whoever, in a circumstance described in subsection (c) of this section—

(1) knowingly and without lawful authority produces an identification document, authentication feature, or a false identification document;

(2) knowingly transfers an identification document, authentication feature, or a false identification document knowing that such document or feature was stolen or produced without lawful authority;

(3) knowingly possesses with intent to use unlawfully or transfer unlawfully five or more identification documents (other than those issued lawfully for the use of the possessor), authentication features, or false identification documents;

(4) knowingly possesses an identification document (other than one issued lawfully for the use of the possessor), authentication feature, or a false identification document, with the intent such document or feature be used to defraud the United States;

(5) knowingly produces, transfers, or possesses a document-making implement or authentication feature with the intent such document-making implement or authentication feature will be used in the production of a false identification document or another document-making implement or authentication feature which will be so used;

(6) knowingly possesses an identification document or authentication feature that is or appears to be an identification document or authentication feature of the United States or a sponsoring entity of an event designated as a special event of national significance which is stolen or produced without lawful authority knowing that such document or feature was stolen or produced without such authority;

(7) knowingly transfers, possesses, or uses, without lawful authority, a means of identification of another person with the intent to commit, or to aid or abet, or in connection with, any unlawful activity that constitutes a violation of Federal law, or that constitutes a felony under any applicable State or local law; or

(8) knowingly traffics in false or actual authentication features for use in false identification documents, document-making implements, or means of identification; shall be punished as provided in subsection (b) of this section.

(b) The punishment for an offense under subsection (a) of this section is— (1) except as provided in paragraphs (3) and (4), a fine under this title or imprisonment for not more than 15 years, or both, if the offense is—

(A) the production or transfer of an identification document, authentication feature, or false identification document that is or appears to be— (i) an identification document or authentication feature issued by or under the authority of the United States; or (ii) a birth certificate, or a driver’s license or personal identification card;

(B) the production or transfer of more than five identification documents, authentication features, or false identification documents;

(C) an offense under paragraph (5) of such subsection; or

(D) an offense under paragraph (7) of such subsection that involves the transfer, possession, or use of 1 or more means of identification if, as a result of the offense, any individual committing the offense obtains anything of value aggregating $1,000 or more during any 1-year period;

(2) except as provided in paragraphs (3) and (4), a fine under this title or imprisonment for not more than 5 years, or both, if the offense is—

(A) any other production, transfer, or use of a means of identification, an identification document,,

[1] authentication feature, or a false identification document; or (B) an offense under paragraph (3) or (7) of such subsection; (3) a fine under this title or imprisonment for not more than 20 years, or both, if the offense is committed—

(A) to facilitate a drug trafficking crime (as defined in section 929 (a)(2));

(B) in connection with a crime of violence (as defined in section 924 (c)(3)); or

(C) after a prior conviction under this section becomes final; (4) a fine under this title or imprisonment for not more than 30 years, or both, if the offense is committed to facilitate an act of domestic terrorism (as defined under section 2331 (5) of this title)

or an act of international terrorism (as defined in section 2331 (1) of this title);

(5) in the case of any offense under subsection (a), forfeiture to the United States of any personal property used or intended to be used to commit the offense; and

(6) a fine under this title or imprisonment for not more than one year, or both, in any other case. (c) The circumstance referred to in subsection (a) of this section is that--

(1) the identification document, authentication feature, or false identification document is or appears to be issued by or under the authority of the United States or a sponsoring entity of an event designated as a special event of national significance or the document-making implement is designed or suited for making such an identification document, authentication feature, or false identification document;

(2) the offense is an offense under subsection (a)(4) of this section; or (3) either--

(A) the production, transfer, possession, or use prohibited by this section is in or affects interstate or foreign commerce, including the transfer of a document by electronic means; or

(B) the means of identification, identification document, false identification document, or document-making implement is transported in the mail in the course of the production, transfer, possession, or use prohibited by this section. (d) In this section and section 1028A--

(1) the term “authentication feature” means any hologram, watermark, certification, symbol, code, image, sequence of numbers or letters, or other feature that either individually or in combination with another feature is used by the issuing authority on an identification document, document-making implement, or means of identification to determine if the document is counterfeit, altered, or otherwise falsified;

(2) the term “document-making implement” means any implement, impression, template, computer file, computer disc, electronic device, or computer hardware or software, that is specifically configured or primarily used for making an identification document, a false identification document, or another document-making implement;

(3) the term “identification document” means a document made or issued by or under the authority of the United States Government, a State, political subdivision of a State, a sponsoring entity of an event designated as a special event of national significance, a foreign government, political subdivision of a foreign government, an international governmental or an international quasi-governmental organization which, when completed with information concerning a particular individual, is of a type intended or commonly accepted for the purpose of identification of individuals;

(4) the term “false identification document” means a document of a type intended or commonly accepted for the purposes of identification of individuals that— (A) is not issued by or under the authority of a governmental entity or was issued under the authority of a governmental entity but was subsequently altered for purposes of deceit; and (B) appears to be issued by or under the authority of the United States Government, a State, a political subdivision of a State, a sponsoring entity of an event designated by the President as a special event of national significance, a foreign government, a political subdivision of a foreign government, or an international governmental or quasi-governmental organization;

(5) the term “false authentication feature” means an authentication feature that— (A) is genuine in origin, but, without the authorization of the issuing authority, has been tampered with or altered for purposes of deceit; (B) is genuine, but has been distributed, or is intended for distribution, without the authorization of the issuing authority and not in connection with a lawfully made identification document, document-making implement, or means of identification to which such authentication feature is intended to be affixed or embedded by the respective issuing authority; or (C) appears to be genuine, but is not;

(6) the term “issuing authority”— (A) means any governmental entity or agency that is authorized to issue identification documents, means of identification, or authentication features; and (B) includes the United States Government, a State, a political subdivision of a State, a sponsoring entity of an event designated by the President as a special event of national significance, a foreign government, a political subdivision of a foreign government, or an international government or quasi-governmental organization;

(7) the term “means of identification” means any name or number that may be used, alone or in conjunction with any other information, to identify a specific individual, including any— (A) name, social security number, date of birth, official State or government issued driver’s license or identification number, alien registration number, government passport number, employer or taxpayer identification number; (B) unique biometric data, such as fingerprint, voice print, retina or iris image, or other unique physical representation; (C) unique electronic identification number, address, or routing code; or (D) telecommunication identifying information or access device (as defined in section 1029 (e));

(8) the term “personal identification card” means an identification document issued by a State or local government solely for the purpose of identification;

(9) the term “produce” includes alter, authenticate, or assemble;

(10) the term “transfer” includes selecting an identification document, false identification document, or document-making implement and placing or directing the placement of such identification document, false identification document, or document-making implement on an online location where it is available to others;

(11) the term “State” includes any State of the United States, the District of Columbia, the Commonwealth of Puerto Rico, and any other commonwealth, possession, or territory of the United States; and

(12) the term “traffic” means— (A) to transport, transfer, or otherwise dispose of, to another, as consideration for anything of value; or (B) to make or obtain control of with intent to so transport, transfer, or otherwise dispose of. (e) This section does not prohibit any lawfully authorized investigative, protective, or intelligence activity of a law enforcement agency of the United States, a State, or a political subdivision of a State, or of an intelligence agency of the United States, or any activity authorized under chapter 224 of this title. (f) Attempt and Conspiracy.— Any person who attempts or conspires to commit any offense under this section shall be subject to the same penalties as those prescribed for the offense, the commission of which was the object of the attempt or conspiracy. (g) Forfeiture Procedures.— The forfeiture of property under this section, including any seizure and disposition of the property and any related judicial or administrative proceeding, shall be governed by the provisions of section 413 (other than subsection (d) of that section) of the Comprehensive Drug Abuse Prevention and Control Act of 1970 (21 U.S.C. 853). (h) Forfeiture; Disposition.— In the circumstance in which any person is convicted of a violation of subsection (a), the court shall order, in addition to the penalty prescribed, the forfeiture and destruction or other disposition of all illicit authentication features, identification documents, document-making implements, or means of identification. (i) Rule of Construction.— For purpose of subsection (a)(7), a single identification document or false identification document that contains 1 or more means of identification shall be construed to be 1 means of identification.

MARINE BASED FEDERAL/ PRIVATE PROSECUTIONS

project manage a strong record for justice, administrative efficiency.

U.S. Code TITLE 18 > PART I > CHAPTER 47 >§ 1028. Fraud and related activity in connection with identification documents, authentication features, and information

(a) Whoever, in a circumstance described in subsection (c) of this section—

(1) knowingly and without lawful authority produces an identification document, authentication feature, or a false identification document;

(2) knowingly transfers an identification document, authentication feature, or a false identification document knowing that such document or feature was stolen or produced without lawful authority;

(3) knowingly possesses with intent to use unlawfully or transfer unlawfully five or more identification documents (other than those issued lawfully for the use of the possessor), authentication features, or false identification documents;

(4) knowingly possesses an identification document (other than one issued lawfully for the use of the possessor), authentication feature, or a false identification document, with the intent such document or feature be used to defraud the United States;

(5) knowingly produces, transfers, or possesses a document-making implement or authentication feature with the intent such document-making implement or authentication feature will be used in the production of a false identification document or another document-making implement or authentication feature which will be so used;

(6) knowingly possesses an identification document or authentication feature that is or appears to be an identification document or authentication feature of the United States or a sponsoring entity of an event designated as a special event of national significance which is stolen or produced without lawful authority knowing that such document or feature was stolen or produced without such authority;

(7) knowingly transfers, possesses, or uses, without lawful authority, a means of identification of another person with the intent to commit, or to aid or abet, or in connection with, any unlawful activity that constitutes a violation of Federal law, or that constitutes a felony under any applicable State or local law; or

(8) knowingly traffics in false or actual authentication features for use in false identification documents, document-making implements, or means of identification; shall be punished as provided in subsection (b) of this section.

(b) The punishment for an offense under subsection (a) of this section is— (1) except as provided in paragraphs (3) and (4), a fine under this title or imprisonment for not more than 15 years, or both, if the offense is—

(A) the production or transfer of an identification document, authentication feature, or false identification document that is or appears to be— (i) an identification document or authentication feature issued by or under the authority of the United States; or (ii) a birth certificate, or a driver’s license or personal identification card;

(B) the production or transfer of more than five identification documents, authentication features, or false identification documents;

(C) an offense under paragraph (5) of such subsection; or

(D) an offense under paragraph (7) of such subsection that involves the transfer, possession, or use of 1 or more means of identification if, as a result of the offense, any individual committing the offense obtains anything of value aggregating $1,000 or more during any 1-year period;

(2) except as provided in paragraphs (3) and (4), a fine under this title or imprisonment for not more than 5 years, or both, if the offense is—

(A) any other production, transfer, or use of a means of identification, an identification document,,

[1] authentication feature, or a false identification document; or (B) an offense under paragraph (3) or (7) of such subsection; (3) a fine under this title or imprisonment for not more than 20 years, or both, if the offense is committed—

(A) to facilitate a drug trafficking crime (as defined in section 929 (a)(2));

(B) in connection with a crime of violence (as defined in section 924 (c)(3)); or

(C) after a prior conviction under this section becomes final; (4) a fine under this title or imprisonment for not more than 30 years, or both, if the offense is committed to facilitate an act of domestic terrorism (as defined under section 2331 (5) of this title)

or an act of international terrorism (as defined in section 2331 (1) of this title);

(5) in the case of any offense under subsection (a), forfeiture to the United States of any personal property used or intended to be used to commit the offense; and

(6) a fine under this title or imprisonment for not more than one year, or both, in any other case. (c) The circumstance referred to in subsection (a) of this section is that--

(1) the identification document, authentication feature, or false identification document is or appears to be issued by or under the authority of the United States or a sponsoring entity of an event designated as a special event of national significance or the document-making implement is designed or suited for making such an identification document, authentication feature, or false identification document;

(2) the offense is an offense under subsection (a)(4) of this section; or (3) either--

(A) the production, transfer, possession, or use prohibited by this section is in or affects interstate or foreign commerce, including the transfer of a document by electronic means; or

(B) the means of identification, identification document, false identification document, or document-making implement is transported in the mail in the course of the production, transfer, possession, or use prohibited by this section. (d) In this section and section 1028A--

(1) the term “authentication feature” means any hologram, watermark, certification, symbol, code, image, sequence of numbers or letters, or other feature that either individually or in combination with another feature is used by the issuing authority on an identification document, document-making implement, or means of identification to determine if the document is counterfeit, altered, or otherwise falsified;

(2) the term “document-making implement” means any implement, impression, template, computer file, computer disc, electronic device, or computer hardware or software, that is specifically configured or primarily used for making an identification document, a false identification document, or another document-making implement;

(3) the term “identification document” means a document made or issued by or under the authority of the United States Government, a State, political subdivision of a State, a sponsoring entity of an event designated as a special event of national significance, a foreign government, political subdivision of a foreign government, an international governmental or an international quasi-governmental organization which, when completed with information concerning a particular individual, is of a type intended or commonly accepted for the purpose of identification of individuals;

(4) the term “false identification document” means a document of a type intended or commonly accepted for the purposes of identification of individuals that— (A) is not issued by or under the authority of a governmental entity or was issued under the authority of a governmental entity but was subsequently altered for purposes of deceit; and (B) appears to be issued by or under the authority of the United States Government, a State, a political subdivision of a State, a sponsoring entity of an event designated by the President as a special event of national significance, a foreign government, a political subdivision of a foreign government, or an international governmental or quasi-governmental organization;

(5) the term “false authentication feature” means an authentication feature that— (A) is genuine in origin, but, without the authorization of the issuing authority, has been tampered with or altered for purposes of deceit; (B) is genuine, but has been distributed, or is intended for distribution, without the authorization of the issuing authority and not in connection with a lawfully made identification document, document-making implement, or means of identification to which such authentication feature is intended to be affixed or embedded by the respective issuing authority; or (C) appears to be genuine, but is not;

(6) the term “issuing authority”— (A) means any governmental entity or agency that is authorized to issue identification documents, means of identification, or authentication features; and (B) includes the United States Government, a State, a political subdivision of a State, a sponsoring entity of an event designated by the President as a special event of national significance, a foreign government, a political subdivision of a foreign government, or an international government or quasi-governmental organization;